BASE block failure another blow for users of Coinbase’s Layer 2 chain

- BASE reported a failure early on Wednesday, in which no new blocks were added to the network within 45 minutes.

- Coinbase Layer 2 chain’s team confirmed that a fix was deployed, block production has returned to normal.

- The total value of assets locked in BASE dropped $4.02 million this week as the hype surrounding the Layer 2 chain declines.

BASE, a Layer-2 chain created by Coinbase, reported a block failure incident early on Wednesday. The team behind BASE explained that no new block was created for nearly 45 minutes and a fix was deployed to bring production to normal.

BASE mainnet gained popularity among users since its launch, and the failure incident added to the deterrents for the Layer 2 chain’s users.

Also read: These five oversold altcoins might explode soon: DODO, GALA, MAGIC, MASK and SRM

BASE block outage incident

BASE suffered a major outage for the first time since its mainnet launch on August 9. No new blocks were produced on the chain, and developers reported that production was “stalled” at 9:36 pm UTC.

The team behind BASE continued to monitor the chain and released a fix. Block production returned to normal within 45 minutes of the outage. The crypto community is familiar with similar outages as they have affected blockchains like Solana.

Earlier today we had a delay in block production due in part to our internal infrastructure requiring a refresh.

— Base ️ (@BuildOnBase) September 5, 2023

The issue has been identified and remediated. No funds are at risk.

To stay updated, check https://t.co/ipa94DPBLq

The hype surrounding BASE has slowly declined this week, and this is evident from the total value of assets locked by users on the Layer 2 chain.

BASE hype dies as TVL declines this week

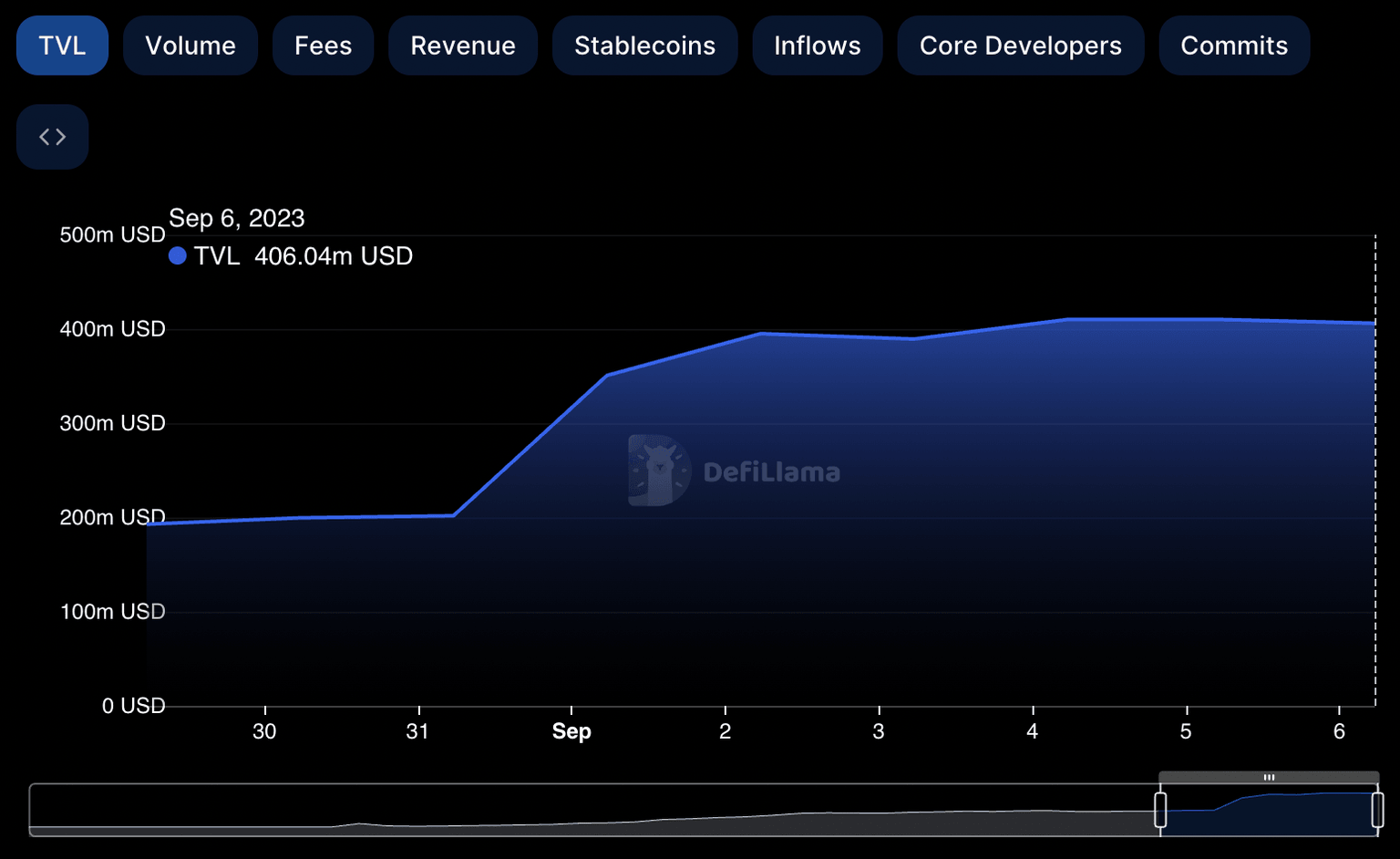

The Layer 2 chain has noted a decline in the total value of assets locked on its blockchain from $410.06 million on Monday to $406.04 million early on Wednesday. This can be considered indicative of a declining interest from market participants.

BASE chain TVL on DeFiLlama

Several critics in crypto have called out BASE for its centralization, attributing the recent outage to the same. The crypto analyst behind the Twitter handle @LucidCIC commented on BASE’s outage and said centralized Layer 2 chains are not perfect.

Base has experienced its first "Stall"!

— Lucid (@LucidCiC) September 5, 2023

Coinbase is a good crypto company from what I have experienced but blockchain technology is complicated! When it comes to securing people's value these systems need to be perfect. Centralized EVM L2 is not perfect.

Staying on Cardano ♂️

Justin Bons, founder & CIO of Cyber Capital, said that all major Layer 2 chains have admin keys and that this makes them susceptible to theft or loss of funds. Bons states that Optimism, Arbitrum, zkSync, dYdX and BASE are being considered a replacement for Layer 1 chains, however, centralization of Layer 2 chains compromises their security.

1/6) All major L2s have admin keys; over $9B of user funds can be stolen right now!

— Justin Bons (@Justin_Bons) August 31, 2023

This includes Optimism, Arbitrum, zkSync, dYdX & Base

That this is seen as an adequate replacement for L1 scaling is a travesty

They promise this will change, but centralization tends to stick:

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.