Oil Double Bottom Confirmed!

Oil has now officially confirmed the double bottom I have been eyeing up for the last month. Now that we are above the 34.82 level, we have seen a very quick move to the other side of the range to 38.39 which has held as resistance initially. However now that the Falling Wedge pattern as also broken and now held on the daily, traders should be wary of a move through the $39-$40 region which could send weak shorts scrambling for the exits.

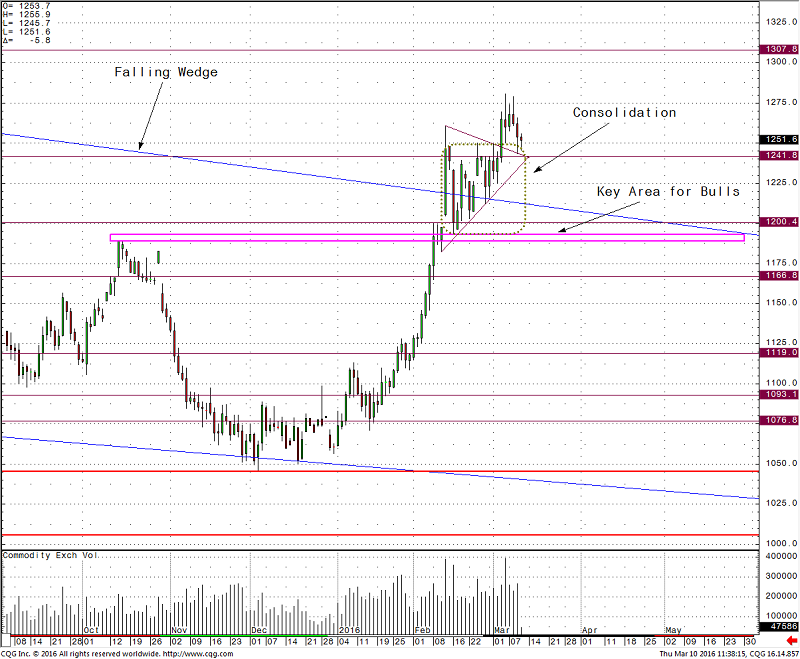

Gold Daily Consolidation Breaks and Holds

The Gold market has also so far shown the whites of it's bullish eyes as it has held key support for bulls at $1200 and broken a key triangle formation to the upside which held nicely yesterday. If we can maintain a bid above the 1241 level, the bulls should maintain control in the short term with a view to trade the 1307 medium term level.

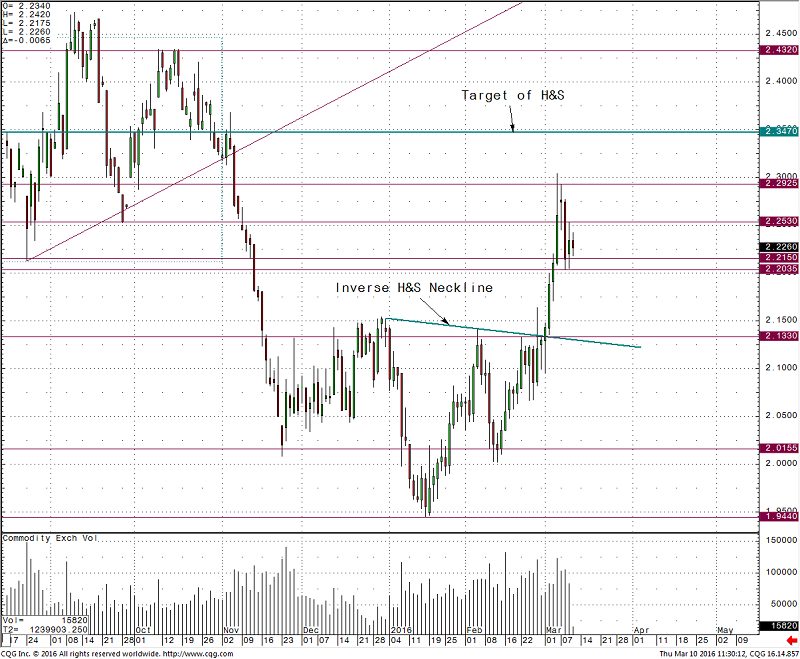

Copper Pulls Back on Thin Air But Holds Key Support

Copper has had a very rapid run up in price since it broke it's key inverse Head and Shoulders pattern.After a rapid pullback as there was a lot of air in the market before passive buyers entered, the market has held the 2.2150 to 2.2035 area, which was a very strong support back in August 2015. If we can remain above this area, the market should maintain its bid, with a target on the H&S at 2.3470. There is currently an inside day formation which could yield some volume and flow on the break on either side, with upside break more likely for continuation in my view.

.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.