Cardano flash crash hits major support, ADA to reverse towards $3.00

- Cardano price is one of the few top 10 cryptocurrencies to maintain a bullish weekly candlestick after Friday’s selling pressure.

- Significant near-term support remains.

- A combination of time cycles and a bullish defense are likely to convert into a massive bull run.

Cardano price was not immune to the massive overnight flash crash that affected the broader cryptocurrency market. Overall, Cardano price action remains a disappointment for long-term holders – but an exception might be made for last week’s trading activity. Amidst the intense selling pressure on Friday that saw many altcoins hit nearly double-digit percentage losses and significant weekly losses, Cardano maintained a positive weekly close.

Cardano price forms a base to serve as a launching pad to $3.00 and above

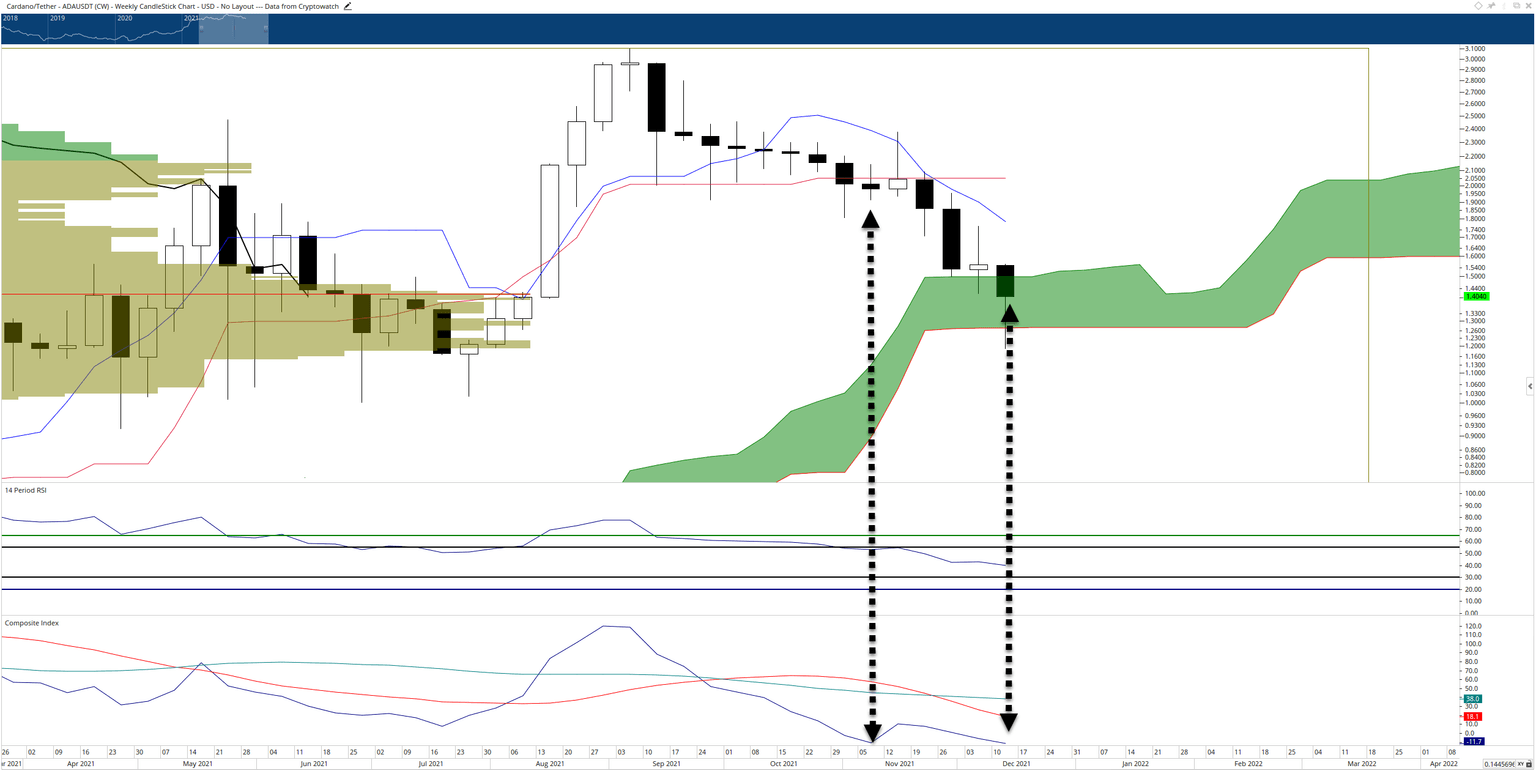

Cardano price action last week spent a good majority of the time establishing and battling for support at the $1.45 - $1.50 price levels. Some of the most significant support zones for Cardano exist near the $1.50 level: 2021 Volume Point Of Control and the top of the Cloud (Senkou Span A). Cardano’s ability to hold this level amidst much stiffer weakness across the altcoin market gives traders a heads up on where Cardano is likely headed.

And then the flash-crash during the New York midnight trading session occurred. At one point, Cardano collapsed more than 25%, dipping below the weekly Senkou Span B. Cardano price has since recovered and is now holding steady above Senkou Span B.

A decisive factor supporting the idea that Cardano will make a new bull run is the condition of the Composite Index. The arrows on the chart below point to the week of the November 5th swing low in the Composite Index (the second-lowest reading in Cardano’s history) and its corresponding candlestick directly above it and last week’s Composite Index line to its corresponding candlestick.

The candlestick shows lower closes and lower lows, while the Composite Index shows higher lows. When this discrepancy appears, it’s known as regular bullish divergence. Regular bullish divergence is a warning for market participants that the current downswing could soon reverse, that the demand for sell-side pressure has waned and that buyers are likely stepping in. This divergence appeared as Cardano found support against two key levels that adds to the bullish outlook.

ADA/USDT Weekly Ichimoku Chart

Downside risks are likely limited to the $1.25 level, where the weekly Senkou Span B and a final chunk of a high volume node exist. However, below that is a vast sea of nothing – flash crash territory exists on any weekly or daily close below the $1.25 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.