Ethereum price hammered after Bank of America report on the blockchain network

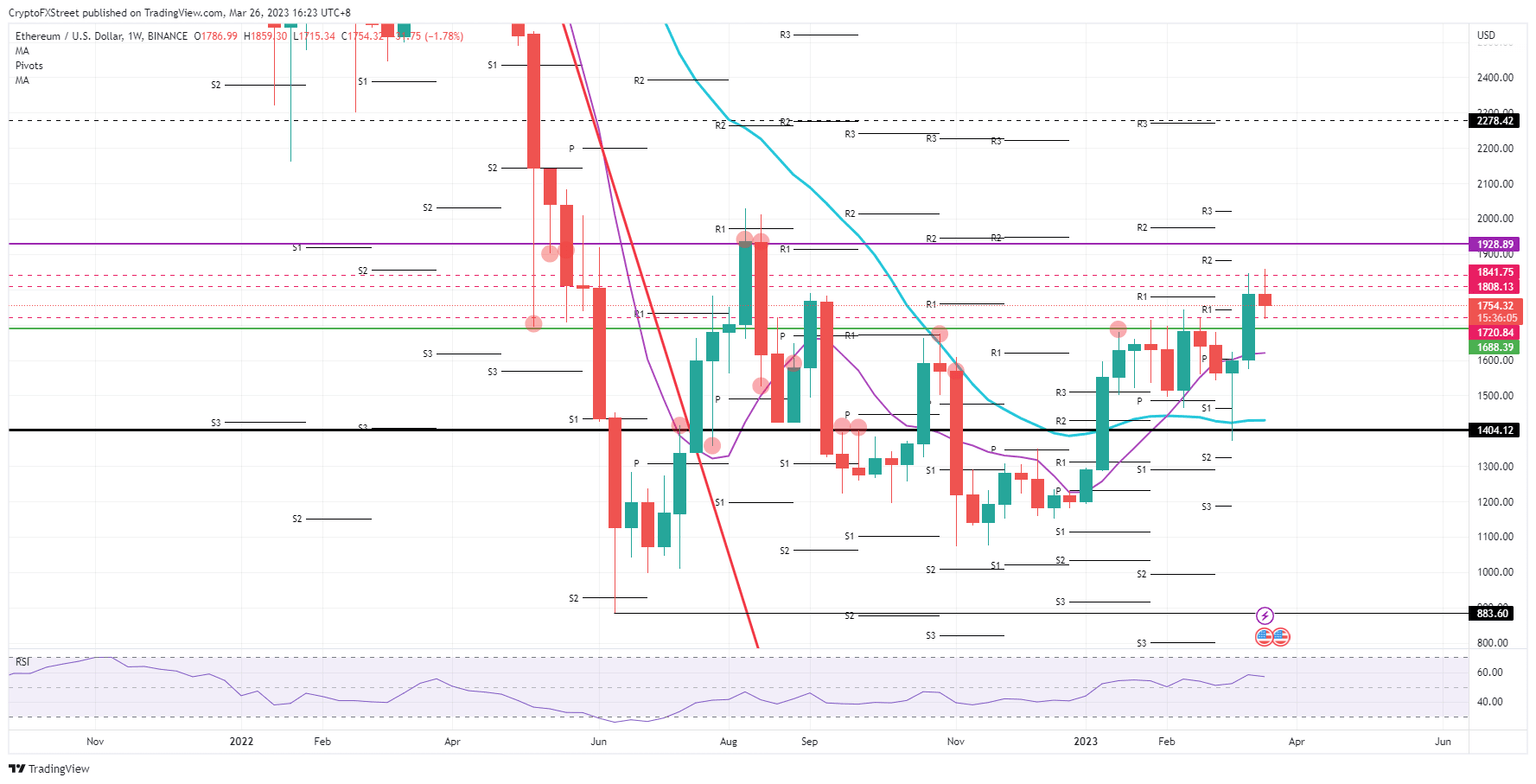

- Ethereum price is at risk of sliding below $1,688 and looking for lower support.

- Top 3 crypto XRP outpacing ETH only fuel the fire in the current decline for Ethereum.

- The worst-case scenario would be another 17% drop on the back of the BofA report.

Ethereum (ETH) price is taking a turn for the worse and has bulls being flabbergasted after Bank of America issued an analyst note that predicts a drop in usage if the speed of the Ethereum network does not pick up soon. Most worrying is that the report ends with the message that those who do not upgrade their network in due time are bound to fade away and end up existing. Although the losses are still relatively contained, this could become more severe as the report becomes more widespread, with a 17% drop in risk.

Ethereum price declines as a simple element as network speed is kicking it against the curb

Ethereum traders must think the world is upside down as smaller brother RIpple price is performing stellar against Ethereum price, which is taking a step back this week. The reason for the breakdown in correlation and the diversion in the sense of direction comes from an analyst report from Bank of America. The analyst mentions that the speed of the Ethereum network has not increased enough and is due for an upgrade if it still wants to claim its top 2 places as cryptocurrency.

ETH could be tanking firmly lower once this report becomes more widespread. Certainly, hedge and investment funds often do all the reading over the weekend and decide on their positions on Monday. Best-case support is found at $1,635, and only 8% losses get priced in, while worst-case near 20% losses need to be factored in towards $1,450.

ETH/USD weekly chart

Often analyst reports are just one in a bunch and could be disregarded quickly once the next big catalyst or headline offers itself. Should the pessimistic mood of last week start to fade a bit, the Ethereum price could be lifted higher. At least a test at $1,928 would be guaranteed.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.