USD/JPY Weekly Forecast: A rising dollar is the summer’s treat

- Fed economic, inflation and rate projections stir markets.

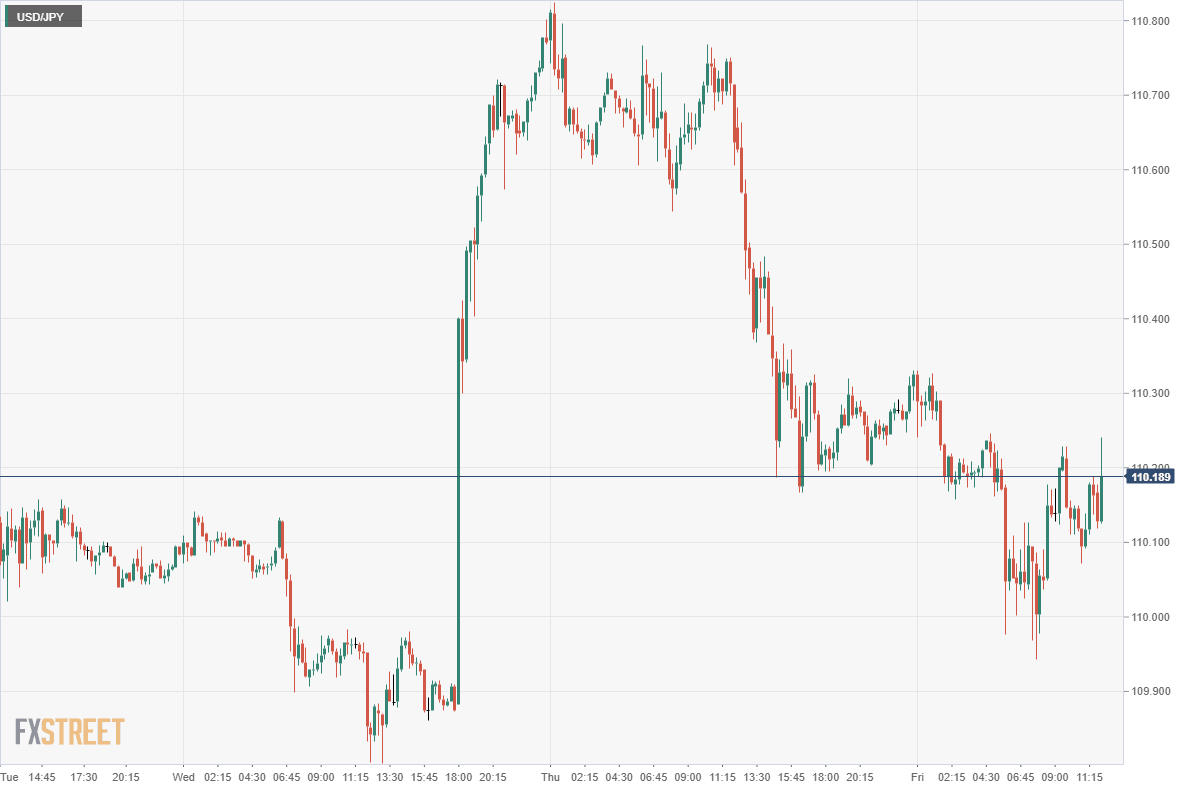

- USD/JPY soars but then surrenders most of its gains.

- Long-term Treasury yields retreat to Wednesday’s start, short-term rates continue higher.

- FXStreet Forecast Poll sees consolidation below 110.00.

The Federal Reserve may have disappointed some of the rate hawks by leaving the timing for a taper undefined after its meeting on Wednesday, but no one can complain about the volatility.

As soon as the bank’s new set of Projections Materials were released the dollar was off to the races.

The USD/JPY rose 60 points in the first 15 minutes, topped out at 110.83 several hours later and closed at 110.713, its best daily finish since March 25, 2020. The 15-month record was by a whisker, the USD/JPY had closed at 110.710 on March 31.

Currency markets bought the dollar in all pairs after the Fed release. The euro lost 131 points on the day closing at 1.1995, its first finish below 1.2000 since April 16. The sterling, aussie, kiwi dropped to multi-week lows, the USD/CHF and USD/CAD did the reverse and all improved the US dollar's gains on Thursday and Friday.

The USD/JPY diverged from the general dollar run on Thursday, and Friday reversing most of Wednesday's increase while the other pairs reinforced the greenback’s improvement.

The primary reason was the availability of profit. To the open on Wednesday the USD/JPY had gained 6.7% this year. The EUR/USD in contrast had slipped just 0.7%, while the sterling had climbed 3.4% and the loonie had added 4.6%.

That is also the reason the dollar continued to improve against all other currencies except the yen. The Fed’s overt acknowledgement of a strengthening US economy and inflation is a policy shift, even if the timing may not be clear until the bank’s annual August conclave at Jackson Hole, Wyoming. The USD/JPY had already incorporated the potential from the changing rate environment in the US, the other pairs had not.

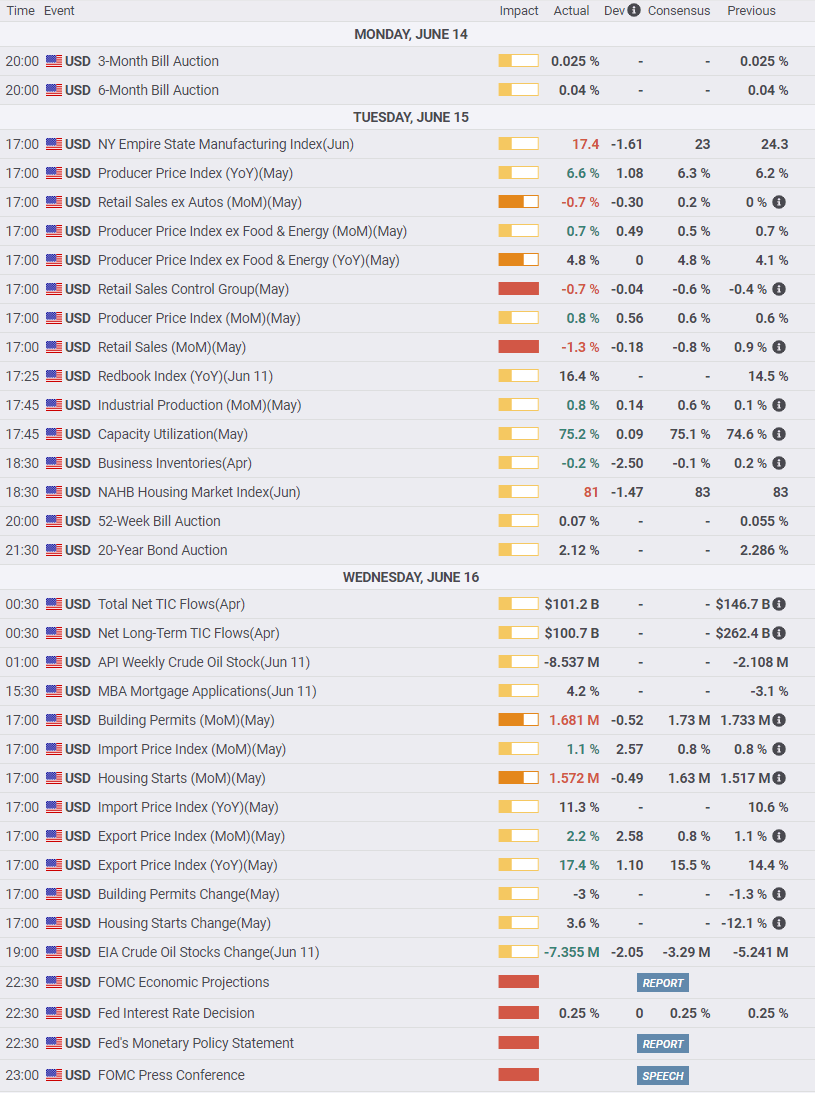

As widely expected, the Federal Open Market Committee (FOMC), left the fed funds target range at 0.0% to 0.25%, where it has been since March 2020 and did not alter the $120 billion a month of credit asset purchases.

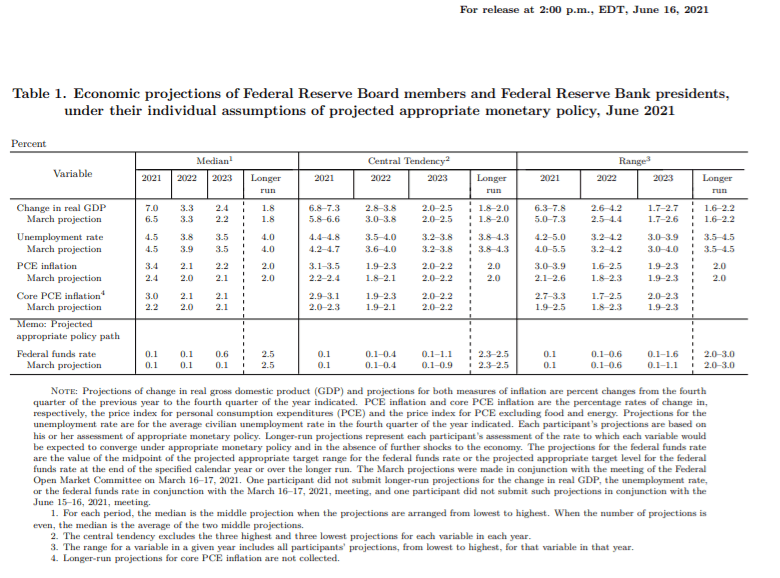

In 2021’s second set of economic projections, the contributing members increased their GDP, inflation and fed funds forecasts.

Headline PCE inflation at the end of 2021 rose one percentage point to 3.4%. The core PCE rate that the Fed targets at 2%, climbed to 3% from 2.2%. Economic growth in 2021 is now posited at 7% instead of 6.5%.

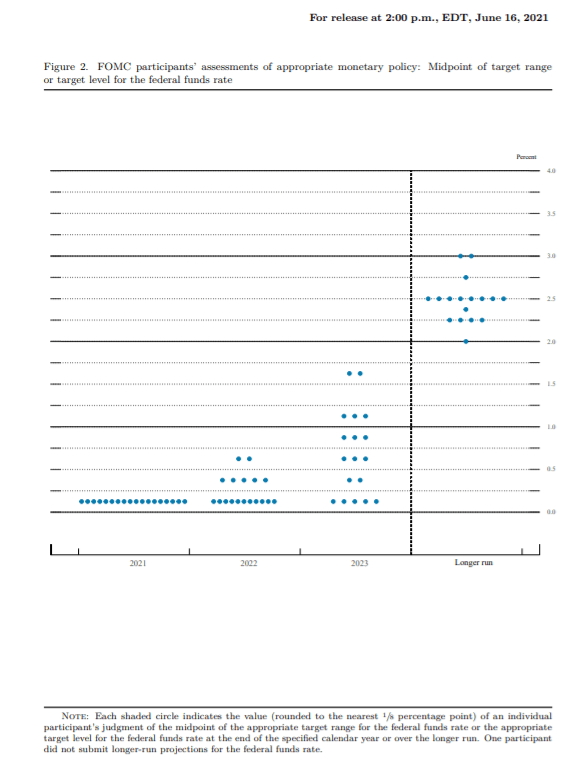

In a major change, the estimate for the fed funds rate at the end of 2023, which had been unaltered in March at 0.1%, moved to 0.6%. Federal Reserve rate increases, unless under emergency conditions, come in increments of 0.25%, implying two hikes that year.

In the so-called dot plot, which charts the individual projections of the FOMC participants, all 18 saw rates unchanged this year. In 2022, 11 members had rates remaining stable, five saw one hike, and two suggested two rate increases. For 2023 only five had rates unaltered, two members foresaw one hike and three each had two, three and four increases.

Despite the positive updates, Federal Reserve Chair Powell gave no indications when the bank might begin to reduce its bond purchases. This program has pinned the short end of the yield curve to near historic lows for more than a year.

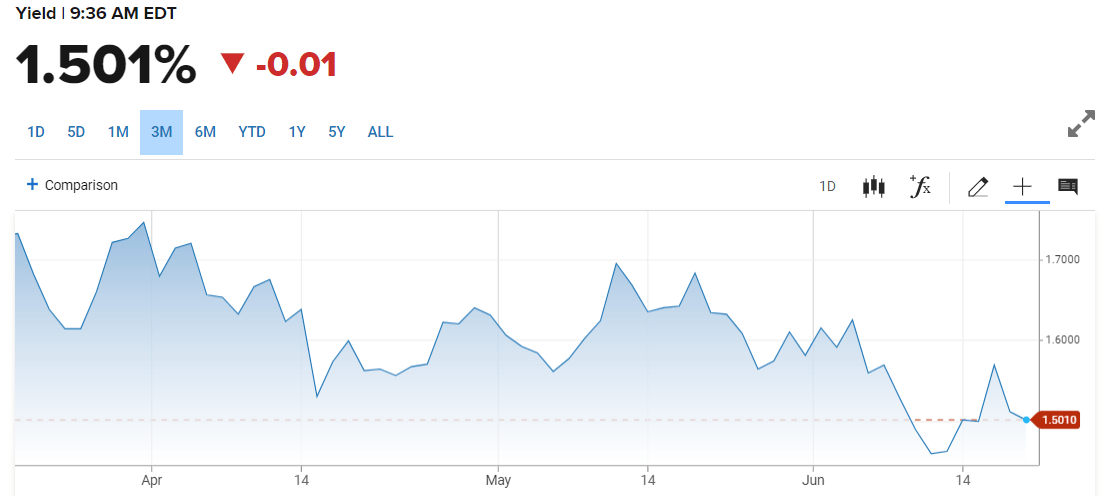

Treasury rates had initially risen sharply with the 10-year yield rising 7 basis points on Wednesday to 1.569% but by Friday morning the increase was gone with the bond trading at 1.499%.

10-year Treasury yield

CNBC

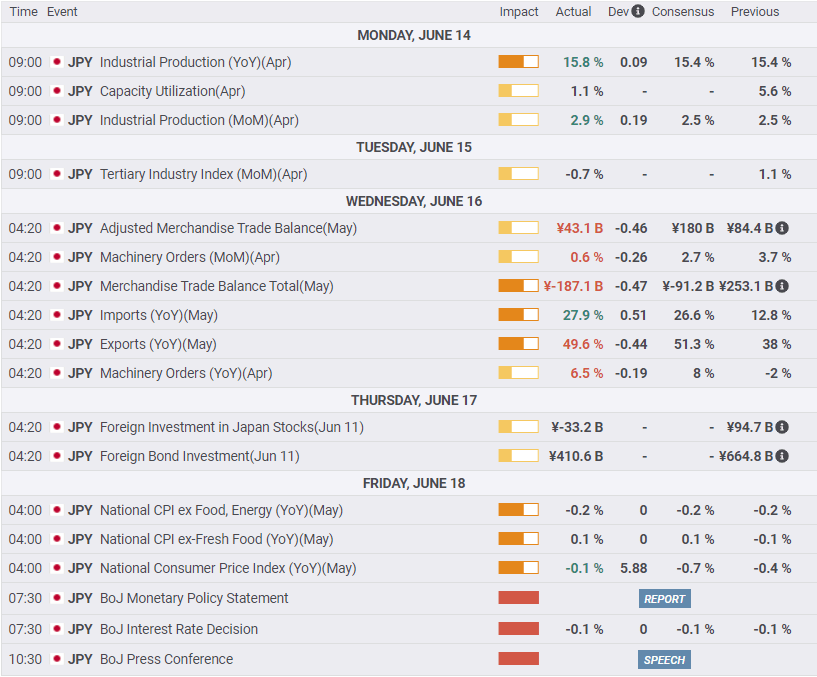

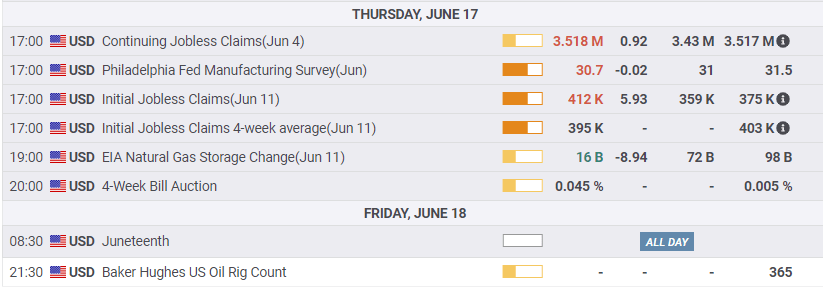

In a sign that the credit markets do indeed believe the Fed has changed policy, the yield on the 2-year Treasury closed at 0.205% on Wednesday, its highest in over a year and the first finish above 0.2%. Yield gains continued on Thursday with a 0.213% finish and a move to 0.252% in early Friday trading. The short end of the yield curve, particularly the 2-year, had been the main focus of the Fed’s bond-buying program. The 5-year yield also rose, adding 4 basis points to 0.925% on Friday.

2-year Treasury yield

CNBC

American equities suffered with their worst week since January in post-FOMC trading, as the prospects of higher rates moved from the theoretical to the factual.

The Bank of Japan’s own meeting on Friday produced no substantive policy changes, though the governors did announce a special lending facility to help banks combat global warming, or as it is now called, climate change.

Japanese consumer prices almost exited deflation in May posting at -0.1%, their eighth straight month of annual decline. The forecast had been for a drop of 0.7%. Imports were slightly better than expected in May and exports slightly worse.

In other economic data, US Retail Sales in May dropped 1.3% on a -0.8% forecast, though the prior month was revised to 0.9% from flat. Industrial Production rose more than expected in May but April’s gains faded to almost nothing. Initial Jobless Claims for the June 11 week rose unexpectedly above 400,000. All these statistics underlined the difficulty of providing accurate information quickly in the unusual circumstances of the currency economy.

The Federal Reserve has changed its rate policy and the currency, credit and equity markets have responded as expected. The gains in the 2-year and 5-year Treasury yields are the key indications. They had been deliberately held in check by the Fed. No longer. The end of the pandemic accommodation will play out over the rest of the summer.

USD/JPY outlook

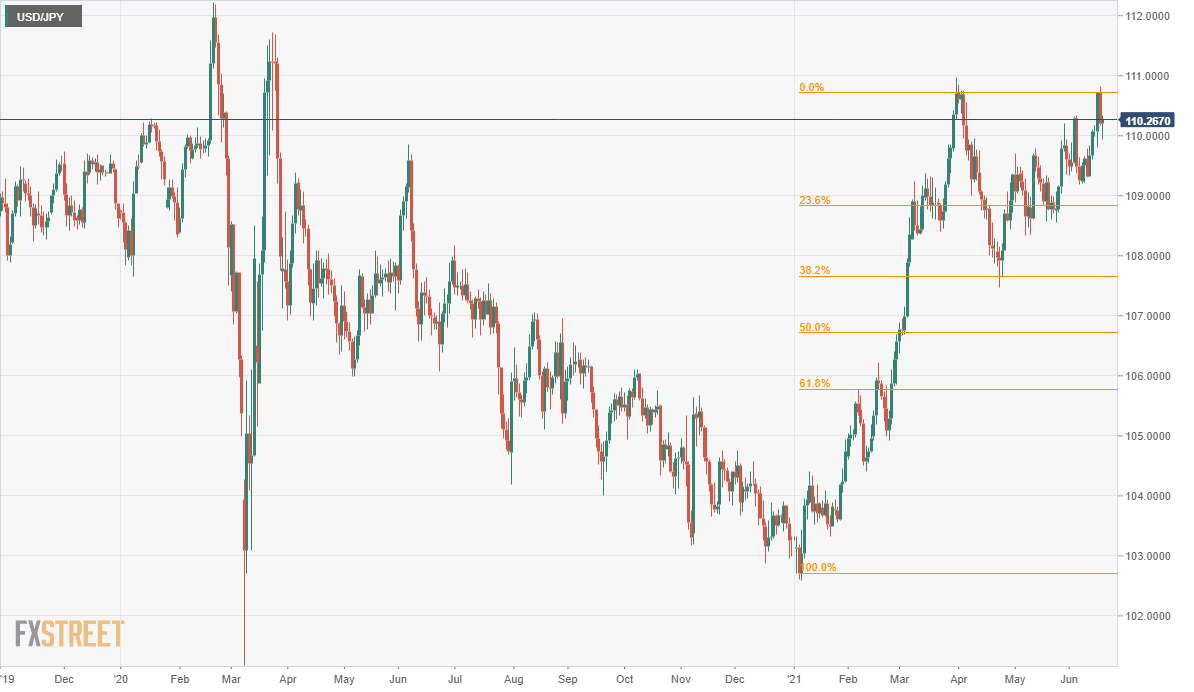

The US dollar has gained more against the yen this year than any other major currency. Until the end of March the chief driver was the rising dollar interest rate advantage as US Treasury rates increased. That benefit stalled somewhat in the second quarter. It has been reignited at the short-end of the yield curve by the Fed’s policy shift. That will become the dominant factor for the USD/JPY over the next few weeks.

The panic high of the USD/JPY during the pandemic of just over 112.00 is a sign-post but not serious resistance.

As the US dollar gains ground in the other major currency pairs that advantage will spill over into the USD/JPY. Consolidation above 110.00 is probable for the next week or two as the rest of the market catches up.

The range from 112.00 to 115.00, common from December 2016 to December 2018, is the summer’s destination.

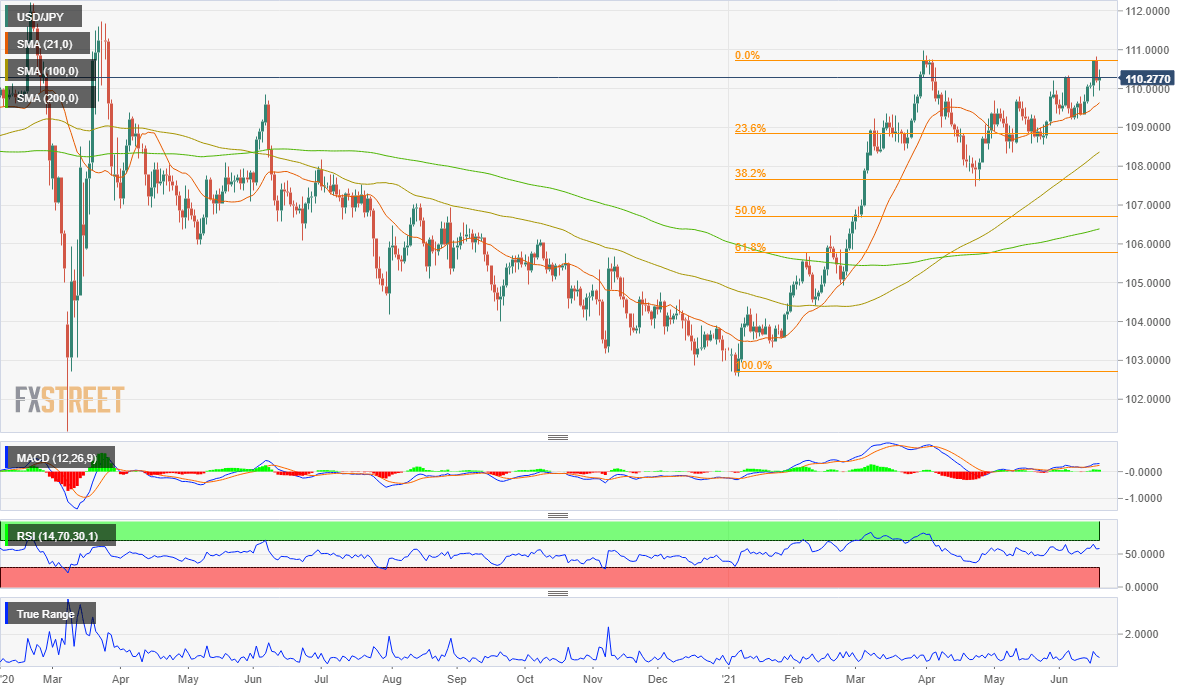

Japan statistics June 14–June 18

US statistics June 14–June 18

FXStreet

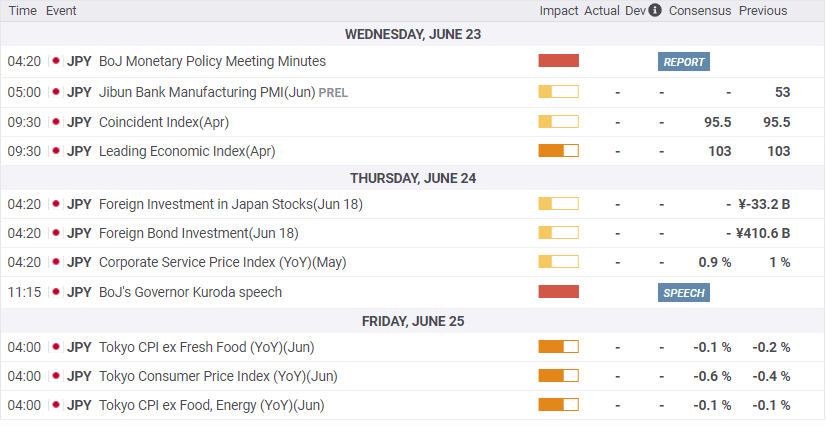

Japan statistics June 21–June 25

The Jibun Bank's Manufacturing PMI for June will indicate continued factory expansion but at levels well below that of the United States. Tokyo CPI will give a first look at inflation for June. Neither will impact currency trading.

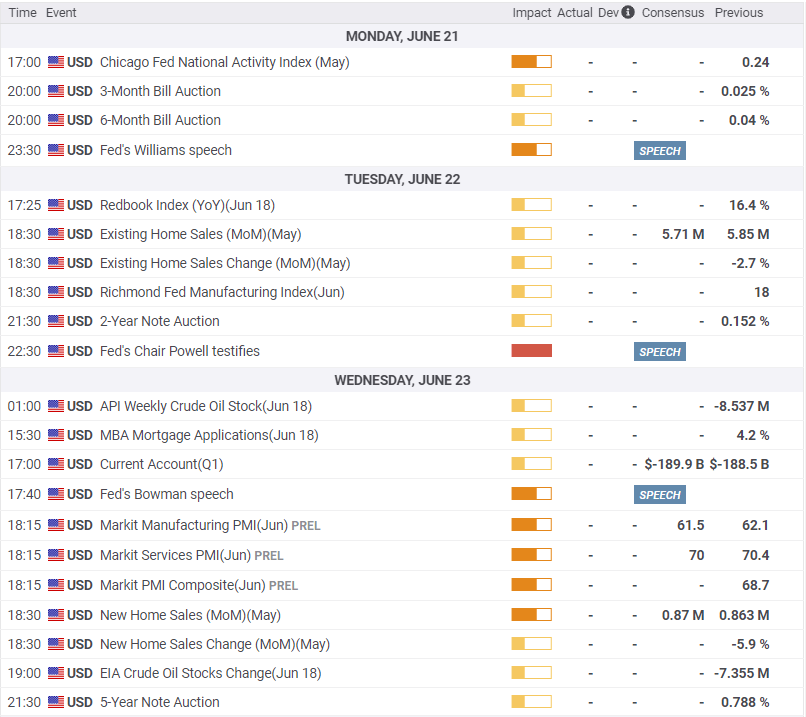

US statistics June 21–June 25

A thin week for new information though data abounds. Existing Home and New Home Sales are for May and will not reflect the recent rise in mortgage rates. Durable Goods Orders offer details on Retail Sales but little new information except for Nondefense Capital Goods which provides a look at business spending. All data this week is economic background.

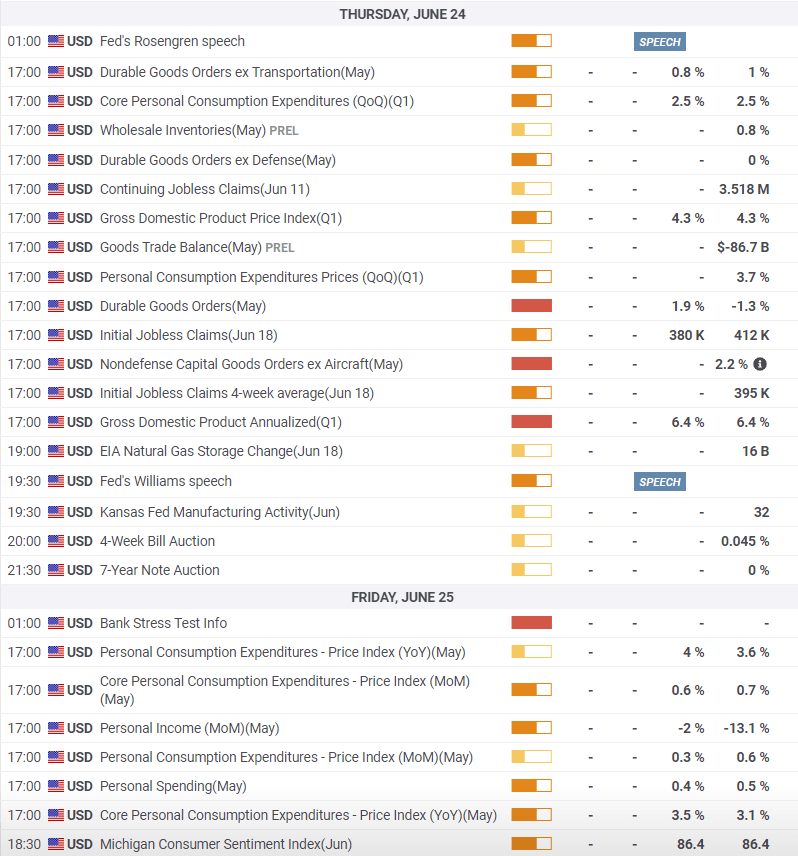

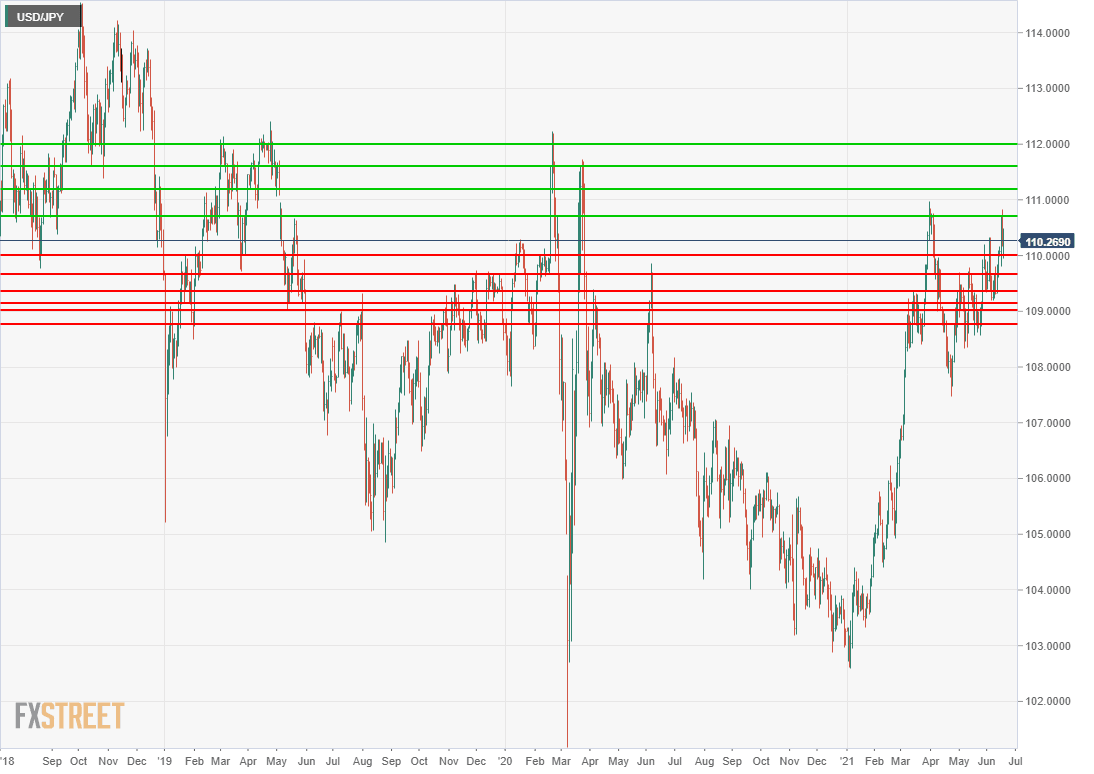

USD/JPY technical outlook

Despite the pull-back on Thursday and Friday this is a market that is hard to short. All the moving averages are inclined higher. The 200-day moving average (MA) continues to widen its gap over the 100-day MA giving indication of strong upward momentum. The Relative Strength Index (RSI) and the MACD are buy indicators while the True Range decline on Thursday and Friday is temporary.

The area at 111.00 saw pushback in late March but that one trip did not create significant trading resistance. The twin panic highs of February and March 2020 are likewise weak. The past three months have created multiple support lines between 109.00 and 110.00. Resistance at 110.70, the effective high this year will present a more substantial block. The resistance lines that intersect with the trading ranges prior to June 2019 will gain in importance the longer the USD/JPY spends above 110.00.

Resistance: 110.70, 111.20, 111.60, 112.00

Support: 110.00, 109.65, 109.35, 109.15, 109.00, 108.75

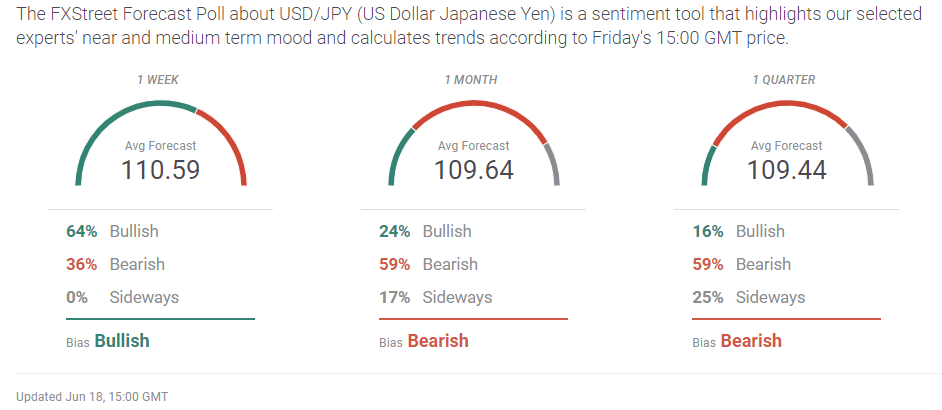

FXStreet Forecast Poll

Given the more than 6% rise in the USD/JPY this year with little profit-taking, a modest decline is understandable for the FXStreet Forcast Poll. However, the underlying fundamental shift in US interest rate prospects argues for further gains in the pair.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.