USD/CAD Weekly Forecast: The exception that proves

- Bank of Canada keeps monetary policy, asset purchases unchanged.

- Strong February job creation boosts Canadian dollar.

- WTI fades on weekend profit taking, but up 26% in February.

- USD/CAD at three-year low belying the general US dollar trend.

- Commodities remain strong with global growth prospects.

- US Treasury rates rise on Friday after mid-week stall at the 10-year auction.

- Canadian government bond rates keep pace with the US.

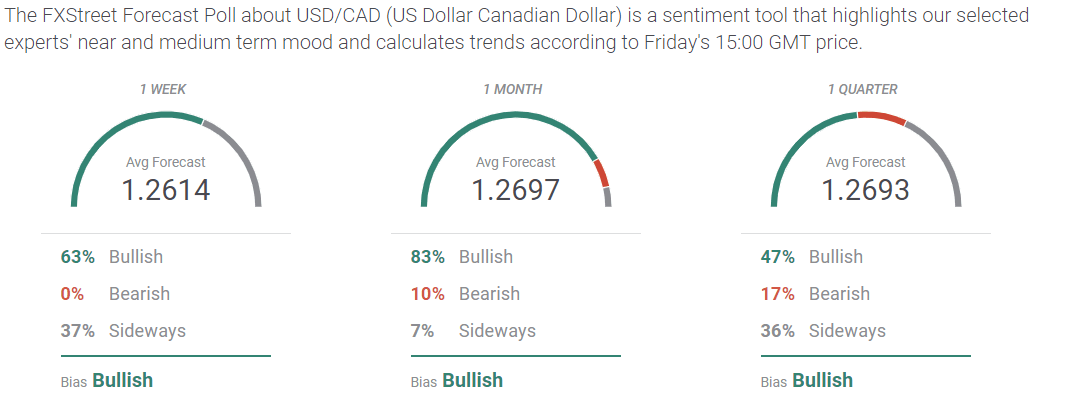

- FXStreet Forecast Poll sees a limited rebound out to one quarter

The Canadian job market roared to life in February punching the loonie to a three-year high and successfully countering the US dollar's interest rate based surge in all other major currency pairs.

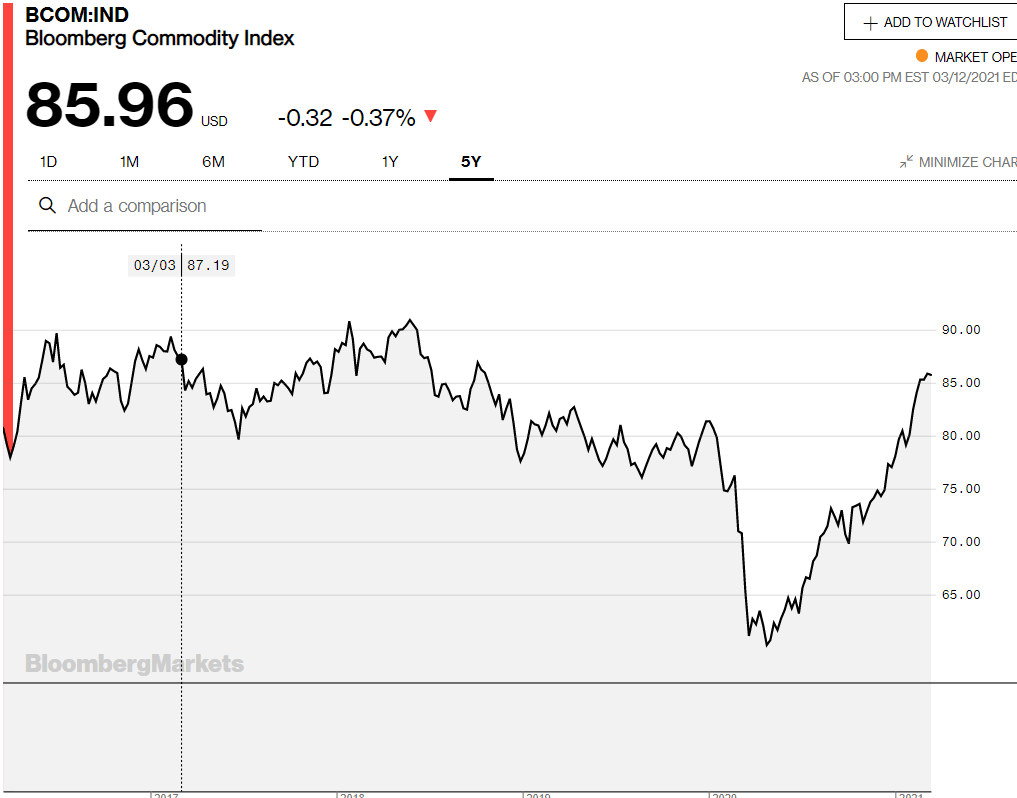

West Texas Intermediate consolidated above $65 a barrel, its best sustained price in two years, as prospects for a US economic recovery accelerated with the new multi-trillion dollar stimulus package signed by President Biden. Commodities retained their strong aspect with the Bloomberg Commodity Index (BCOM) close to its two-and-a-half year high.

The Bank of Canada (BOC) left its base rate at 0.25% and the asset purchase program unchanged at its Wednesday meeting as universally expected. “The Bank is maintaining its extraordinary forward guidance, reinforced and supplemented by its quantitative easing (QE) program, which continues at its current pace of at least C$4 billion per week,” noted the statement accompanying the decision.

Canada's economic outlook improved with Governor Tiff Macklem saying that the bank now expects the economy to grow in the first quarter, a reversal of its forecast of just weeks ago.

Statistics Canada has reported that its preliminary estimate for December was slightly positive at 0.1% despite the lockdowns and that seems to have convinced BOC economists on the first quarter as well. A report from the Conference Board of Canada predicted a rebound in provincial economies in 2021 as vaccinations permit travel and economic restrictions are lifted. Deferred spending and accumulated savings are expected to enhance the recovery with consumers in the lead.

The crux of the Canadian dollar's strength, despite rising US Treasury rates, is the same as that for the yields themselves. The US economy appears poised for a exceptionally fast rebound from the economic debacle of the pandemic lockdowns. Canada is the largest trading partner of the US and a major global supplier of commodities. Its economy will improve in lockstep with its that of its southern neighbor and it has the additional benefit of commodity prices at a 30-month peak.

Canadian data has been improving for several weeks. In addition to the stellar employment results and GDP mentioned above, the housing market is exceptionally strong, the trade balance switched to surplus in January, exports rose and Ivey PMI was much better than forecast in February.

In the US the story was Treasury rates. The 10-year yield closed at 1.625% on Friday, up seven basis points on the week, 55 on the month and 71 on the year.

American Treasury rates are, despite the recent run, well beneath their recent ranges. The 10-year yield was above 2% from November 2016 to July 2019. Even though the Fed is repressing the short end of the yield curve, it too will move higher as soon as the governors permit.

As important as the actual rate increase has been the Federal Reserve acknowledgment that the US economy can handle higher yields without penalizing growth. With the Fed bond purchase program pinning the short end of the Treasury curve, markets needed assurance that the central bank does not view the steepening as cause for intervention.

The anticipation for Wednesday's 10-year Treasury auction had been predicated on inflation expectations.

January's Producer Price Index had jumped 1.2%, doubling the annual rate to 1.7% from 0.8%. With the federal government incurring trillion dollar plus deficits annually, a $1.9 trillion addition just enacted and an expected growth and demand surge ahead, the classic conditions for a inflation spike seemed to be in place. In the event, February's CPI results, which arrived before the auction, were slightly weaker than forecast and took much of the wind from the bond market sails.

Other US statistics this week were positive. Jobless claims moved to the lower edge of the pandemic range but had no market impact. Consumer sentiment rebounded in March but it remains far from its pre-pandemic range.

USD/CAD outlook

One reason rising US Treasury rates have had no impact on the USD/CAD is Canadian government rates have actually risen faster, though most are slightly lower. The yield on the 10-year government bond closed at 1.584% on Friday, up 91 basis point on the year.

MarketWatch

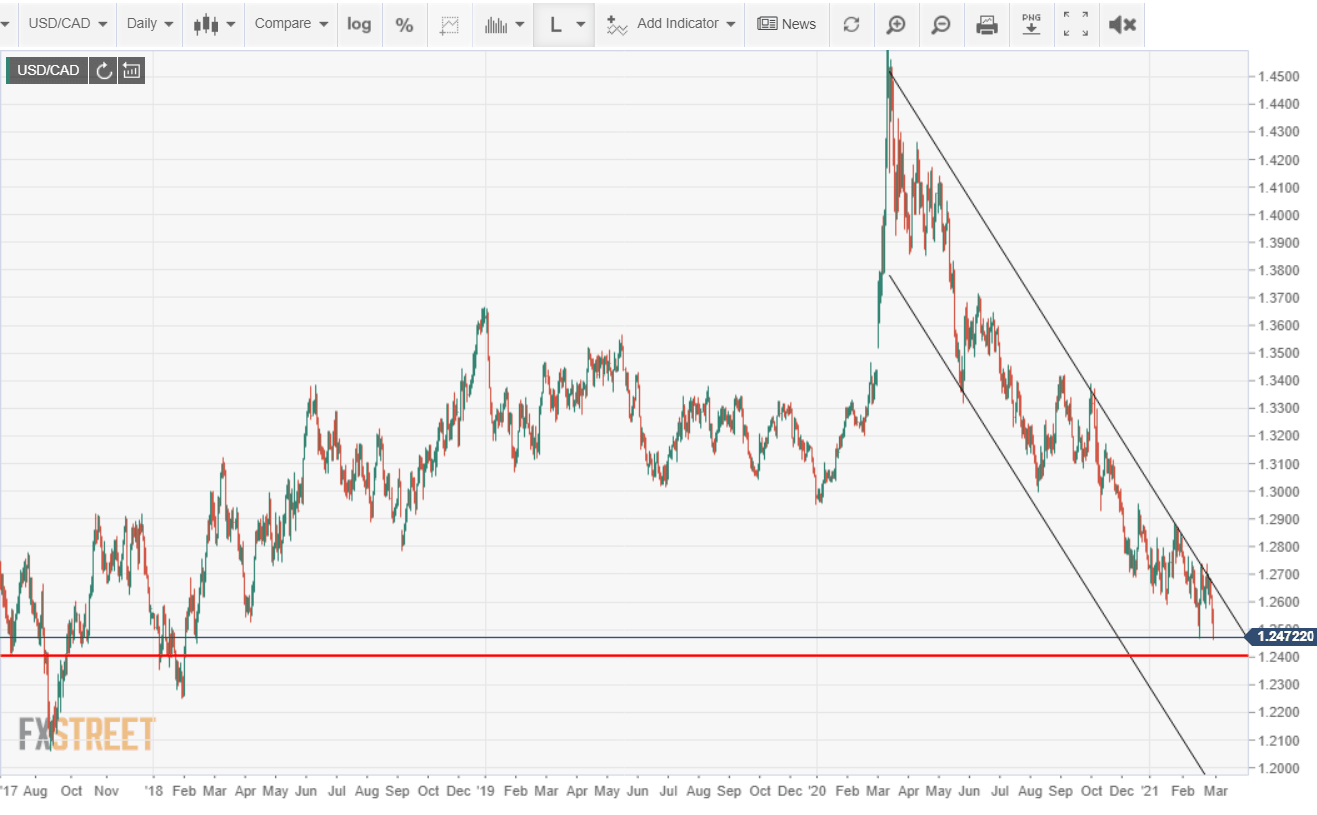

The USD/CAD came to rest at the 1.2470 support on Friday, a level not visited since February 2018. The bias is lower because technical support is weak and downward momentum strong. But the supposed advantage to the Canadian economy from commodity prices has yet to be established in the data and cannot be until second quarter information is issued. In the interim the trend remains, slowing but intact.

First support at 1.2400 is the initial goal but the steep 1.5% drop this week makes the USD/CAD vulnerable to the profit-taking rebounds that have characterized its entire pandemic decline.

The US Federal Reserve meeting on March 16 and 17 is the main event in the coming week.

There will be no policy developments but the first Projection Materials for the year are due. Any improvement in the GDP and unemployment estimates, which is likely, will confirm the positive US economic outlook. The slightest hint from Chairman Jerome Powell of a tempering in the bond purchase program will send US rates and probably the USD/CAD higher. Likewise US Retail Sales on Tuesday and Canadian on Friday will be important notices for their consumer sectors.

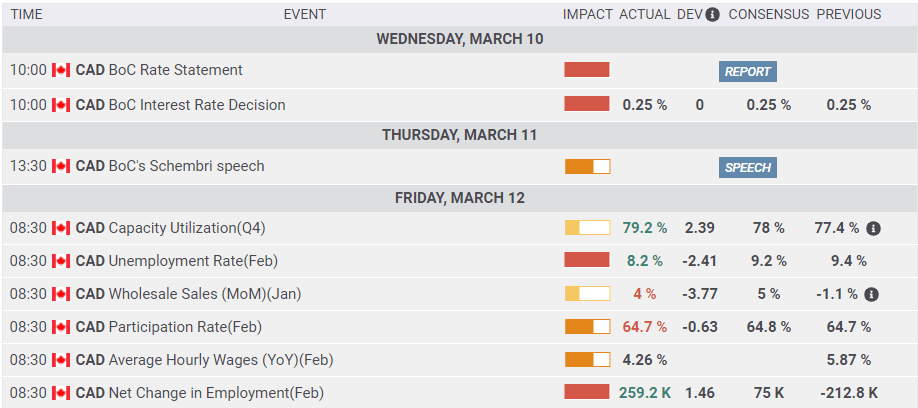

Canada March 8-March 12

Strong February employment surprised the market much as it had in the United States. The Unemployment Rate fell 1.2% to 8.%

The Bank of Canada's policies were unaltered. The bank's modestly bolstered outlook may have provided the loonie with some support. Employment regained the initiative in February after two months of losses.

Wednesday

The BOC base rate remained at 0.25% and asset purchases at C$4 billion a week after the governors meeting.

Friday

Net Change in Employment added 259,200 in February more than three times the 75,000 forecast, and reversing the 212,800 loss in January. The Unemployment Rate dropped to 8.2% from 9.4%. It had been expected to fall to 9.2%. The Participation Rate was unchanged at 64.7. Capacity Utilization climbed to 79.2% in the fourth quarter from 77.4%. Average Hourly Wages rose 4.26% (YoY) in February after a 5.87% increase in January. Wholesale Sales gained 4% in January, missing the 5% forecast after a revised 1.1% drop in December.

FXStreet

US statistics March 8-March 12

Inflation or its lack dominated economic information this week. After Monday's 1.613% reach in the 10-year Treasury yield attention turned to February's CPI on Wednesday morning and the auction of $38 billion that afternoon. Headline CPI was flat as forecast and core fell slightly taking some of the wind from the inflation sails. The auction rate was 1.523%, about where it started. The February PPI, released on Friday settled back to a 0.3% gain after 1.2% in January, which, along with CPI mitigated inflation concerns but did not dampen the yield ascent.

Wednesday

The Consumer Price Index for February rose 0.4% on the month and 1.7% annually as forecast, up from 0.3% and 1.4% in January. The core rate rose 0.1% and 1.3%, missing the 0.2% and 1.4% predictions, higher on the month than January's 0.0% but down from 1.4% on the year. The closely watched auction of $38 billion in 10-year Treasuries produced a 1.523% average rate, two basis points below the prior close at 1.545%.

Thursday

Initial Jobless Claims dropped to 712,000 in the March 5 week from 754,000 prior. It was the lowest weekly total since November 6 at 711,000. Continuing Claims declined to 4.144 million on February 26 from 4.337 million, falling for the eighth week in a row. The JOLTS Job Openings Survey registered 6.917 million positions in January, up from 6.752 million in December, better than the 6.6 million estimate and the highest total since February 2020.

Friday

The Producer Price Index climbed 0.5% in February after soaring 1.3% in January. The annual rate jumped to 2.8% from 1.7%. Core PPI rose 0.2% and 2.5% following January's 1.2% and 2% increases. Michigan Consumer Sentiment climbed to 83 in March from 76.5, ahead of the 78.5 estimate and the highest of the pandemic era.

FXStreet

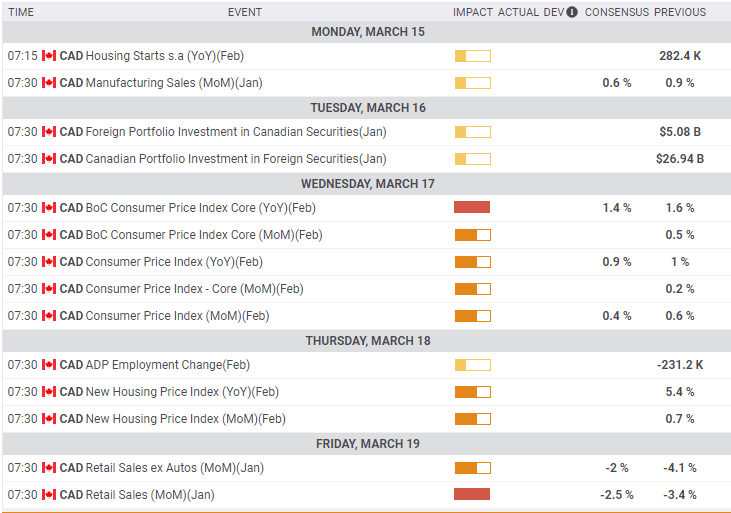

Canada March 15-March 19

Consumer prices and Retail Sales in February will give some indication of the strength of the economy but they are not market movers.

Monday

Housing Starts in February should fall to 262,000 annualized from 282,400 in January. Manufacturing Sales in January are forecast to rise 0.6% after 0.9% in December.

Wednesday

February CPI is expected to rise 0.4% monthly and 0.9% annually in February from 0.6% and 1% in January. The Bank of Canada Core CPI (YoY) is forecast to slip to 1.4% from 1.6%.

Thursday

ADP Employment Change for February: January -231,200. New Housing Price Index for February: January 0.7% (MoM), 5.4% (YoY).

Friday

January Retail Sales are predicted to fall 2.5% on the month and 2% on the year after -3.4% and -4.1% respectively in December.

FXStreet

US statistics March 15-March 19

Retail Sales for February and the Fed meeting are preeminent. No change in policy is anticipated from the central bank but the recent rise in US Treasury rates is sure to be a topic at Chairman Jerome Powell's news conference. The Fed will release its first set of economic and rate projections for 2021. January Retail Sales produced an unexpected moonshot at 5.3% overall and 6% in the Control Group, a combined factor of six over forecasts. With both categories projected to fall any positive result will point to further gains in March when the latest stimulus check should be ready for spending.

Tuesday

Retail Sales are projected to drop 0.4% in February after soaring 5.3% in January. Sales ex-Autos are expected to be flat following a 5.9% jump in January and the Control Group is forecast to be down 1% in February subsequent to January's 6% increase. Industrial Production in February should rise 0.5% after 0.9% in January. Capacity Utilization will be little changed at 75.7% after 75.6% in January. Business Inventories in January are predicted to increase 0.3%, half the December gain. The Export Price Index could rise 1.1% in February after a 2.5% increase in January; the Import Price Index is slated for a 1.3% gain following 1.4% in January.

Wednesday

Housing Starts are forecast to drop 0.9% in February to 1.565 mllion (annualized) after fading 6% to 1.58 million in January. Building Permits may drop 7.2% in February to 1.75 million after the 10.7% jump to 1.886 million in January. The Federal Reserve Open Market Committee (FOMC) will leave its policy rate at the 0.25% upper target and bond purchases at $120 billion per month, 2/3 in Treasuries and the balance in mortgage backed securities. Economic projections are expected to improve while it is anticipated that the rate horizon for the fed funds will be unchanged.

Thursday

Initial Jobless Claims should drop to 705,000 in the March 12 week from 712,000 prior. Continuing Claims should fall to 4.0 million in the March 5 week from 4.144 million previously.

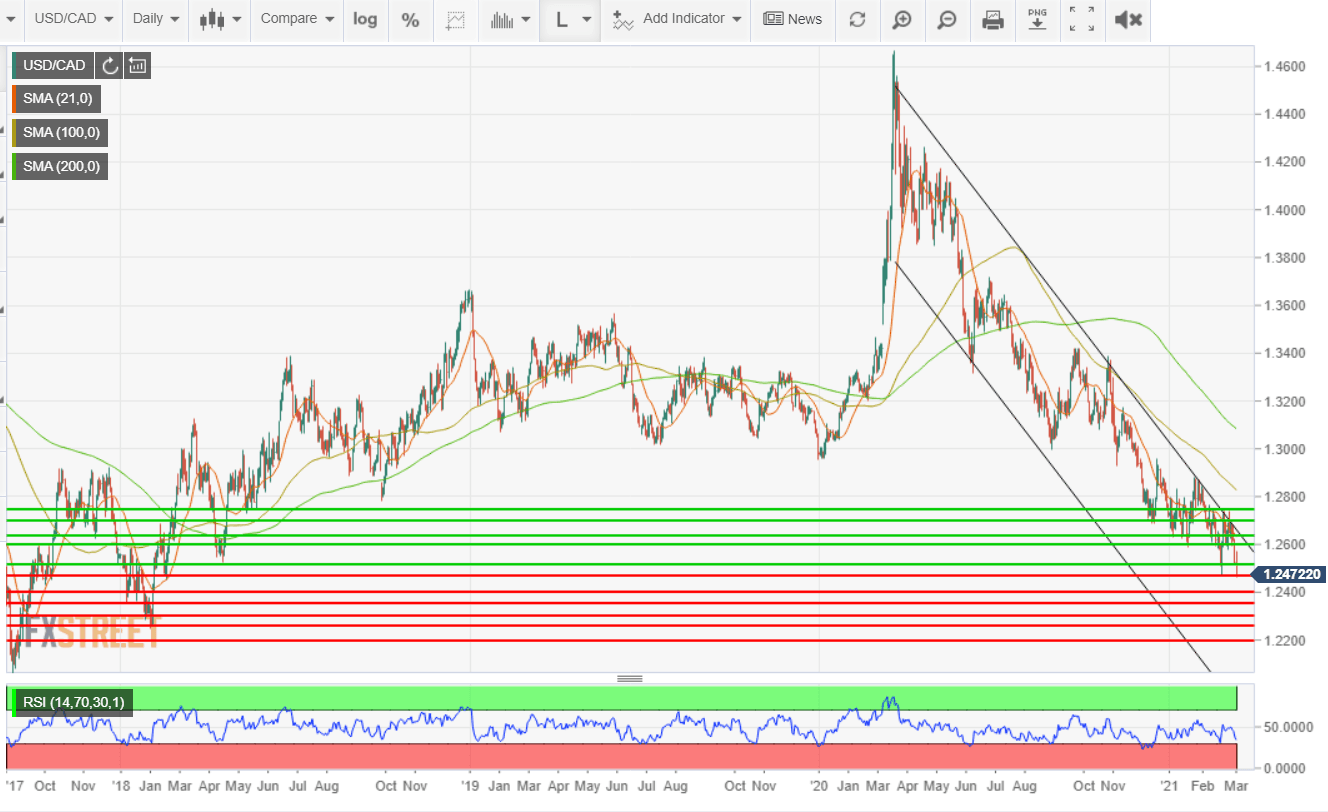

USD/CAD technical outlook

The disparity between near and recent resistance lines and near but antiquated support is the chief technical feature. If support at 1.2470 gives way, the goal would be 1.2400. The first resistance at 1.2515 is weak, 1.2600 is strong. The Relative Strength Average at 34.28 is oversold, given the steep drop this week, though just above the actual band.

As noted above the USD/CAD is vulnerable to a profit-taking rebound, particularly one based on a fundamental factor, interest rates or data. It is doubtful technical considerations alone would provide enough of a base for a bounce. The moving averages are all above with only the 21-day at 1.2631 in possible contention. The 100-day at 1.2827 and the 200-day at 1.3084 are witness to the decline of the last three months.

Resistance: 1.2515; 1.2600; 1.2635; 1.2700; 1.2745

Support: 12470;1.2400; 1.2350; 1.2300; 1.2260; 1.2200 (all are from September 2017 to February 2018)

USD/CAD Forecast Poll

The mean reversion strategy in this week's FXStreet Forecast Poll, is a technical response to the USD/CAD's prolonged fall. However, its fails to capture the potential improvement in the Canadian economy from a global economic rebound. While a recovery is yet hypothetical, its odds are rising daily.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.