Cardano price remains trending downwards while crypto markets rebound

- Cardano price is paring back losses that occurred last weekend.

- ADA price is still trending lower in line with a very well-respected trend line.

- Expect bulls to test and try to break $1.67, depending on the strength of the tailwinds.

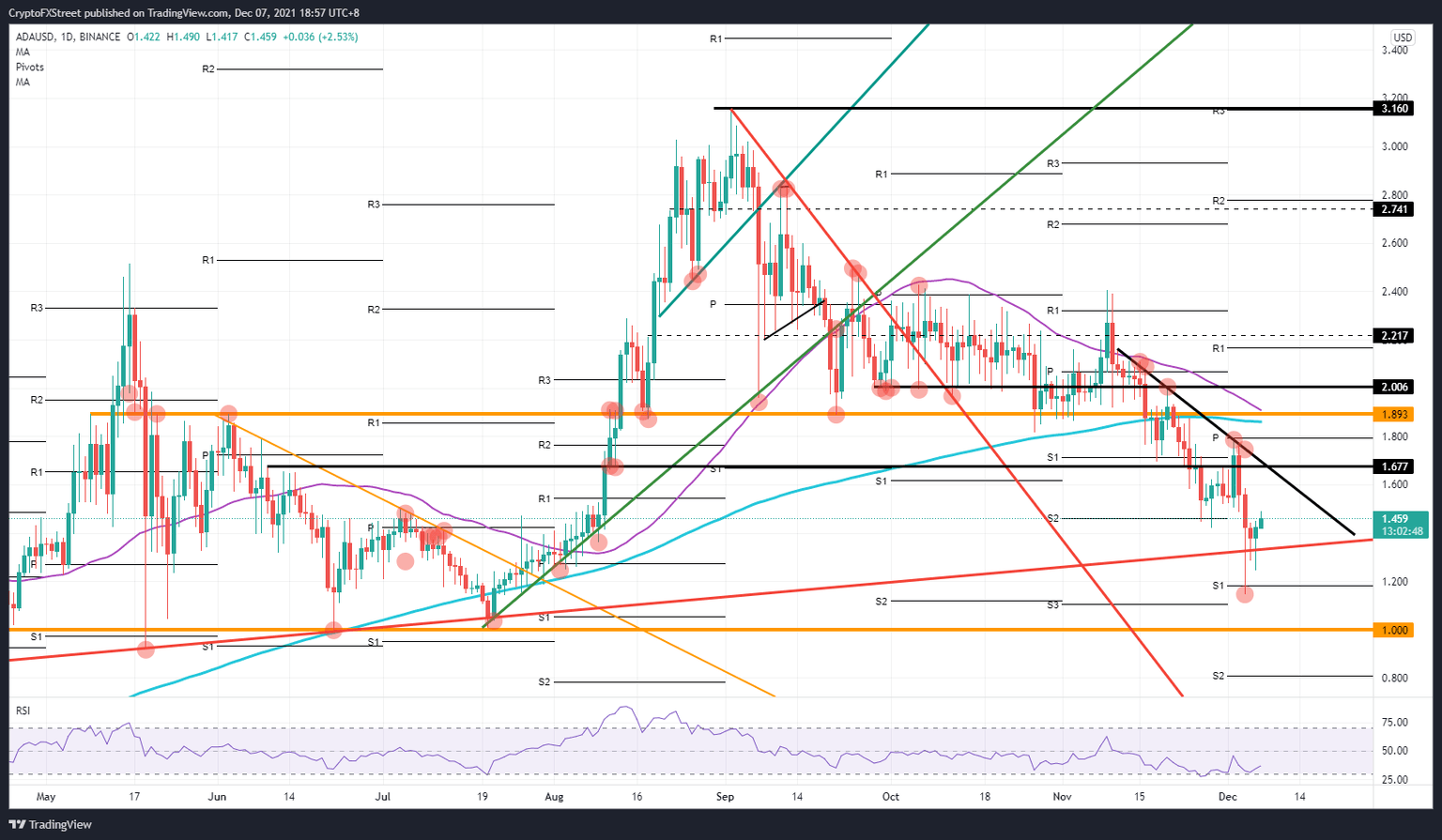

Cardano (ADA) price has been declining since mid-November when its trend accelerated in the spillover from the Bitcoin flash crash. Now ADA price sees bulls returning to the scene as Cardano trades at an attractive discount. It is possible this may be a short-term reaction, however, as the downtrend is technically still in play, and buying volume will only pick up once bulls break above $1.67 to the upside.

Cardano investors sidelined as downtrend still active

Cardano price has already lost 51% of its value since the high of November when it reached $2.40. ADA would be expected to see quite some inflows from investors and buyers at the current price who may be looking to pick up some interesting cryptocurrencies at a discount. However, the uptick in buying volume is mild as traders know that the downtrend in ADA is still very much alive, with the black descending trend line acting as a reference for that trend.

ADA price will see investors start to buy back in once bulls can break above $1.67 around the intersection from the descending black trend line and a historical level that has been well respected since June. The two false breakouts on December 2 and 3 will make investors nervous, and would only see them starting to buy in when the price can consolidate above that level. That push higher will depend on whether the current tailwinds linked to the rebound in global equity markets extends.

ADA/USD daily chart

ADA bulls will, therefore, be closely watching for any breaks and the behavior of price action around $1.67. Once through there, expect bulls to quickly face further resistance at $1.90, with the 200-day and 55-day Simple Moving Average merging just above that level. So, price action is facing some pretty hefty resistance.. Should current tailwinds start to fade once again, expect a quick dip back below the red ascending trendline near $1.30, and a further correction towards $1.0.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.