The British pound rose on Wednesday after the relatively strong UK consumer price index (CPI) data. According to the Office of National Statistics (ONS), the country’s consumer inflation rose from 1.5% in April to 2.1% in May on a year-on-year basis. Similarly, the core CPI that excludes the volatile food and energy products, rose from 1.3% to 2.0%. This increase was mostly because of higher clothing and gasoline prices as the country continued to reopen. The data came a day after the ONS published a relatively strong unemployment rate and a few days ahead of the Bank of England decision.

The Australian dollar rose slightly after Australia and the UK inked a post-Brexit deal that will see the two countries remove tariffs and non-tariff barriers. The currency also reacted to news that Victoria will start easing the ongoing lockdown as the number of daily cases decline. Meanwhile, the Australian dollar reacted mildly to the relatively weak economic data from China. According to the National Bureau of Statistics (NBS), the country’s retail sales rose by 12.4% in May, missing analysts forecasts for the second straight month. The country’s industrial production and fixed asset investments also rose by 8.8% and 15.4% in May. This was lower than the expected 9% and 16.9%.

Global stocks were mixed today as investors waited for the Federal Reserve decision. In Europe, the DAX index declined by 0.20% while the FTSE 100 and CAC 40 index rose by less than 0.20%. In the United States, the Dow Jones, S&P 500, and Nasdaq 100 index declined by 0.10%. At the same time, the 10-year bond yield declined to 1.49% while the 30-year declined to 2.19%. With the Fed’s decision, analysts will be looking at the dot plot and the term “transitory.” The dot plot will provide a picture on when officials expect to start tightening.

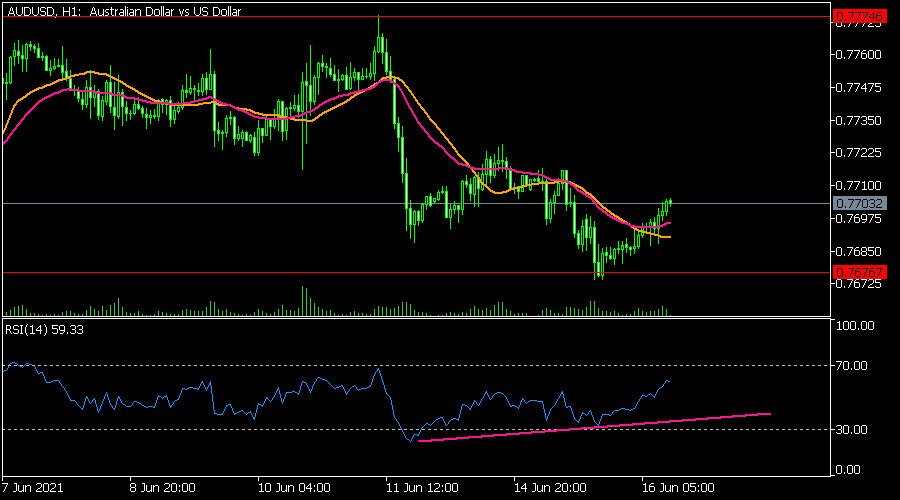

AUD/USD

The AUDUSD pair rose to 7700 after the latest UK and Australia deal. On the hourly chart, the pair managed to rise above the short and medium-term moving averages while the Relative Strength Index has also been rising. It is also slightly above the important support at 0.7676, which was the lowest level on May 28. The pair will likely retreat before and after the FOMC decision.

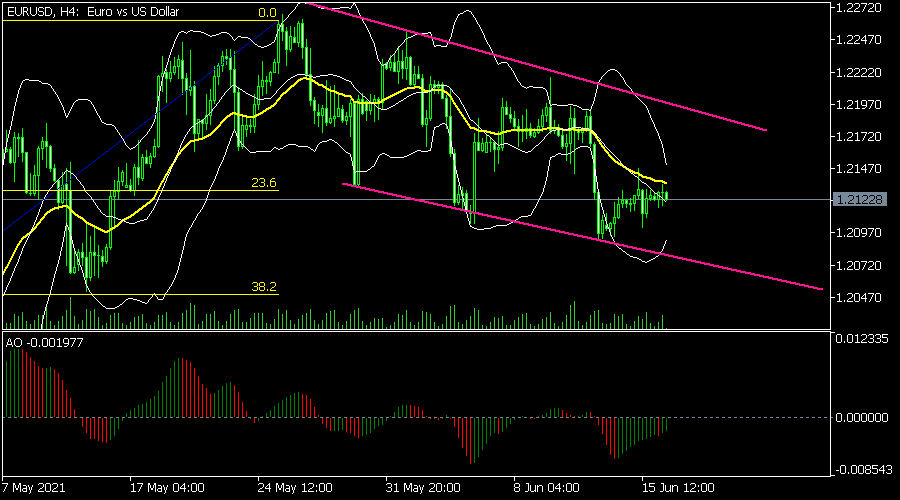

EUR/USD

The EURUSD moved sideways ahead of the FOMC decision. On the four-hour chart, the pair is at the same level as the 23.6% Fibonacci retracement level. It is also slightly below the 25-day moving average while the awesome oscillator is approaching the neutral level. The pair is also between the descending pink trendline and is at the same level as the middle line of the Bollinger Bands. Therefore, like the AUDUSD pair, the EURUSD may resume the downward trend.

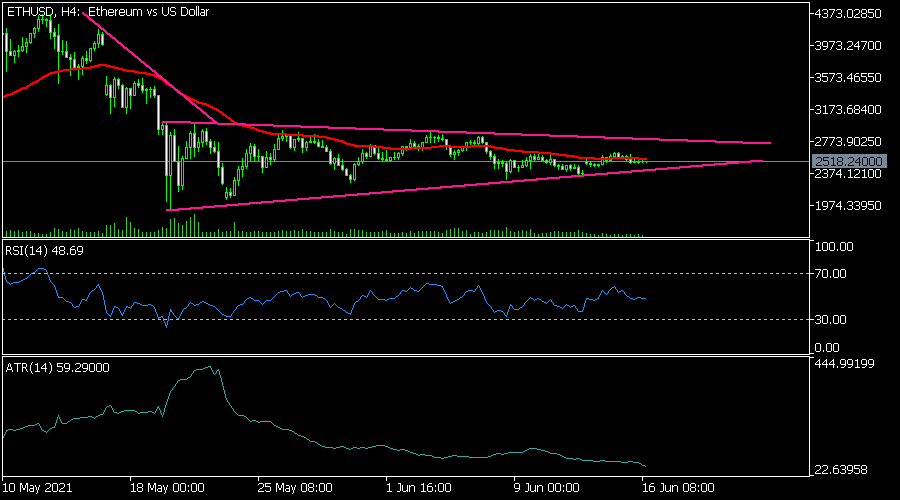

ETH/USD

The ETHUSD pair remained in a tight range ahead of the Fed decision. On the four-hour chart, the pair has formed a symmetrical triangle pattern. A closer look shows that this pattern looks like a bearish pennant. The pair is also oscillating at the 25-day moving average while the Average True Range (ATR) has started to drop. Therefore, the pair may break out lower ahead of the Fed decision.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.