USD/JPY Weekly Forecast: Will gloom guide it lower? Geopolitics, jobless claims, coronavirus all eyed

- USD/JPY has been torn between hopes and concerns related to the virus.

- US jobless claims, COVID-19 statistics, and Sino-American tensions will likely set the tone.

- Mid-July's chart is painting a balanced picture with clear battle lines.

- The FX Poll a lower target in the long term ahead of sideways movements beforehand.

Coronavirus vaccine hopes and mostly upbeat data were countered by rising US COVID-19 cases and rising Sino-American tensions as the Bank of Japan stayed pat. The same themes remain prominent for another week as USD/JPY is nearing decision time.

This week in USD/JPY: Vaccine or further damage

Vaccine hopes: Both Moderna and AstraZeneca reported significant progress in developing immunization for coronavirus testing. While larger experiments are needed, Anthony Fauci, the go-to person on the virus in the US expressed hopes that a solution will come by year-end. That helped markets move up and somewhat weighed on the safe-haven yen.

Fauci also said that some states opened too early – unsurprisingly given the acceleration in US COVID-19 cases. America hit a daily high of around 75,000 infections and the deaths are near 1,000 per day once again. The positive test rate and hospitalizations are also on the rise. The focus remains on larger states such as California – which announced a sweeping shutdown – Texas, and Florida, but most of the US is struggling.

The data also showed the double-edged sword nature of reopenings. US retail sales leaped by 7.5% in June, exceeding the previous year's level and also expectations. On the other hand, that data may already be stale. Jobless claims and other high-frequency figures are painting a gloomier picture, keeping the yen bid.

The Bank of Japan left its interest rate unchanged at -0.10% and vowed to do whatever is needed. Governor Haruhiko Kuroda and his colleagues said the economic situation in Japan is worse than previously estimated. His comments came as Tokyo and Osaka continue experiencing an increase in coronavirus cases. The government rejected the need to announce a new state of emergency.

Sino-American tensions remain elevated, especially around Hong Kong. The White House is reportedly considering preventing all 90 million members of the Chinese Communist Party from entering the US in retaliation to Beijing's tighter grip of the city-state. Chinese authorities announced sanctions against several outspoken Senators that have criticized it.

Moreover, the UK's decision to phase out the usage of Huawei's equipment – due to American pressure – did not help to defuse the situation. So far, President Donald Trump prefers sticking to the trade deal, signed earlier this year, and markets remain calm.

Overall, the news was more bad than good, but USD/JPY movements were limited.

US events: Coronvirus stats, jobless claims and more

Investors' focus remains on coronavirus statistics, kicking off in Florida and ending in California. If statistics begin flattening, markets may cheers, while an ongoing rise – especially in mortalities – may trigger a risk-off sentiment.

Recent opinion polls have not moved away from a clear lead for challenger Joe Biden over Trump, yet markets have been shrugging off political developments. Perhaps if the Senate begins clearly shifting toward the Democrats – allowing them to enact business-unfriendly policies – stocks may notice and the yen may rise.

The upcoming week features a sparser economic calendar. Housing figures and Markit's preliminary Purchasing Managers' Indexes are of interest but the focus will likely be on jobless claims. Initial applications are for the week ending July 17 – in which Non-Farm Payrolls surveys are held.

Any increase in claims would weigh on markets while a fresh drop would provide optimism. Continuing claims are also of interest and investors will want to see them continuing the downtrend.

Here are the top US events as they appear on the forex calendar:

Japan: Geopolitics and BOJ minutes

Will Washington and Beijing end the trade deal? That remains a remote option but as rhetoric and sanctions ramp up, the risk is growing. If either side hints that could happen, the yen would have room to rally.

The yen is also turned to other conflicts such as around North Korea and Iran, both dormant for now. Nevertheless, a string of mysterious explosions in the Middle East may escalate. Tensions between the US and Iran dominated the news early in the year, before vanishing.

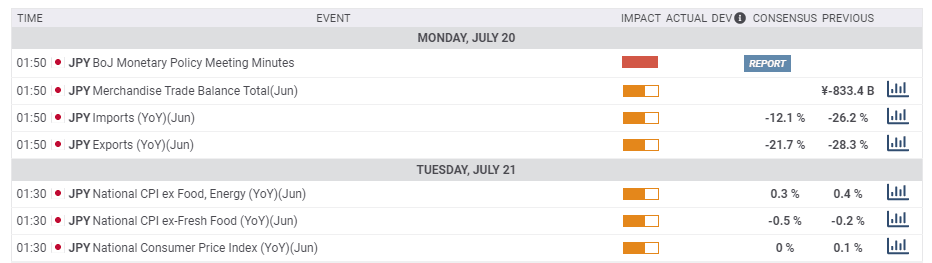

Japan's economic calendar consists of the BOJ's meeting minutes – from the June meeting – and it is unlikely to stir markets. The Tokyo-based institution has not made substantial changes to its policy and probably has few tools in its shed.

Inflation figures are of interest and they may show a growing risk of persistent deflation. Despite rising demand for food – amid lockdown fears – price pressures are subdued.

Here are the events lined up in Japan:

USD/JPY Technical Analysis

Dollar/yen is trading in a narrow range, with two clear battle lines. The currency pair is capped by 107.50, where the 50-day and 100-day Simple Moving Averages converge and just above the recent highs. The bottom line is 106.60, which has supported USD/JPY several times in both June and July.

Momentum has all but disappeared, but bears have a minor advantage as long as dollar/yen trades below the 200-day SMA, currently at 108.40. 108.20, a late June high, is another resistance line. High above, 109.60 was the peak early in June and may come into play upon a significant break to the upside.

Support below 106.60 is at 106, a round number that was May's trough. It is followed by 105, an even rounder level which was also a gap line in the turbulent days of March.

USD/JPY Sentiment

Dollar/yen has room to the downside as the disease spread and demand for the safe-haven yen intensifies. However, the big breakout may wait for another week, with only a minor retreat in the nearer future.

The FX Poll is showing a bearish bias in the short term and a bullish one afterward – but targets are tight just above 107. The longer-term already provides a broader range of views and a tendency for a downfall.

Related Forecasts

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637305855086574538.png&w=1536&q=95)