Market Brief

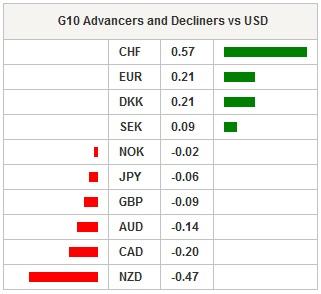

FX markets were quiet, shifting into summer trading patterns. USD was marginally weaker against G10 and EM currencies as US rates were unchanged at 2.264%. EURUSD traded from 1.0929 to 1.0949 in controlled behavior. USDJPY traded in a u-shaped pattern down from 124.25 to 123.91 then back to 124.16. Indicative of a sleepy August Friday trading session. Asia regional equity indices were higher across the board. The Nikkei was up 0.12%, the Hang Seng rose 0.52% and the Shanghai composite increased 0.60%. Commodities remain under pressure with gold falling from $1089 to $1083. Since interest rates have begun to rise globally, gold cost of carry has increased making the precious metal an unfavorable asset to hold. VIX index fell to 12.13 as volatility in stocks dried up. In FX, volatility also continued to decrease indicating that carry based trades should become popular again. In our view CHF and JPY would be the strongest candidate for funding they interest rate driven trades. According to newswire, Alexis Tsipras won his battle against the far left dissenters for the governing of Syriza party. The terms of the current €86bn bailout being negotiated remains highly divisive and we are likely to get a end of year snap election. Elsewhere, the IMF board has told Athens that the unsustainable high level of debt and weak history of reform implementation could keep the IMF from participating in the third bailout. Lingering concerns over Greek bailout negotiations and technical break of 1.0930 should keep EURUSD risk to the downside. Finally, the Swiss National Bank has reported a loss of CHF 50.1 billion for the first half of 2015 (chf 10bn above prior report). Residual costs of abandoning the EURCHF minimum exchange rate.

Japan’s June CPI increased 0.4% y/y above market expectation of 0.3% y/y, but slower than the 0.5% rise in May. Core inflation was unmoved at 0.1% y/y against 0.0% expected and CPI excluding food & energy surged to 0.6% y/y, both above expectation of 0.4%. Overall household spending disappointed falling -2.0% y/y in June, below then consensus growth of 1.9% following a 4.8% increase in May. Weak consumption spending will weigh on 2Q GDP growth and has become a worrying signals that Abenomics effect are slowing.

New Zealand July business confidence fell to -15.3 following a dip -2.3 in June and activity outlook continued falling to 19.0 in July from 23.6. These reads indicated a further weakening of growth momentum. South Korea’s June industrial production growth hastened 1.2% y/y above expectations of a -2.0% fall and revised slump of 3.0% in May.

In a light European session, traders will see EA June unemployment rate which is expected to fall 11.0% from 11.1%. EA July flash HICP inflation is anticipated to be unchanged at 0.2% y/y and core inflation at 0.8% y/y. In Russia, we expect that central banks to cut 50bp in line with consensus. The central bank is in a real bind with inflation rising yet growth collapsing. We remain buyers of USDRUB, as the fragile growth outlook and lower official rates, will have markets selling RUB (CBR interventions have paused due to increase RUB decline and high volatility).

In the US session, Canada GDP is expected to be flat at 0.0% m/m from -0.1% in May. The BoC recent rate cut would suggest that market will overlook this weak read. We remain significantly bearish on the CAD due to slowing growth, weak commodity prices and dovish central bank. In the near term USDCAD bullish trend remains intact and likely challenge 1.3103 July 15 high, break would extend strength to 1.3275.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.