Market Brief

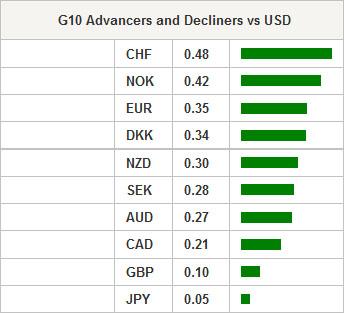

The latest data from the US were broadly mixed with April Durables Goods Orders matching expectations at -0.5%m/m (4% prior). Markit Flash Services PMI came in below expectation at 65.4 versus 56.5 expected (57.4 prior) indicating that the US service sector lost momentum in May. However, since a read above the 50 threshold indicates an expansion, May’s figure is therefore not that bad. Finally, Consumer Confidence surprised markets on the upside as the index surged at 95.4 in May versus 95 expected and 94.3 prior. All in all, data release didn’t trigger major moves in FX markets as USD consolidates against G10 overnight before sliding slightly in late Asian session.

In Asia, equity returns are broadly negative. Korea’s Kospi is the biggest loser, down -1.68%. In Japan, the Nikkei is roughly positive, up 0.17% while the Shanghai Composite is rising, again, up 0.72%. Australian shares are down -0.83% despite Westpac leading index surged 0.1%m/m in April, rebounding from -0.35m/m in March. USD/JPY is consolidating around 123 after adding more than 3% in less than 3 weeks. This morning, BoJ minutes indicate that Japanese officials are comfortable with a weak Yen, helping to boost inflation. The dollar should find support at 121.48 (Fib 38.2% on late April – May rally) while a strong resistance implied by June 2007 high stands at 121.14. Further South, AUD/USD free fall continues as the Aussie broke the 0.7786 support (Fib 61.8% on April 13 – May 14 rally). Moreover, the break of the 50dma (0.7808) validate a negative trend, we therefore expect the pair lower. On the downside, the next support can be found at 0.75 (psychological threshold).

In Canada, we expect the BoC to leave its target rate unchanged at 0.75% at its policy meeting today, in line with consensus. USD/CAD broke the 50dma to the upside and is now finding resistance at the bottom of its January-April 1.2425-1.2845 range.

In Europe, equity futures are blinking green on the screen after yesterday sharp sell-off. Euro Stoxx 50 is up 0.42%, UK’s Footsie is up 0.19%, German DAX up 0.40% while Swiss equities gained 0.44%. GBP/USD has proved unable to break the 1.5338 support (Fib 38.2% April 13 – May 14 rally). The cable rebounded on the level and is heading toward the closest resistance standing around 1.55 (psychological threshold and April 29 high). EUR/GBP remains in its declining channel even if the pace of depreciation has slowed down. The euro reached 0.7041 against the sterling yesterday after losing 5.5% in less than 3 weeks.

USD/CHF stands at a turning point, testing the strong resistance at 0.9525 implied by the conjunction of its 50dma and 200dma. The dollar will need fresh boost to validate a break to the upside, if not the pair will find support at 0.9052 (Fib 61.8% on January 16 – March 12 rally).

Today’s economic calendar is light, however traders will be watching MBA Mortgage applications from the US and Bank of Canada rate decision at 14pm GMT. G-7 finance ministers and central banks chiefs meet in Dresden, Germany. The meeting will last three days until Friday.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.