Gold Price Weekly Forecast: XAU/USD not far from record highs

- Gold remains around the $2,000 area with a bullish bias.

- A quiet week ahead could see Gold approaching record highs if US yields continue their decline.

- The yellow metal is not risk-free and could suffer sharp corrections.

Gold continues to trade near the $2,000 level, lacking solid conviction to break higher. The risk remains tilted to the upside as US yields pull back. However, as fundamental factors still favor the US economy over other economies, the Greenback could see its losses limited, which in turn, would keep XAU/USD at risk of sharp corrections.

A lot happened

Plenty of economic reports, central bank decisions, and the US official employment report were released. The Bank of Japan (BoJ), the Federal Reserve (Fed) and the Bank of England (BoE) decided in line with expectations, keeping the monetary policy stance unchanged at their respective meetings.

The Federal Reserve acted as expected. It remains data-dependent. Unless inflation rebounds, it appears unlikely that they will raise rates further. The meeting had a modest impact on the overall sentiment of the US Dollar and did not favor Gold.

Economic data from the US showed that Initial Jobless Claims reached their highest level in seven weeks, while Continuing Claims rose to levels not seen since April. Most notably, the economy added 150,000 jobs in October, according to the Nonfarm Payrolls report, below the market consensus of 180,000. The Unemployment Rate also rose from 3.8% to 3.9%. Data from the manufacturing sector showed complications, and on Friday, the ISM Services PMI pulled back more than expected but remained in expansion territory.

So far, the fourth quarter appears less promising than the third quarter GDP showed last week. The market cheered that this may signal the end of the global tightening cycle.

The week before US CPI

Next week, the market will have a quiet week in terms of economic data. In the US, there are practically no top-tier reports. The highlight will be Thursday with the weekly Jobless Claims, particularly after the recent jobs data. The other relevant report will be the University of Michigan Consumer Sentiment survey on Friday, providing preliminary numbers for November.

What Federal Reserve officials say may not be as relevant as it used to be, as the market perceives that the central bank is done with interest rate hikes. The economic figures due during the week have little potential to change that projection.

Regarding what the Fed will do next, and more importantly, for how long it will keep interest rates at sufficiently restrictive levels, inflation data will be crucial. The following Consumer Price Index report is due on November 14, and the last Federal Open Market Committee (FOMC) meeting of 2023 is scheduled for December 12-13.

The more confident the market becomes that the Fed will not raise interest rates further, the more upside potential Gold has if US yields remain steady. The Fed not raising rates further, along with slowing inflation and softening US data, could be positive news for Gold. However, as fundamentals back the US Dollar over other currencies due to growth differentials, a stronger Greenback could lead to corrections or limit gains for XAU/USD.

After a week of many central bank decisions, the only game in town next week will be the Reserve Bank of Australia (RBA). On Tuesday, the RBA could raise interest rates. Chinese trade data (Tuesday) and inflation figures (Thursday) will be closely watched. Eurostat will also release wholesale inflation data on Tuesday.

Overall, barring a collapse in Wall Street, the bond market will remain a key driver for Gold and the US Dollar. After this week's rally, if bonds continue to rise, Gold should benefit sooner or later.

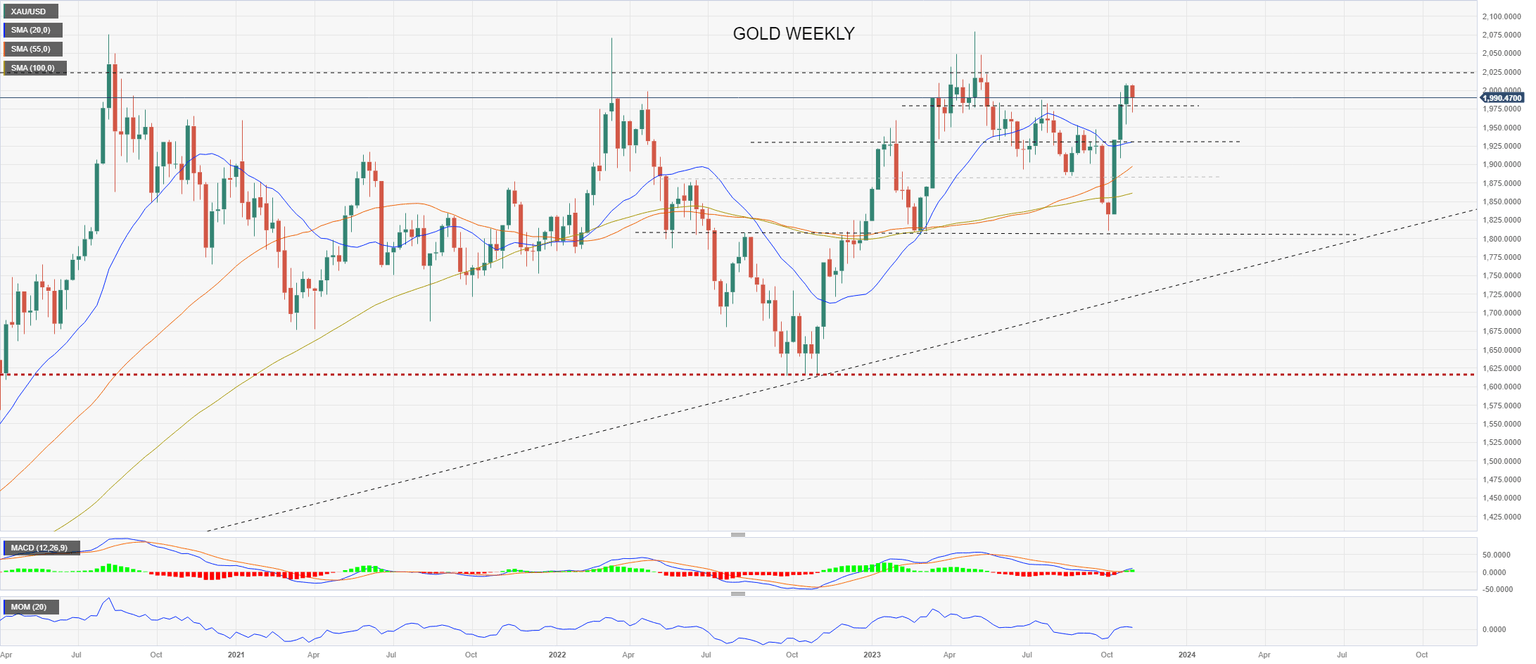

Gold price technical outlook

Gold price has lost some bullish momentum after being unable to sustain above $2,000 and failing to break $2,010. However, the bias remains to the upside in the short term and on the weekly chart.

If the price drops below $1,980, a deeper correction is likely, and we could expect the 20-week Simple Moving Average (SMA), which stands at $1,930, to provide support. On the contrary, the yellow metal needs a weekly close above $2,025 to open the door for a test of its record highs.

XAU/USD is in a strong resistance zone that previously capped the upside in April. If it manages to overcome this area, an acceleration higher seems likely. Conversely, a failure to do so in the short term could spark a correction.

On the daily chart, Gold is moving between $2,005 and $1,980. The bias is still to the upside. However, the Relative Strength Index (RSI) is nearing overbought levels, indicating further consolidation. The price is well above the 20-day Simple Moving Average (SMA) and other key SMAs, supporting the bullish bias.

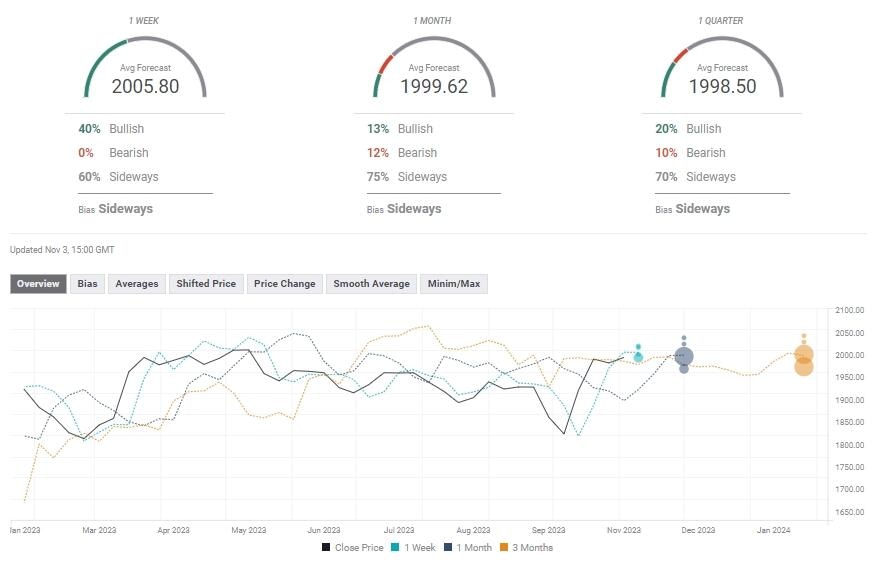

Gold price forecast poll

The FXStreet Forecast Poll indicates that most experts anticipate Gold prices not moving further from current levels over the next week and months. For next week, the average price is $2,005, and for one month, it is $1,999. The average price for a quarter ahead is $1,998.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.