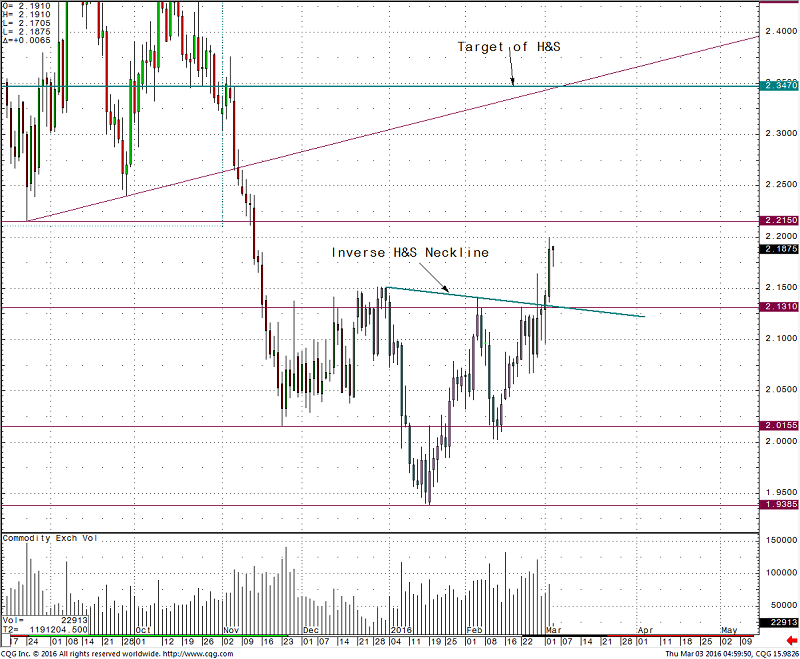

Copper Breaks theInverse Head and Shoulder

Copper has been on my radarfor last month as a daily/ weekly time frame Inverse Head and Shoulders has beenforming (refer to Weekly Market Wrap and Road map streams). This week, themarket has broken that very key pattern at 2.1330 leaving the yearly low at1.9385 and is showing bullish price action thus far. If we can close theweek above this neckline, there is scope for the market to continue the rallyup to 2.2150 which was a key swing low. Above there and the market could makeit's way to the target of 2.3470.

Crude Oil DoubleBottom At Critical Juncture

Over the last few weeks I havealso been watching the crude oil very closely as the market has now DoubleBottomed at $26 and is now in the key pivotal zone between 33.85 and 34.82. Weare not building value in a zone that has been rejected several times, which isa bullish signal according to auction theory. If we can break above the 34.82level and close the week above there, the Double Bottom will be confirmed andthere could be a short squeeze on the cards. Above here the next area ofresistance is the Falling Wedge resistance and pivot at 37.75. With very littlestructure above there, a break of the falling wedge could see a very strongreversal. If we cannot hold above 34.82 however, then the scope remains backinto the middle of February's range.

Gold Holding AboveKey Bullish Support Zone

After breaking the very key Falling Wedge Pattern thatI have been watching since the beginning of the year, the market isconsolidating in a range between 1193.6 and 1249.3. We have in the interim alsoheld just above the key support region for the bulls at 1189 which we pointedout in a previous TNTV. If we manage to break this consolidation to the upside,there should be some further juice as longer term shorts begin to get squeezed.The next area of resistance comes in at the 1307.8 and above there at 1346.8.Below the key support region the next real area of support comes in at 1147.3.

.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.