The Race for Employment in 2021: US job market is the key for the US dollar

- Job destruction was the metric of economic collapse.

- Employment recovery will signal the end of the pandemic economy.

- Are equities telegraphing a robust return to growth or central bank liquidity?

- Is US job creation the new differential for currencies?

- The greenback has fallen as US initial claims have climbed and payrolls declined.

When the economic history of the pandemic is written its most striking feature will be the nearly instantaneous mass unemployment that followed the lockdown orders.

In the US, 22 million people lost their jobs in March and April. In Canada, three million people, a similar percentage of the population, joined the unemployment rolls.

Even in the European Union with its restrictions on firing, higher unionization and popularity of part-time work plans, total employment still fell 3.1% (QoQ, YoY) in the second quarter and 2.3% in the third, the worst six months in the 24-year record of the Eurozone.

Reuters

US current unemployment rate

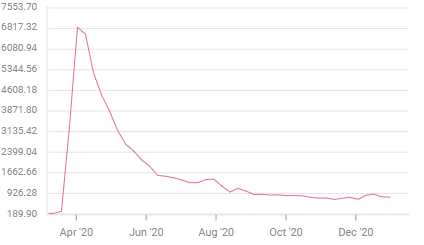

For the US, Initial Jobless Claims were a never-ending trauma. In eight weeks beginning in late March, 36.2 million former employees applied for government assistance. Six months after the original 3.3 million shock on March 26 more people were still applying for help each week than had filed at the height of the financial crisis and recession, the previous record. The average number of claims each week from March 20 to December 25 is an astonishing 1.78 million.

More than anything else it was the speed of the catastrophe that astounded everyone. In the week of March 7, jobless claims were 211,000. The next week 282,000, then 3.30 million, 6.86 million, 6.61 million, and on and on in a numbing succession of job losses.

Initial Jobless Claims

In February, the US unemployment rate was 3.5%. The six months to that point had averaged 3.53%, the best job market in five decades. Two months later, in April, unemployment was 14.7%, almost 50% higher than at the height of the worst post-war recession in 1982, 10.8%.

One has to return to August 1931 for a comparable rate of 15%. In the Great Depression, the unemployment rate reached 25.6% in June 1933, six months after the inauguration of Franklin Roosevelt and remained above 15% for almost five years to June 1936.

Reuters

Many readers could, no doubt, recite these recent numbers from memory. They are repeated to illustrate the degree to which the labor market has become the symbol and the arbiter of the economic collapse and recovery. The psychology of the market is bound to the success of the labor economy.

Statistical markers

Every age and every economic disaster has its economic chronicle, its statistical emblem.

For the 2008 financial crisis and recession, it was the collapse of housing prices in the United States. In the 1987 market crash, it was the Dow. In the 1929 crash and Depression, it was the Dow first and then unemployment.

In the 1990s when the US trade deficit was still somewhat of a novelty, the monthly release at 8:30 am of the international balance, helped coin a phrase that was a byword in the currency markets for extreme instantaneous volatility, a New York Friday.

Labor market recovery

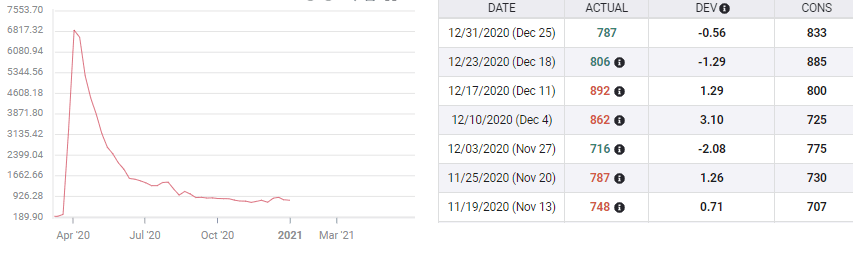

The labor market recovery in the United States has proceeded on two parallel tracks, the hiring recorded in Nonfarm Payrolls and the decline of the weekly Initial Jobless Claims.

Through November 12.3 million workers have rejoined payrolls, about 55.5% of the losses in March and April. The December addition is expected to be just 100,000 when it is released on January 8.

The decline of payrolls in November to 245,000 from an average of 660,000 in September and October coincided with that month's increased volatility in jobless claims.

Nonfarm Payrolls

Claims in the first week of November were 711,000, the lowest of the pandemic era. That jumped to 747,000 the following week.

But it was the result for the third week of the month, 787,000 on a forecast of 730,000, released on November 25, that prefigured the vault of the euro above its four-month resistance at 1.1950 two days later. December's average of 837,000, up from 741,000 in November, confirmed the deterioration of the US labor market and the EUR/USD moved steadily higher through the month closing at 1.2299 on Tuesday, January 5.

Equity response: Federal Reserve delivers low rates and liquidity

The evident degradation of the labor market recovery under the revived lockdowns in several states, most importantly, California, the country's largest economy, has had a relatively minor impact on the equity markets.

Despite the losses on Monday, January 4 (Dow -1.25%, -382.59, S&P 500 -1.48%, -55.42, NASDAQ -1.47%, -189.84) all three averages remain near their all-time records.

Two reasons are behind the optimism of equity traders.

First, they are discounting the eventual economic recovery in the second and third quarters.

Deferred consumer and business spending and the psychological release from the pandemic are expected to drive the US economy into a robust expansion. The Atlanta Fed GDPNow model estimates US growth at 8.6% annualized in the fourth quarter. It is hard to see how that does not improve as the vaccine distribution liberates the economic outlook.

Second, the Fed has been emphatic on the need to maintain extremely low rates until the economy is, as Chairman Jerome Powell has phrased it, “well on the way to recovery.” The December Projection materials kept its forecast for a 0.25% upper fed funds target until the end of 2023.

However, from a market perspective, it is the Fed's $120 billion bond purchase program that is most important. Yields in the Treasury markets can move independently of the fed funds rate if the situation warrants. The return on the 10-year Treasury closed at 0.917% on Monday, January 4. That is about half of where it opened 2020 and far less than the 2% to 2.5% range for most of 2018 and 2019.

CNBC

The treasury market can see as effectively into the future as equities and the only reason rates have not risen back to pre-pandemic ranges is that they are being restrained by the Fed.

Currency Market Response: Treasury rates and labor market signals

The key difference in the currency response to the labor market is the Federal Reserve's $120 billion a month in bond purchases. Simply put, what is good for the equities is equivocal for the dollar.

The Fed's promise to keep rates, meaning market rates not the fed funds, low as long as necessary means that the degree of repression depends on the economic recovery. The chief indicator for the central bank's governors is the success of the labor market. The Fed has already permitted almost a doubling of the 10-year Treasury yield since August as the economy has strengthened.

When the economy starts to accelerate in the second or third quarter Treasury returns will begin to rise, regardless of the fed funds rate. Fed bond purchases will regulate the yield increase not prevent it.

US unemployment forecast 2021 and the US dollar

For the US dollar, the indicators have changed but the rate game remains the same.

Reuters

The Fed's bond purchase program intends to manage US interest rates not freeze them in place. Treasury yields and the market rates that they key will be permitted to rise, gradually perhaps rather than at a rush, when the improvement in the economy becomes firm and self-sustaining. For the immediate future economic strength will be determined by the labor market, that is, Nonfarm Payrolls and Initial Jobless Claims.

Does the USD depend on the US labor market? The answer is most assuredly, yes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.