Market Brief

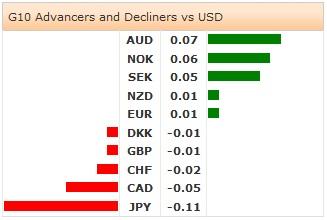

Asia opened the week through a quiet trading session. USD/JPY and JPY crosses were slightly better bid in Japan as the industrial production expanded faster in May (0.7% m/m vs. 0.5% exp. & 1.0% y/y vs. 0.8% exp.), the capacity utilization contracted at the slower pace of -0.7% (vs. -2.2% a month ago). USD/JPY faces offers pre-101.50 (optionality), more resistance is eyed toward 101.91/96 (200-dma/daily Ichimoku cloud base). The BoJ meets this week; no surprise is expected while the government is now concerned about the weakness in stock markets and stagnation in JPY. EUR/JPY started the week at the very tight range of 137.82/99. Trend and momentum indicators are marginally negative, resistances are seen at 138.55 (21-dma), 139.02 (50-dma) then 139.39 (200-dma).

The Antipodeans slightly outperformed their G10 peers at the week opening. NZD/USD advanced to 0.8823 as REINZ data showed slower contraction in house sales in June. In Australia, the credit card purchases increased in May, lifting AUD/USD up to 0.9403. Offers above 21-dma (0.9401) capped the upside as sentiment remains negative. Governor Stevens stated over the weekend that “investors are maybe underestimating the probability of a material decline” in the Aussie-complex. The RBA minutes are due on Tuesday and may further weigh on AUD.

EUR/USD flat-opens the week within 1.3597/1.3611 range (at the time of writing). Technically, the pair trades along the June-July uptrend floor, light resistance keeps the upside limited below the 21-dma (1.3616). The short-term support is placed at 1.3576 (Jul 7th low), decent option bids at 1.3555 are likely to secure downside today. On the upside, we see resistance between 1.3647/78 (50-200 dma). EUR/USD is likely to remain range-bound until FOMC Chair Yellen’s testimony before US lawmakers on Tuesday. EUR/GBP is in the upside correction zone, yet the bullish forces remain weak. First line of resistance is placed at 0.79745 (21-dma). Heavy option related offers are waiting to be activated at 0.79300 at tomorrow expiry.

In its bearish corrective attempt, GBP/USD tests support at 1.7100. The short-term technicals point downwards, support is eyed at 1.7075/86 (21-dma/Jul 8th low). Option bets are skewed negatively below 1.7150.

Released on Friday, labor data showed that Canadian economy unexpectedly erased 9'400 jobs in June, the unemployment rate deteriorated from 7.0% to 7.1% for a participation rate seen steady at 66.1%. USD/CAD cleared resistance at 1.0700, advanced to 1.7047 in Asia. Trend and momentum turned positive and will suggest deeper upside correction as long as 1.0700/17 support (optionality/21-dma) holds. We are heading into an important week for the Loonie. The BoC meets on Wednesday July 16th and is expected to keep the policy rate unchanged at 1.0%; the inflation is due on Friday.

We have a light economic calendar this Monday. Traders focus on Italian May General Government Debt, Euro-Zone May Industrial Production m/m & y/y and Canadian June Teranet/National Bank HPI m/m & y/y.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.