Binance Coin in bullish breakout, set to hit $450

- Binance Coin sees bulls preparing to break out of the triangle.

- BNB coins are in significant demand, with the RSI set to rise as demand triples.

- Expect to see more bulls joining the rally, lifting price action from $389 to $452 in a matter of days.

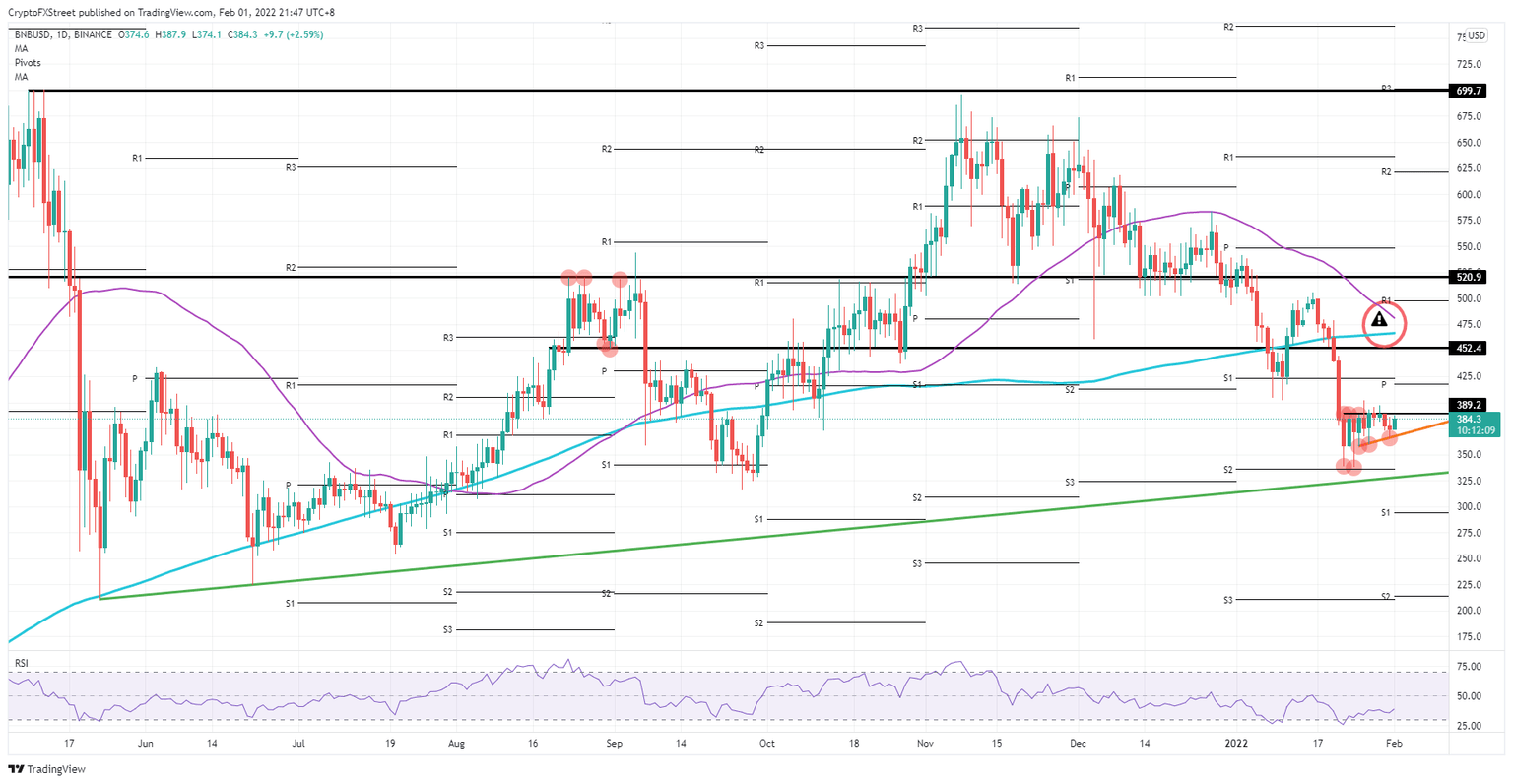

Binance Coin (BNB) price action is set for a pop as the bullish triangle formation nears completion and global sentiment is back in risk-on mode. With plenty of respect for the red ascending trend line of the triangle, bulls are now ready to sit on their hands and see price ramped up as demand comes in strong on the back of further gains in the Nasdaq, creating tailwinds for cryptocurrencies. This will be translated throughout the week into more gains to come, hitting $452, or 16% of gains, by the end of this week.

BNB price counts in good news spiral and spillover effects

Binance Coin price is in the last phase of completing the bullish triangle that started on January 25. Bulls got plenty of opportunities to get in long positions, along the sloping side of the triangle, as higher lows pushed price action against the base at $389.20. As more bulls get ready for a breakout higher, the demand-side is exploding as the sell-side runs dry, which will result in a violent spike higher.

BNB price will react as the Nasdaq returns its second day of gains, which will spark a massive flood of investors looking to pick up cryptocurrencies, seeing the demand-side exploding and quickly seeing BNB price rise above $389.20. The roadmap is set from that point on towards $418.00 where the monthly pivot is situated, and from that point towards $452.40 – the profit target for this week.

BNB/USD daily chart

Current sentiment depends clearly on the US indices and Nasdaq going forward. Should the Nasdaq tank, expect interest in cryptocurrencies to fade as quickly as it came. A break below the ascending trendline in the triangle could see an accelerated dip towards $350, and with that, see the 55-day Simple Moving Average (SMA) start closing in or crossing the 200-day SMA, risking the formation of a death cross, which would spark a massive selloff in BNB.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.