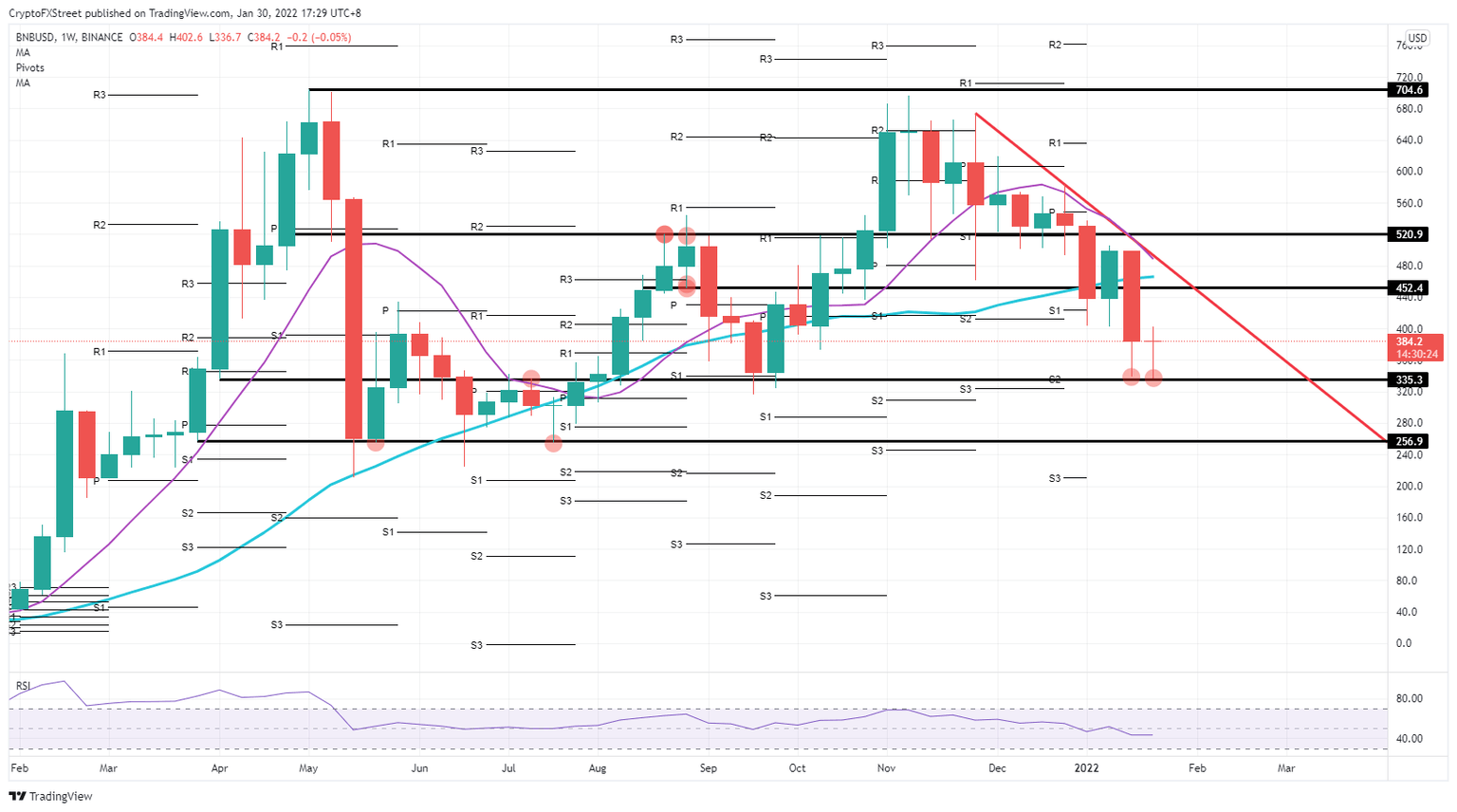

Binance Coin looks to hold potential for 33% profit but is still stuck in a downtrend

- Binance Coin made a solid bounce off the $335.3 level for a second week in a row.

- With bulls having had twice the window of opportunity to get in for long, expect price action to be in control for bulls next week.

- Bulls and investors will need to keep in mind that the downtrend is still present.

Binance Coin (BNB) lost 33% of its value in the descent from last week's trading. But investors are looking to flip a coin as BNB price action looks set for either a 30% uptick next week or shedding another 20% of its value. As bulls have entered twice in two weeks at $335.3, the risk is that the level loses interest among investors and bulls and could break if global markets face another week of headwinds.

Binance Coin sees bulls flipping in coin for next week's trading

Binance Coin bounces for a second week in a row off the $335.3 level that coincides with the monthly S2 support level and sees bulls attempting to close above $400. That attempt from last week failed, this week looks a bit more promising and could set the scene for more upside towards $452. But that is where the good news stops for now for more upside as the 200-day Simple Moving Average (SMA) hovers as cap just above that level, and the red descending trend line from the high of December is still present and acts as the backbone for the downtrend.

BNB price will thus need to go into the weekend and have investors attempting to stay above the $400-markerm to produce a bullish candle and set the scene for next week. As the weekend will give institutional investors a chance to let the dust settle and come up with a game plan for current market conditions, the potential of Binance Coin could be a valuable asset in that game plan for institutionals and hedge funds going forward. This creates plenty of demand throughout next week and could lift price action towards $466 for a test and pole position for the week after that.

BNB/USD weekly chart

As BNB price action looks to go, either way, a further continuation of the downtrend is more than possible. Current headwinds contain much more fundamental weight and could set the tone for the rest of February. A third test and break below $335.3 could add another 20% of losses, with $256.9 as the low for the end of March and several bounces and false breaks along the way towards the coming week.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.