- GBP/USD has recovered from the lows after the BOE's Bailey signaled negative rates are not imminent.

- UK GDP, Brexit talks, and coronavirus are set to move sterling.

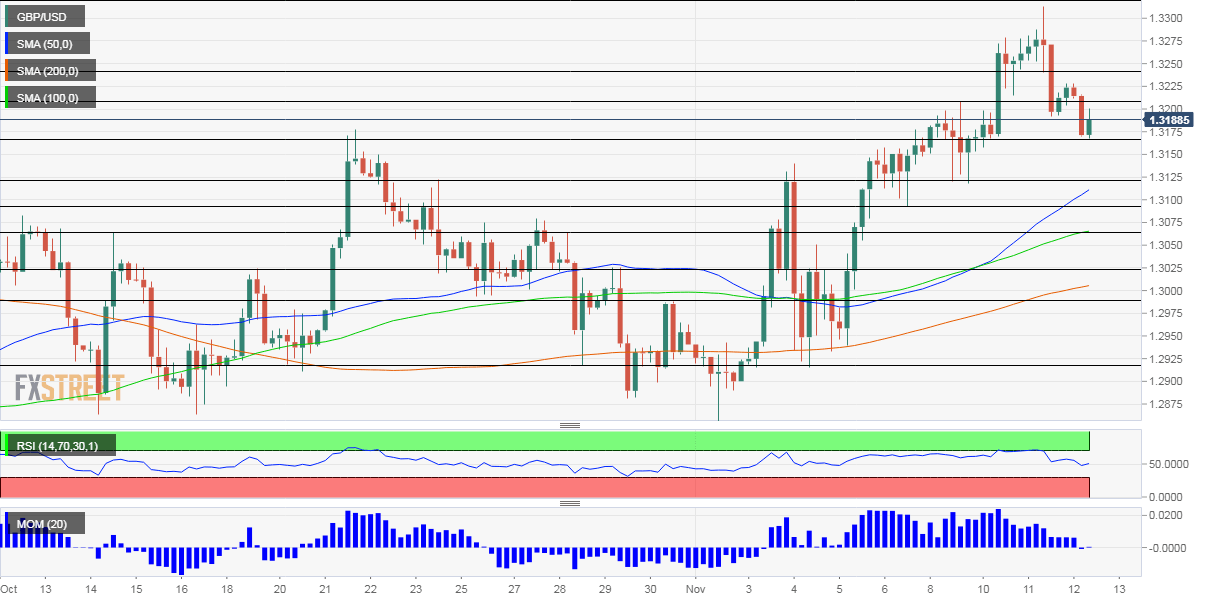

- Thursday's four-hour chart is painting a bullish picture.

A deadline – like in Brexit talks – can be pushed back. But when there is no target date, the chances of something happening at all are even lower – and that is helping the pound. Andrew Bailey, Governor of the Bank of England, has said that he does not have a date in mind for setting negative interest rates, allowing sterling to bounce.

Bailey and his colleagues previously seemed keen on pushing borrowing costs below zero, even announcing they are examining their implementation. These recent comments seem to push it off the agenda. Moreover, Bailey has also spoken positively on this week's uplifting news of an upcoming coronavirus vaccine, perhaps pinning his hopes that immunization would make any additional easing unnecessary.

Where next for the pound? Bulls have reasons to cheer. Regarding the vaccine, the UK has secured deals with no fewer than six pharmaceutical companies that are working on immunization. Moderna, Johnson&Johnson, and Britain's AstraZeneca are all performing Phase 3 trials – and are using the same mRNA approach that Pfizer is applying. Additional announcements may come out in the coming days.

See Pfizer's success promising for three other efforts, rally may have only just begun

Moreover, Britain is also testing the usage of quick lateral flow covid tests, that could enable receiving results rapidly and a return to a more normal life. The economy rebounded by 15.5% in the third quarter – an impressive surge in normal days, but insufficient now. The leap comes after output collapsed in the second quarter and high level of uncertainty prevails.

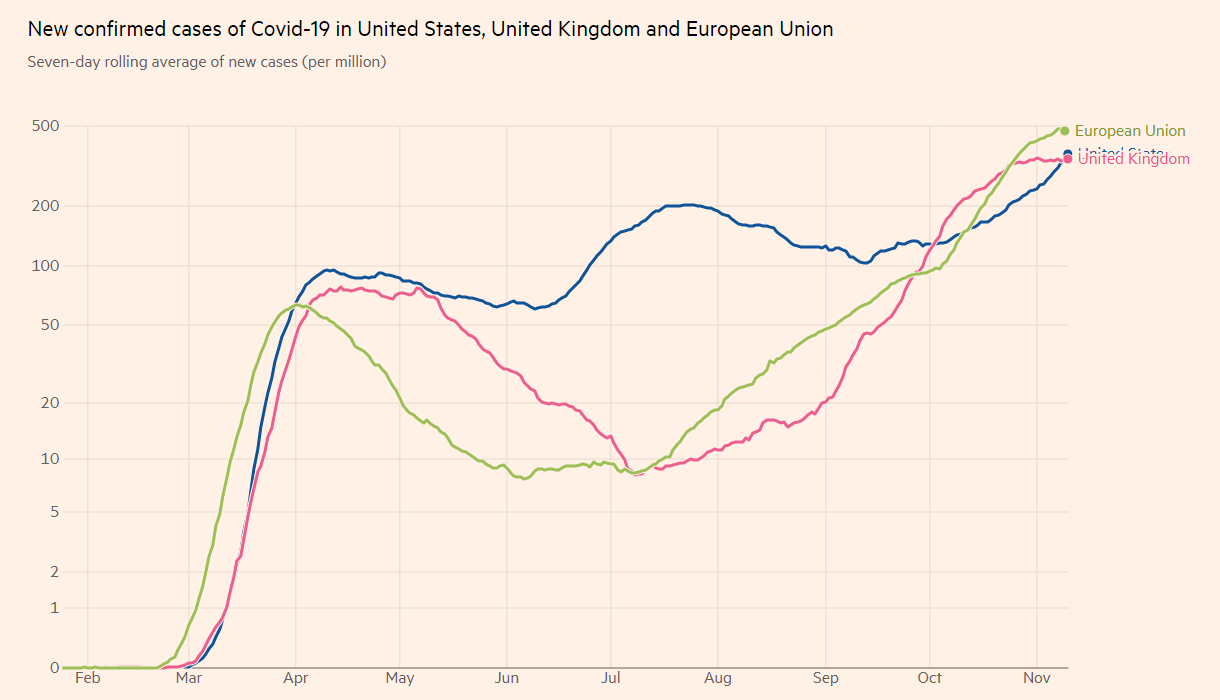

While the UK COVID-19 case curve has flattened, deaths are on the rise, hitting the grim milestone of 50,000 mortalities. Statistics are going in the wrong direction also in America, where hospitalizations hit a new peak over 65,000 and infections hit a record of 144,000 daily. The deterioration in the US has boosted the safe-haven dollar.

Source: FT

In the political world, the EU and the UK reached a conclusion that they are unable to meet the November 15 deadline to reach a Brexit deal. While that sent sterling down, it essential to remember that the only genuine deadline is December 31 and that negotiations continue. Positive comments from either side could send sterling higher.

US President-elect Joe Biden continues working on the transition despite President Donald Trump's refusal to concede. Both parties seem to continue campaigning ahead of the two Senate runoff in Georgia – critical for control of the upper chamber.

See 2020 Elections: Biden wins also per Fox, markets set to focus on Georgia's Senate races

Later in the day, Bailey will speak alongside Federal Reserve Chairman Jerome Powell and European Central Bank President Christine Lagarde in a panel. Markets will be waiting to hear from Powell about expanding the Fed's bond-buying scheme.

US inflation figures for October and weekly jobless claims are also of interest.

See US Initial Jobless Claims and CPI Previews: The linkages are gone

GBP/USD Technical Analysis

Momentum on the four-hour chart has turned positive and GBP/USD trades above the 50, 100, and 200 Simple Moving Averages. After the recent fall, the RElative Strength Index is back to around 50, well-balanced.

Overall, there is room for gains.

Some resistance awaits at 1.3210, which capped the pair last week. It is followed by 1.3245, a temporary support line earlier this week. The recent high of 1.3312 is the next line to watch.

Pound/dollar has support at the daily low of 1.3160, followed by 1.3125 and 1.31.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.