Axie Infinity set to slip 30% if AXS bulls do not get their act together

- Axie Infinity slips below the essential technical support area.

- AXS could see another correction between 16% and 30%.

- When bulls can build on upbeat global sentiment, expect a recovery back above $85.

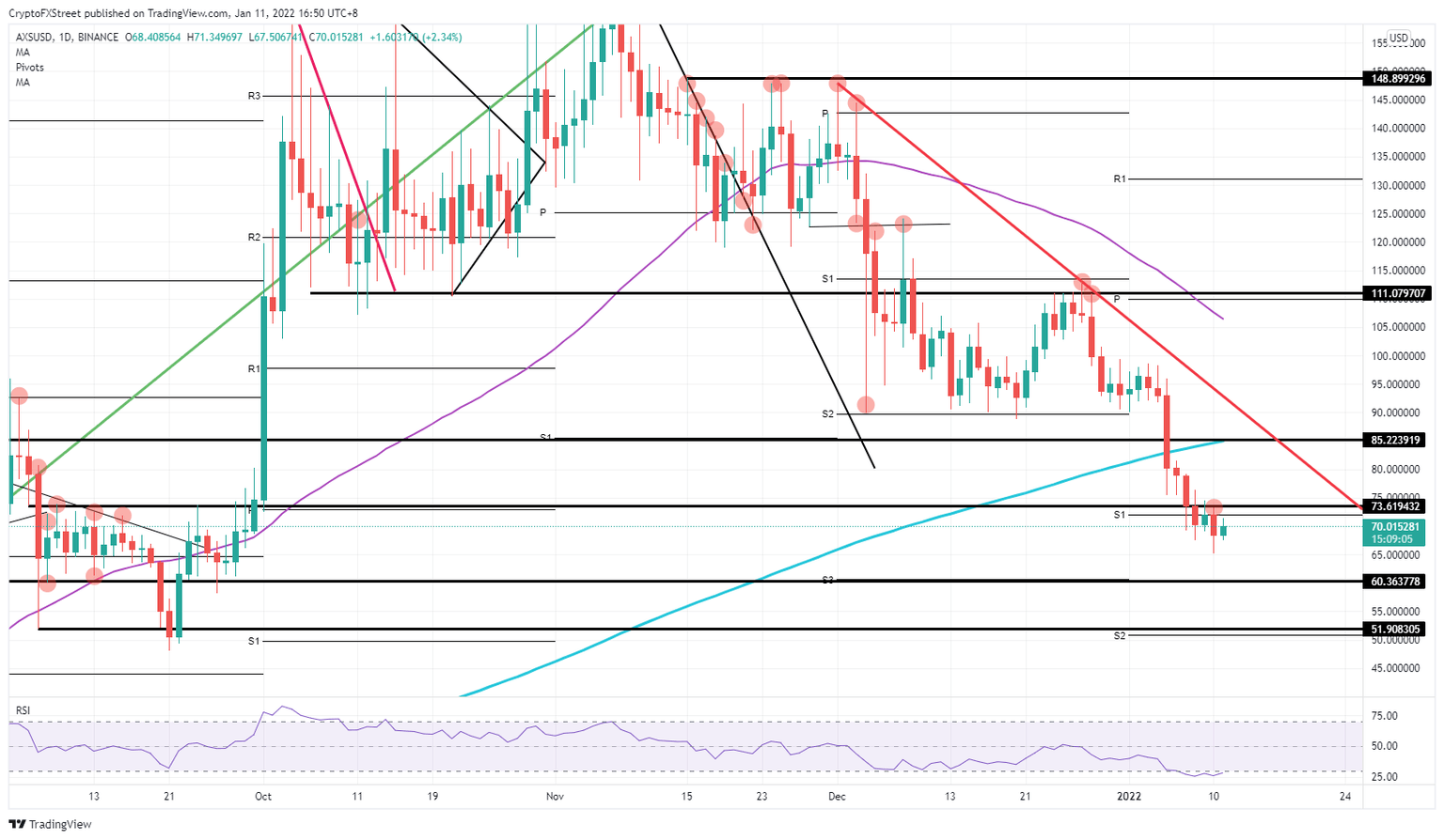

Axie Infinity (AXS) is in rough shape after an acceleration of the downtrend at the beginning of the year. Investors are not showing their hand, reflected in the Relative Strength Index (RSI) trading firmly in the oversold area with no real bullish knee-jerk reactions. As the price this morning firmly opens below $70, it looks as though bulls have given way to sellers which could see AXS price hitting $60 in the process.

AXS price action sees bulls fleeing with more losses to come

Axie Infinity looks to say goodbye to the $70-area for now. Although the historical level at $73 and the monthly S1 support level around $70 look very promising and make sense as an entry for a long, price action gaped open lower this Tuesday, with bulls now facing the elements mentioned above in the form of resistance capping any further upside for now. As investors do not have a profit target and incentive in sight, expect AXS price action to look for support further down the line, offered around $60.

AXS could thus be going against the mainstream recovery that we are seeing today, but that would also fit as a reason for AXS price action not dipping further towards $50, as the RSI is already quite far in oversold territory already, thus limiting any further gains for sellers. With the tailwinds from the broad recovery in global markets, AXS will not see a sharp accelerated decline since the positive ambience will likely set a break or slowdown on the decline.

AXS/USD daily chart

Hopes that Axie Infinity price could still swing back above $75 are not unfounded if the current tailwinds kick in with a delayed effect once investors decide to re-engage with cryptocurrencies. A break above $73 would see a broad pickup in demand on buying volume and would see an accelerated move back towards $85, where the 200-day Simple Moving Average (SMA) comes into play together with a historical level. Expect this to be an area for a pause and some profit-taking, depending on the strength of the tailwinds, before AXS price mounts an attack and possible breakout above December 01’s red descending trend line.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.