US Initial Jobless Claims and CPI Previews: The linkages are gone

- Unemployment claims to fall to 735,000 from 751,000.

- Continuing claims should drop to 6.9 million from 7.285 million.

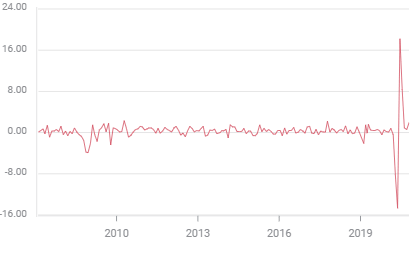

- CPI expected to be stable at 0.2% on the month and 1.3% year in October.

- Claims and CPI are now background statistics with focus on jobs and growth.

- Limited market impact seen from claims and CPI data.

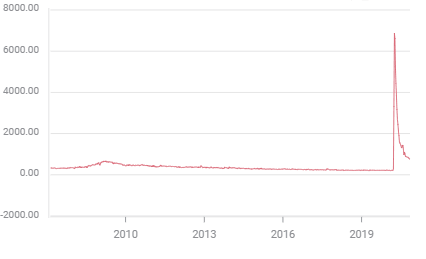

The pandemic employment collapse has long since lost the ability to shock or even move markets. An average of more than three-quarters of a million new claims were filed weekly in the last month and that is the lowest since March but traders took no notice.

Inflation has recovered from the pricing desert of April and May when the annual rate plunged to 0.3% and 0.1% and the core rate dropped to 1.4% and 1.2%, though it remains well below the Federal Reserve's 2.0% core target. The Fed's recent adoption of inflation averaging, which seeks the target over time rather than in any specific month, insures that prices will stay far from any policy input for the forseeable future.

Initial Jobless claims are expected to fall to 735,000 in the November 6 week. Continuing Claims are forecast to drop to 6.9 million from 7.285 million in the October 30 week. Both numbers would be the lowest since the unemployment crisis vaulted into the news in the third week of March.

Initial Jobless Claims

FXStreet

The Consumer Price Index (CPI) is projected to be unchanged at 0.2% in October and the annual rate to slip to 1.3% from 1.4%. The Core Consumer Price Index will also be stable at 0.2% and and the yearly rate will rise to 1.8% from 1.7%.

US economic recovery

Economic growth jumped 33.1% in the third quarter after collapsing 31.4% in the pandemic marred second three months.

The Atlanta Fed GDPNow model is running at 3.5% annualized growth in the fourth quarter.

Nonfarm Payrolls have returned 54.4%, 12.07 million of the 22.16 million workers laid off in March and April, to their jobs through October. The unemployment rate has fallen from a high of 14.7% in April to 6.9% in October.

Retail Sales in September at 1.9% were almost triple their 0.7% projection and have averaged a 1.01% monthly increase from March through September. The Control Group, which enters the government's gross domestic product (GDP) calculation, rose 1.4% on a 0.2% expectation. It's monthly pandemic average is 1.27%.

Retail Sales

The business spending proxy from Durable Goods Orders, Nondefense Capital Goods, have a 0.5% monthly increase from March to September.

These consumption figures would be standouts in a normal economy, in one ravaged by unemployment and lockdowns they are astonishing.

Conclusion: Initial Claims, CPI and the economy

The growth and retail consumption figures show a disconnect between what would normally be considered recessionary rates of unemployment and initial claims and consumer spending and economic growth.

Clearly the standard linkages from job retention and consumer spending are unreliable in the COVID-19 era. Americans have surprisingly boosted their spending despite the widespread job losses and closures.

Initial Claims at their current slowly declining levels are not predictive of the direction of the overall economy or of the restitution of jobs in the labor market.

Likewise, CPI offers no insight into Fed interest rate policy or the potential acceleration of an over-heating economy, its traditional signals.

Unless the claims numbers are severely above forecasts, and the spreading limited closures in many states make that a possibility, expect both numbers to drop into the memory hole.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.