Nasdaq 100 and Dow Jones struggling as earnings growth slows

Global stocks are still on edge as worries about the Federal Reserve continued. Futures tied to the DAX and Nasdaq 100 continued dropping in early trading. The sell-off accelerated when the Fed decided to reduce liquidity in the market by hiking interest rates and starting a quantitative tightening policy. As a result, stocks declined as investors avoided betting against the Fed. At the same time, the earnings season has pointed to margin contraction considering that earnings have declined. According to FactSet, earnings growth was at 9.1%, which is the lowest level since Q4 of 2020.

The price of crude oil rose slightly as investors reacted to the latest meeting by OPEC+ leaders. The members, as expected, decided to continue hiking production gradually even as demand kept rising. They will now continue adding about 432k barrels of oil per day. The announcement came as the European Union continued deliberating on blocking Russian oil. The process stalled when Hungary decided to veto it saying that the move would deprive the economy of the vital resource.

The economic calendar will not have any major events today. Therefore, investors will focus on the ongoing earnings season. The companies that will publish today include Tyson Food, Palantir Technologies, Lordstown Motors, Maxar Technologies, and Vroom among others. Raphael Bostic, a Fed official will speak and share his opinion about the economy. Earlier on, the Chinese statistics agency said that its exports declined slightly because of recent lockdowns.

XBR/USD

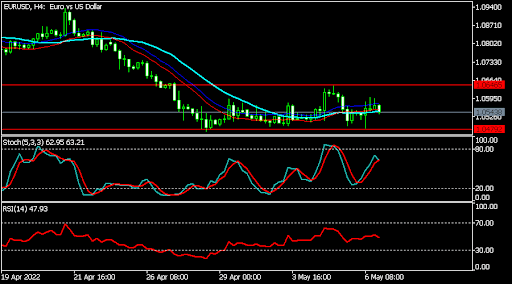

EUR/USD

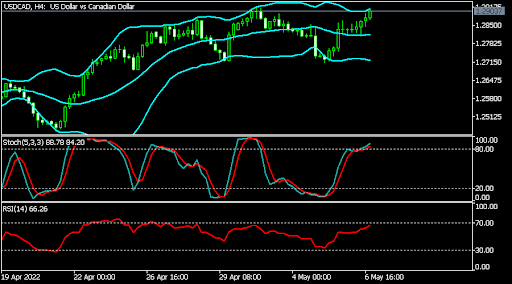

USD/CAD

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.