Axie Infinity enters bear market conditions, AXS at risk of dropping to $50

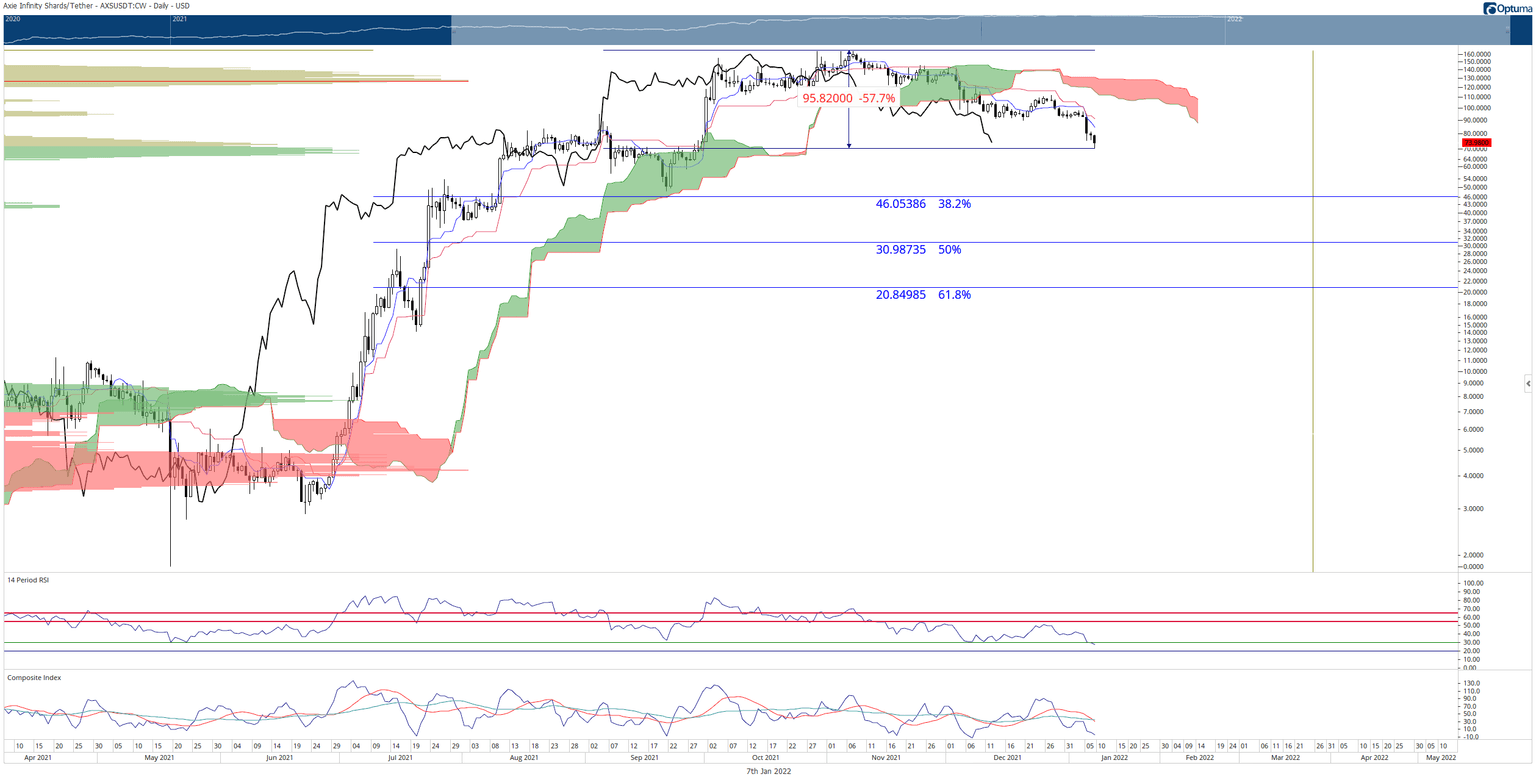

- Axie Infinity price action is down nearly 60% from its all-time high.

- Selling pressure continues as the volume profile continues to thin out.

- A bounce should be expected if AXS continues to create significant gaps between the candlestick bodies and the Tenkan-Sen.

Axie Infinity price action continues on its bearish trajectory, following its peer's lower. In addition, profit-taking and broader cryptocurrency market weakness continues to weigh in on the gaming token and metaverse crypto asset classes.

Axie Infinity price finds temporary support at $70, but failure to hold that zone could trigger a deeper push south

Axie Infinity price may consolidate for a few days before determining its primary trade direction. The second-largest high volume node in the Volume Profile at $70 has created a support zone for AXS, but it remains to be seen whether this is enough to halt further selling pressure.

Gaps between the bodies of the daily candlesticks and the Tenkan-Sen may temporarily limit how much lower Axie Infinity price can go, but that may be just a pause before another drive down begins. The Volume Profile thins out considerably between $65 and $50, which is where Axie Infinity price is anticipated to find its next primary support zone.

The $50 value area is vital for several reasons. First, it is a significant psychological number. Second, a high volume node exists between the value area of $45 and $50, and third, the closest Fibonacci retracement (38.2%) is at $46. Finally, if Axie Infinity price drops below $65, the $50 value area should prevent any further bearish momentum.

AXS/USDT Daily Ichimoku Chart

Bulls will need to rally Axie Infinity price to a close above the daily Kijun-Sen at $95 to invalidate any current bearish bias.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.