USD/JPY Weekly Forecast: The view from the heights

- US payroll gains spark modest Friday profit-taking.

- USD/JPY up 3.1% from 107.92 since late April.

- Fed forecast revisions remain the dollar’s guiding light.

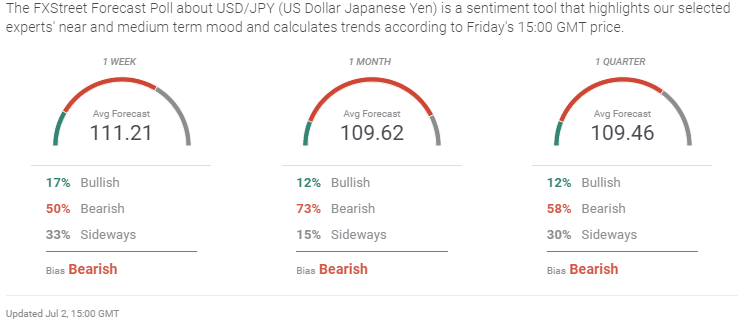

- FXStreet Forecast Poll predicts a retreat from 111.00.

The US Nonfarm Payrolls report brought out a few long dollar sellers on Friday but the basic case for a higher greenback remained intact.

Since the last extensive dip in late April, the USD/JPY has gained 3.1%, with almost 1% on Wednesday and Thursday this week. On the year the USD/JPY is up 8.4%. Friday’s slide from 111.44 to 111.17 after payroll release just scratched the surface of the dollar’s recent gains.

Economic and interest rate projections released at the Federal Reserve meeting on June 16 continue to be the fundamental background for the currency markets with inflation the driving logic. June payrolls did not alter the Fed’s economic calculus.

The Fed and Chair Jerome Powell have asserted that the surge in first quarter consumer inflation is a temporary base effect from last year’s lockdown. That is correct. However, it doesn’t change the impact of product scarcity on prices and the wage inflation produced by extensive labor shortages. It is probably the latter and its potential to change inflation expectations, that has moved the Fed to its slightly surreptitious tightening stance.

Fed rhetoric has largely remained focused on the labor market but its rate projections, with two possible hikes in 2023 and a taper this year, sing a different tune. It is very much a case of watch what we do, not what we say.

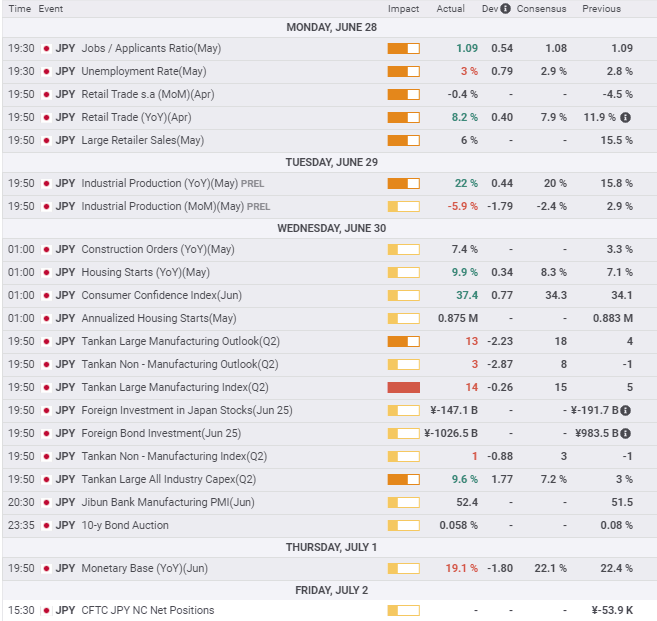

Japanese economic data was mixed with slightly better than forecast Retail Trade in April offset by a weaker than expected Tankan Manufacturing Survey for the second quarter. One bright spot was All Industry Capex (capital investment) which rose to 9.6% from 3% in the first quarter.

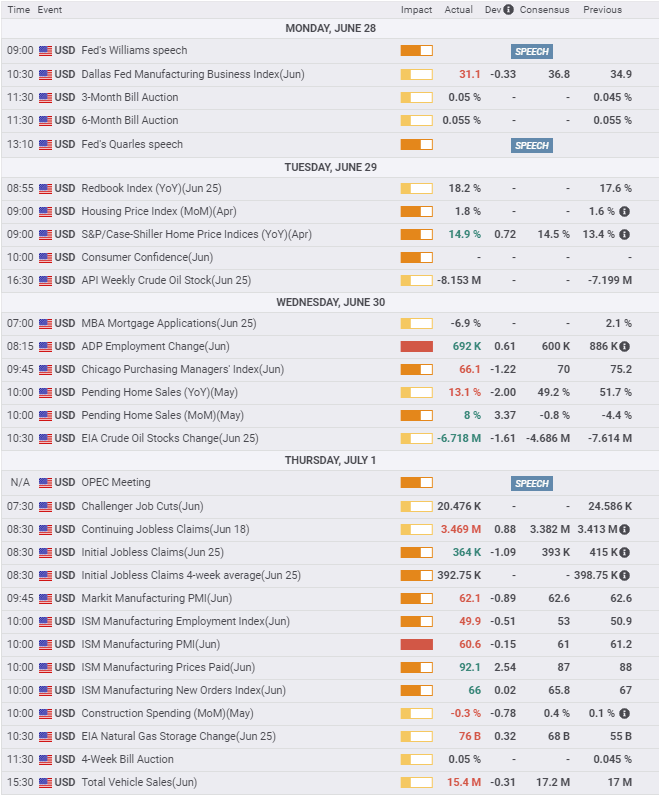

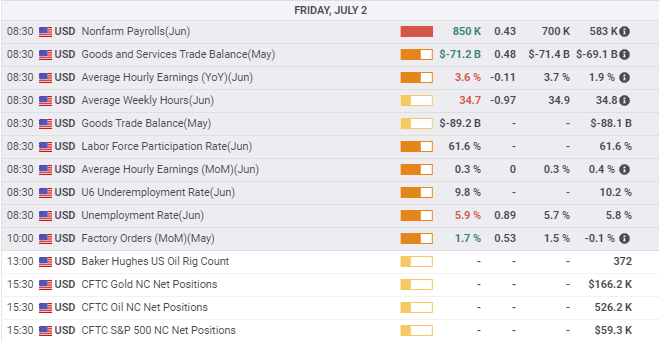

In the US, Nonfarm Payrolls confirmed the Purchasing Managers’ Index picture of a robust expansion oddly joined to a somewhat reluctant workforce. The Prices Paid Index registered a record high in June, suggesting that inflation pressures are more than temporary and rooted in economy-wide changes.

The discrepancy between the record number of jobs on offer, 9.3 million in April, and the large pool of unemployed, also 9 million by some counts, is the policy conundrum for the Fed. Initial Jobless Claims fell to a pandemic low, further evidence that the unemployment rate is not a purely economic function.

USD/JPY outlook

The USD/JPY has reached levels where a tendency to take profits can be expected. Buyers and sellers should be evenly matched above 110.50 and consolidation will build a base for future gains. The area above 111.50 has not been extensively traded since late 2018 and early 2019 and reference points are consequently weak.

That said, the contrast between the US and Japanese economies and the rate outlook for the two central banks should keep the USD/JPY bid. The Bank of Japan is highly unlikely to make any move that would strengthen the yen, given the economy’sperformance and export dependency.

Treasury yields dropped after the US payroll report which was not strong enough to move a potential taper closer but may have been sufficient to diminish concerns about rampant wage inflation. It may be several months before a clearer US rate picture emerges.

The April 2019 high of 112.35 is a likely first target. Initial support is at 111.00 and then at regular intervals to 108.00.

Japan statistics June 28–July 2

US statistics June 28–July 2

FXStreet

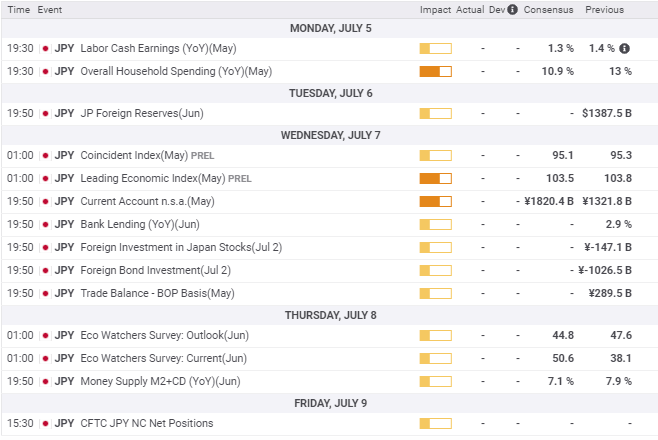

Japan statistics July 5–July 9

Labor Cash Earnings and Overall Household Spending for May will give an indication on the condition of the Japanese consumer economy. Unlike the US, domestic consumption does not drive Japan's economy. The Eco Watchers Survey for June will be timely but it has limited market impact.

FXStreet

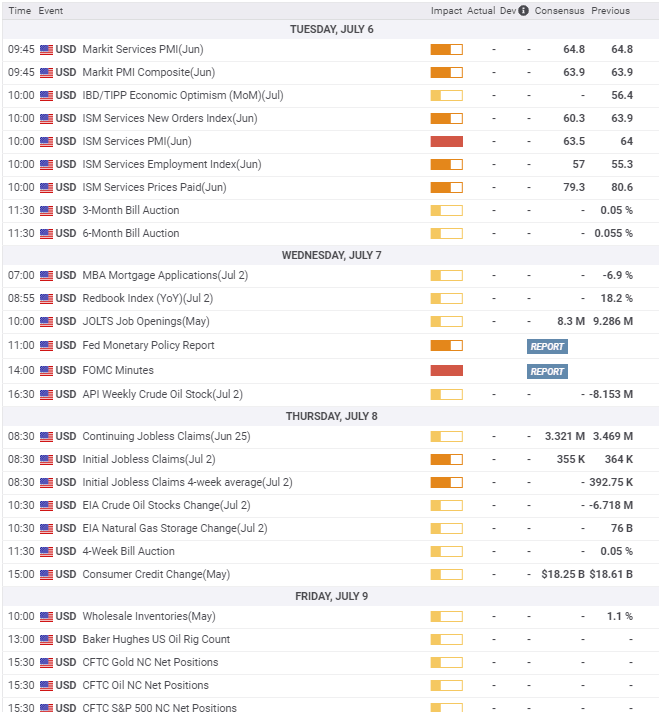

US statistics July 5–July 9

Services PMI should confirm the overall manufacturing outlook with particular interest in the employment and prices indexes. The JOLTS report for May is expected to drop the million gained in April. This is not normally a market moving statistic, largely because it is relatively old data, but it will certainly be noted.

USD/JPY technical outlook

Buying momentum has waned in the Relative Strength Index (RSI) and True Range. The MACD retains weak purchase advice. Thursday's top at 111.63 and close at 111.53, both 15 month records, are a culmination of the entire pandemic era. Future trends depend on the economic and rate balance between Japan and the US and their central banks.

The fundamental picture heavily favors the US and the dollar but the timing, especially the advent of the Fed bond taper, which will be its most important manifestation, is unclear. Robert Kaplan, the President of the Dallas Fed, has said that he would prefer it to begin this year, and the likelihood is that it will, but officially all is silence.

Consolidation above 110.50 is this week's prescription. The USD/JPY has come a long way in a relatively short time and a base for a push above 112.00 needs to be developed. Rate prospects in the US would seem to be a strong bet for a higher dollar but the Fed is being very discreet about its plans. A surge in US Treasury rates could obviate the need for a technical base but at the moment that does seem likely.

Support lines are recent and well documented, thus stronger. Resistance lines are either briefly traded, as in two closest to market, or based on levels from more than two years ago, and consequently weak. All of the support lines occur in the interval above the 23.6% Fibonacci line of the January to June run.

Resistance: 111.65, 112.00, 112.25, 112.65, 113.00based on

Support: 111.12, 111.00, 110.70, 110.50, 111.30, 110.10, 109.85

FXStreet Forecast Poll

The FXStreet Forecast Poll, as it did last week, discounts fundamental strength in favor of technical adjustment.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

%20-%20Copy-637608356549238309.png&w=1536&q=95)

-637608395228156089.png&w=1536&q=95)

-637608399576409341.png&w=1536&q=95)