US Michigan Consumer Sentiment Index July Preview: Are inflation expectations changing?

- The Fed is watching jobs, is the consumer watching inflation?

- Outsize price gains likely to continue for the rest of the year.

- Real hourly wages drop in June, overwhelmed by inflation.

- Markets could see a fall in sentiment as a warning on US rates.

After a year of emotional partnership, the Federal Reserve and the American consumer may have suddenly parted ways.

“There is still a long way to go” before the bank will change its ultra-accommodative monetary policy, said Fed Chair Jerome Powell in remarks prepared for Congressional testimony on Wednesday. He noted that the labor market was still far from its pre-pandemic employment.

But with jobs going begging across the country, there were a record 9.2 million unfilled positions in May, and help-wanted signs as common as weeds in a summer lawn, it should be clear, even to the Fed, that any American who wants work can find it by going around the corner.

Michigan Consumer Sentiment

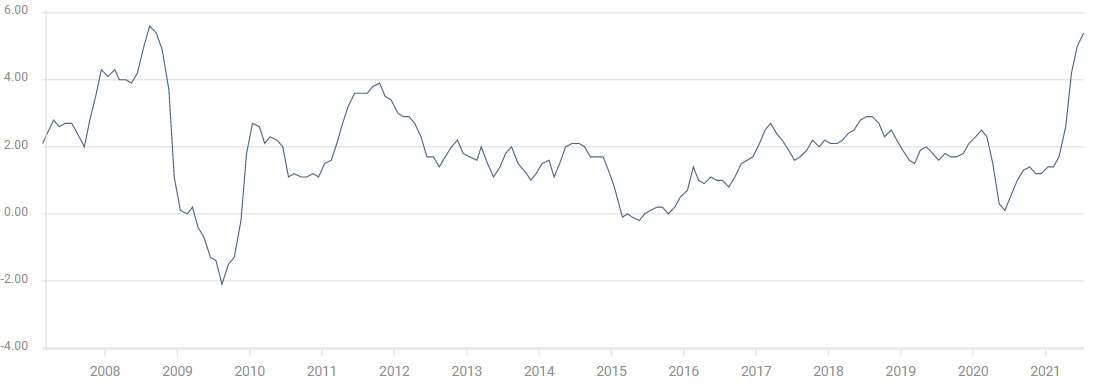

The Michigan Consumer Sentiment Index is forecast to rise slightly in July to 86.5 from 85.5 in June. In February 2020 the index scored 101. Two months later in April it had plunged to 71.8. Since that low the highest has been 88.3 this past April. The six-month average is 82.9.

Michigan Consumer Sentiment

Consumer sentiment and inflation

Consumer sentiment is most closely tied to employment but inflation runs a close second. Constant price increases are probably the most discouraging economic condition for most families short of an inability to find work.

The reason is simple. Wage increases may come once or twice a year and they are hardly automatic. Inflation is inexorable. Rising prices take a larger bite of the family budget every time they go to the supermarket.

CPI and real wages

For working Americans, soaring inflation is undermining wages gains and quickly becoming the greatest threat to their economic well-being.

While the Fed may target the core inflation rate, eschewing energy and food prices, families cannot do so. For most Americans, what matters, and what influences their inflation expectations, are the goods and services they actually buy.

Consumer prices jumped 5.4% in June. It was the highest annual increase in 13 years.

CPI

The acceleration in prices has been astonishing. Over 12 months the CPI average is 2.3%, over six it’s 3.4% and over three months, the moving average is 4.9%.

Core inflation has climbed from 2.1% for 12 months, to 2.6% for the half-year, to 3.8% for the quarter.

Real average hourly earnings fell 0.6% in June, the 0.3% gain in payments negated by the 0.9% drop in purchasing power. If you take the annual figures it is a 1.8% decline over the past year, the 3.6% increase in hourly wages subsumed by a 5.4% jump in prices.

Some items that become more expensive have cheaper substitutes or can be skipped without much change in lifestyle.

One consumer staple has no substitute, gasoline. For most Americans, driving is what economists call an inflexible good. That means as the prices rise consumption does not diminish very much.

Gasoline rose 2.5% in June and the price of a gallon of regular fuel has skyrocketed 45.1% in a year. It now costs almost 50% more to fill a car's gas tank than it did in August 2020.

Inflation is a direct drain on consumer resources. There is no way for a family to counteract price increases, they can only be absorbed. Hence, its direct impact on consumer sentiment.

Federal Reserve policy

The Fed’s new mantras, “substantial further progress” and inflation averaging, which permit prices to run hotter and longer, risk changing inflation expectations for consumers and businesses.

Chairman Powell has repeatedly asserted that recent inflation is temporary, due to lockdown created shortages of material and components, and that increases will eventually wane. However, there are signs that the sources of current inflation, from commodity and oil pricing to wage gains and supply and production dislocations, are more entrenched than economists have assumed. In his Congressional testimony this week, Mr. Powell acknowledged that price increases have been higher and will last longer than originally anticipated by the central bank.

The Fed’s June Projection Materials increased the 2021 inflation estimate from 2.4% to 3.4%. Given the rates of the past three months, that probably understates the final result.

When the Fed instituted its new averaging policy last September, the governors were probably not envisioning months or a year of 4% and 5% increases. If the policy was designed to obtain the 2% core inflation target it is already successful. The 12-month CPI average is 2.3%, the core is 2.1%.

Inflation expectations may have already begun to shift. Many businesses have been forced to offer bonuses and wage increases in order to find workers. When those workers go shopping for cars, food or home improvement products, among many others, they find those wage gains already absorbed by price increases.

If the Fed’s focus on unemployment and returning the labor market to its 2019 fullness means that rates and the bond purchase program will remain unchanged until the end of the year and beyond, each month of high inflation without policy action reinforces the expectation that it will continue.

Conclusion: Sentiment and markets

Tuesday’s June CPI release, cited above, had pushed Treasury yields higher. The 10-year rose 5 basis points and the 2-year added 2 points. Those gains were reversed on Wednesday and Thursday by Chairman Powell’s insistence that the Fed’s accommodative policy will remain in place for the immediate future.

It may take several months for consumer confidence to be substantially damaged by inflation. But if price increases continue at the present rate until the end of the year, it is almost a certainty they will erode sentiment.

Markets do not usually trade sentiment numbers, preferring the hard figures of Retail Sales, which will be reported for June this Friday.

However, if the June Michigan sentiment number is weaker than expected, the likely cause will be inflation.

The economy is producing a large number of jobs. Employment is readily available in most fields, even if employees seem somewhat reluctant to return to work.

Poor consumer sentiment readings could be an early warning sign of shifting inflation expectations.

Federal Reserve monetary policy has a long lead time against inflation. That is not true for inflationary expectations. The more tolerant the Fed is of inflation, the more consumers will expect price increases to continue.

.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.