Cardano Price Prediction: ADA at risk of further losses as death cross looms

- Cardano price is at the brink of collapse as the token faces weakened momentum.

- The Ethereum killer dropped below a critical support level, suggesting a pessimistic forecast for ADA.

- Cardano must reclaim $1.40 to invalidate the bearish outlook.

Cardano price continues to suffer from weakened momentum as ADA fails to bounce back after the crypto market crash. The Ethereum killer could be headed lower as bears dominate the market after the token fell below a significant support level.

Cardano price faces imminent collapse

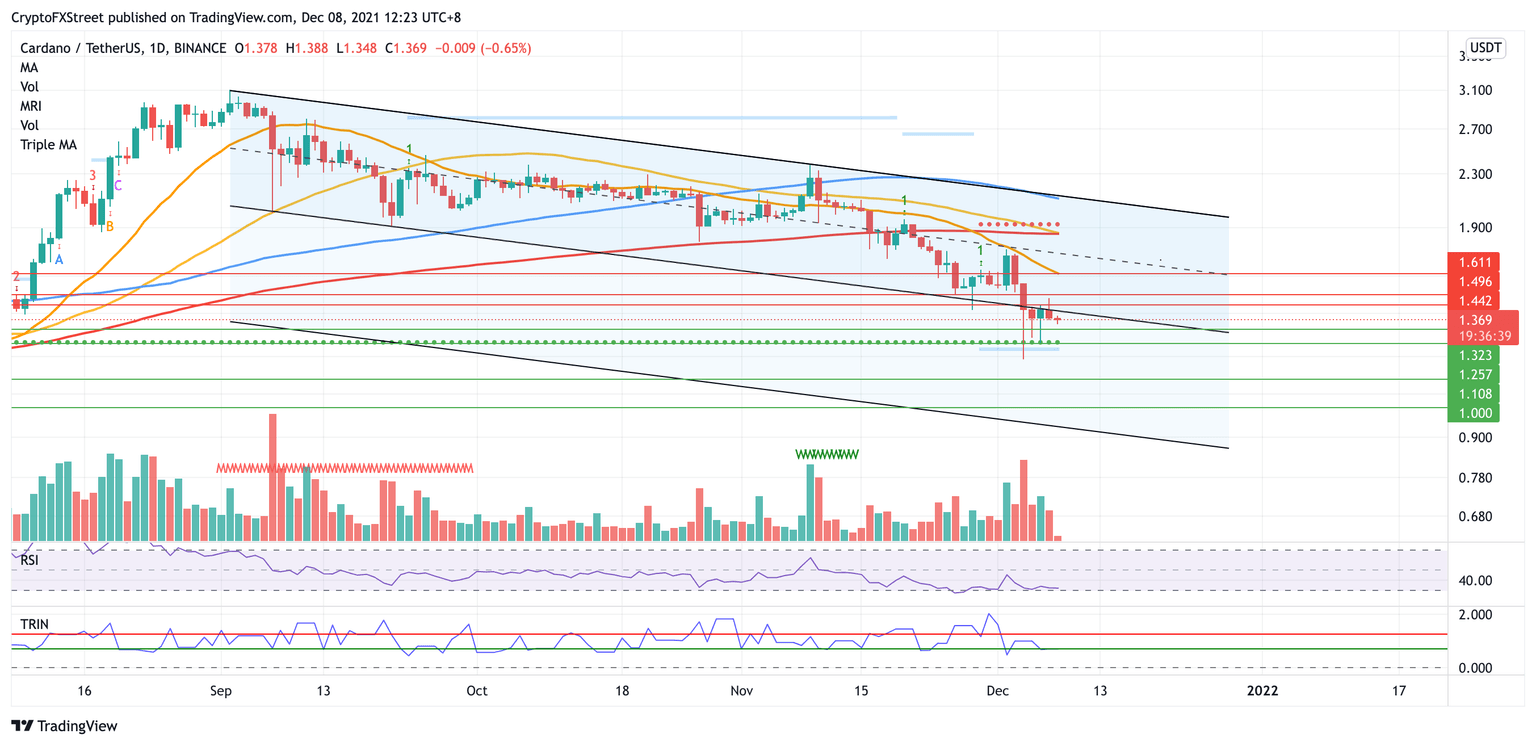

Cardano price has fallen below the lower boundary of the descending parallel channel on the daily chart, suggesting that ADA could have more room to slide. The slice below the prevailing chart pattern indicates that the Ethereum killer could tumble 34% toward $0.91.

The first target for the ADA bears is at the August 4 low at $1.32, then at the July 28 low at $1.25, coinciding with the support line given by the Momentum Reversal Indicator (MRI). This area should act as a reliable line of defense for Cardano price.

However, if Cardano price continues to lose momentum, the token could drop lower toward the June 23 low at $1.10 before falling further to reach the psychological support at $1.00. If selling pressure rises, ADA may eventually reach the pessimistic target at $0.91.

Investors should note that there is a death cross on the daily chart, as the 50-day Simple Moving Average (SMA) has intersected with the 200-day SMA and is expected to trigger a sell-off.

ADA/USDT daily chart

The bulls could reverse the period of underperformance if Cardano price manages to reclaim the lower boundary of the parallel channel at $1.40 as support. However, ADA may face difficult challenges ahead of its attempt at a recovery.

The following area of resistance for Cardano price is at the July 7 high at $1.44. An additional obstacle will emerge at the July 4 high at $1.49 before another hurdle appears at $1.61, where the 21-day SMA and June 15 high converge.

In order for ADA bulls to escape the prevailing downtrend, Cardano price must also target $1.84, where the 50-day SMA and 100-day SMA meet and also break above $2.10, where the 200-day SMA and the upper boundary of the governing technical pattern coincide.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.