Fed Interest Rate Decision Preview: Can Powell calm the markets and propose a taper?

- The announcement of a taper at the September meeting has been anticipated since Fed Chair Powell targeted an end to the bond program in August.

- This would be the first change in the central bank’s pandemic economic support that began last March.

- Markets will focus on the forecasts in the Projection Materials, and Chair Powell’s news conference.

If the Federal Reserve had ever been seriously contemplating a taper announcement after Wednesday’s meeting, the equity turmoil on Monday probably ended that consideration.

Instead, the US central bank now faces the task of reassuring markets buffeted by a property default crisis in China, two-weeks of escalating stock losses and an American economy beset with falling job creation and the worst inflation in a decade.

The Fed will issue its policy statement and this year's third set of economic and interest rate forecasts at 2:00 p.m. ET on Wednesday. Federal Reserve Chair Jerome Powell will speak and answer questions for an hour beginning 30 minutes later.

It is widely expected that the bank will offer a clarification of Mr. Powell’s August promise that the Fed would begin to reduce its $120 billion in Treasuries and mortgage-back securities purchases before the end of the year.

Three weeks ago, speculation was rife that the Federal Open Market Committee (FOMC), the bank’s policy making body, would announce the schedule and amount of its bond taper on Wednesday.

Since then the economic picture has altered markedly.

Economic developments

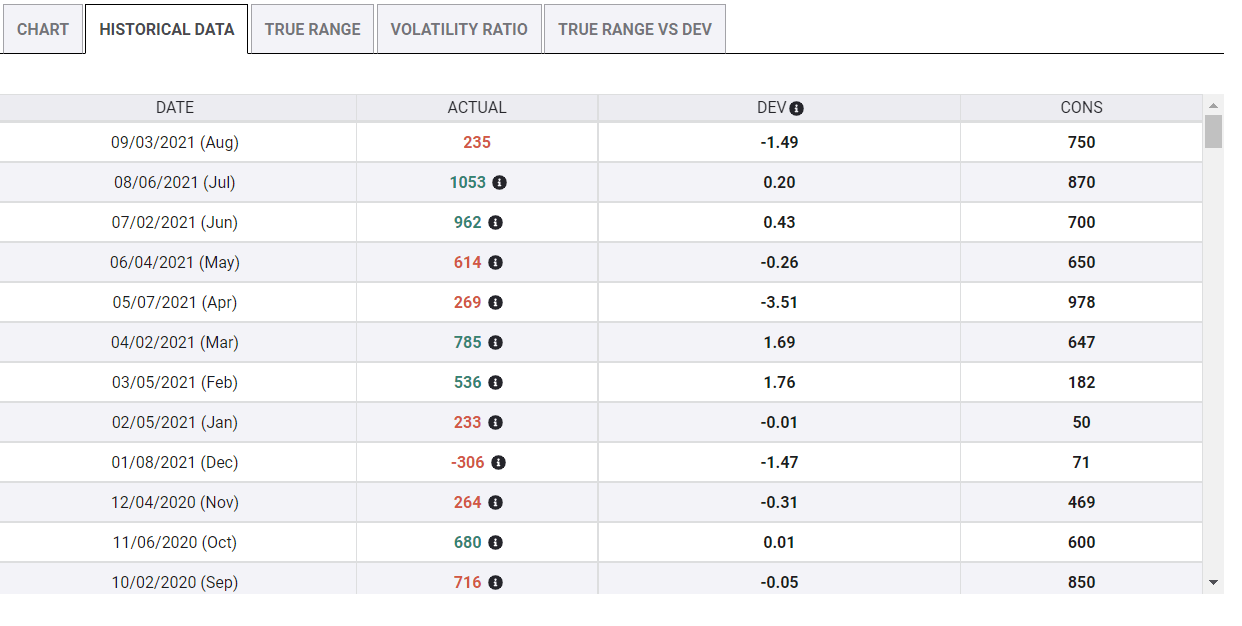

In the, US job production fell by more than 800,000 from July to August. Headline inflation remained above 5%, and the Producer Price Index (PPI) reached its highest level in over 10 years, assuring a long run for consumer price increases.

China’s debt-ridden Guangdong property developer Evergrande Group edged closer to default and ignited a 3% drop in Hong Kong’s Hang Seng index on Monday that spread around the world. The Chinese government is not expected to prevent its bankruptcy if the firm is unable to make a bond interest payment on Thursday.

American equities have been on a prolonged losing streak. The Dow is down 4.8% from its August 16 high of 35,631.19, including a 1.8%, 614 point plunge on Monday. The S&P 500 has dropped 4.2% from its September 2 top at 4,545.85, losing 1.7%, and 75 points on Monday.

Treasury yields are signalling concerns, if not yet outright problems, ahead for the US economy. The 10-year return has shed 5 basis points in the last two sessions, to 1.325% (close 9/21), though it is still above its early August lows.

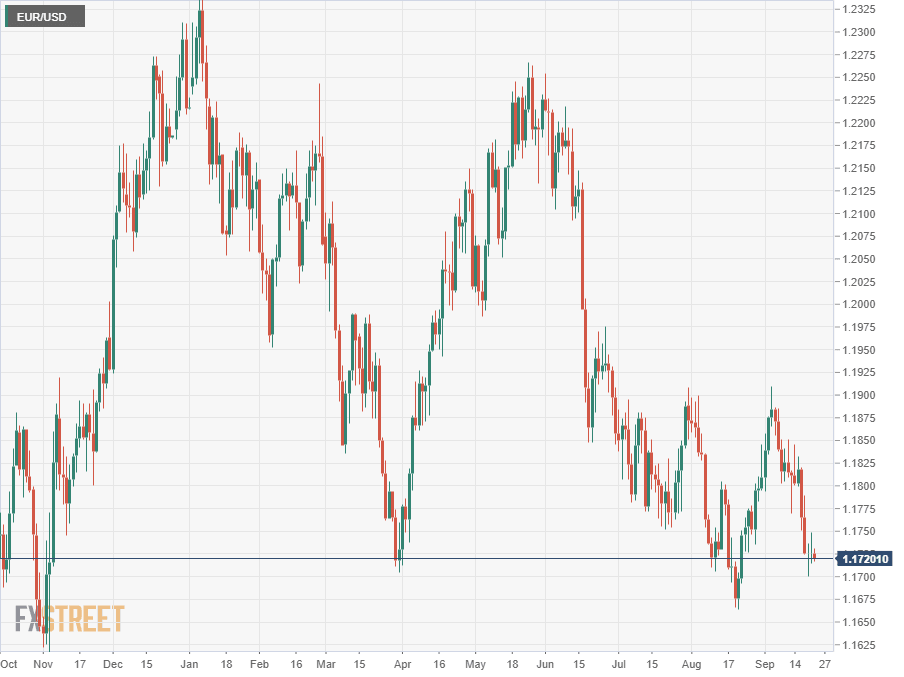

In contrast, risk-aversion and the safety trade have pushed the dollar higher in September against all the majors except the yen, which has its own safe-haven status in Asia.

Projections Materials

The most specific indications of the Fed’s view may come from its quarterly economic and rate forecasts and the voting for the fed funds rate, the so-called dot plot that charts the members' predictions.

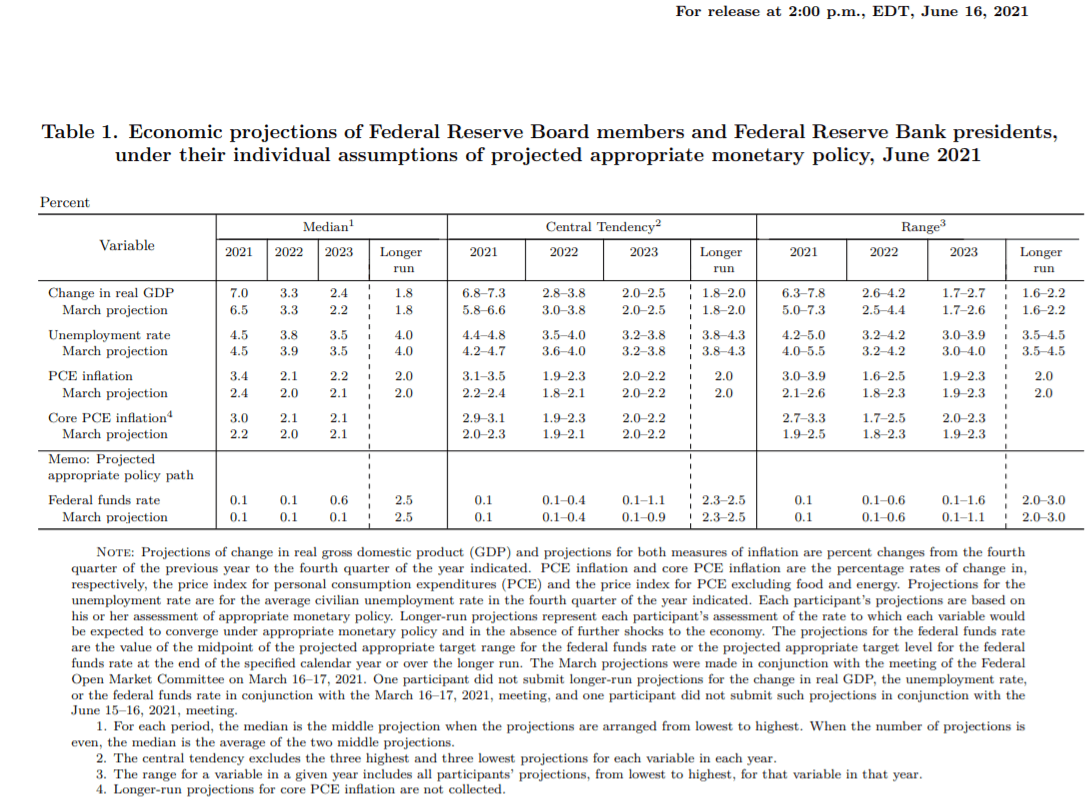

In the June estimates only two members of 18 contributing, had expected a rate hike in 2022. For 2023, 11 predicted the fed funds rate would be higher by two quarter-point increases.

If the number of members voting for higher rates increases, it will signal to markets that the fed funds cycle might start sooner than currently anticipated.

It would also affect the way the credit market views the advent and speed of the bond taper, moving the date sooner and the amounts higher.

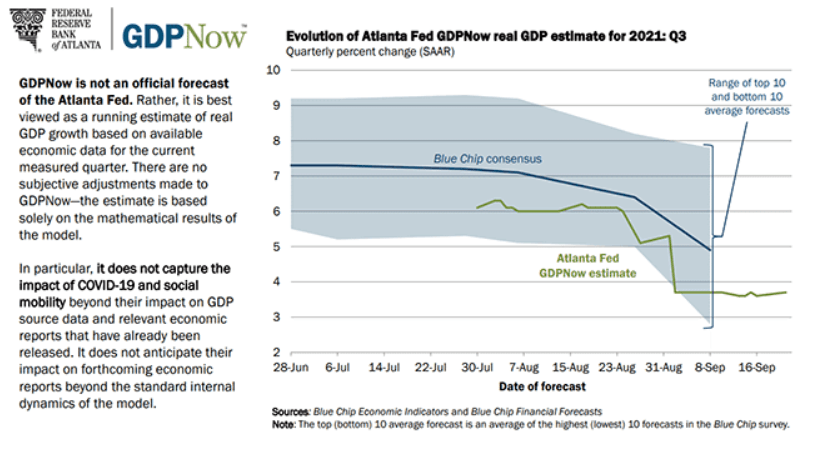

The June prediction for GDP this year climbed to 7.0% from 6.5%. That is unlikely to increase. Although the US grew at an annualized 6.5% rate in the first half, the expansion has tailed off in the third quarter. Dragged down by covid restrictions and labor and materials shortages, the Atlanta Fed GDPNow model posits just 3.7% growth in the third quarter.

The final category is PCE inflation. In June the headline rate rate for this year moved up to 3.4% from 2.4% and the core rate projection climbed to 3.0% from 2.2%. With the overall rate at 4.2% in July and the core rate at 3.6%, these estimates could easily increase.

Press conference

It will be up to Federal Reserve Chair Jerome Powell to explain the bank’s policy and views to the press and markets. Whatever the Fed decision on the taper it will be covered in his short presentation before the press conference.

The bank’s most likely position, considering the recent economic and market developments, is for Mr.Powell to confirm the intention to begin the taper by then end of the year but again defer the date and amount.

Conclusion: Cautionary change

The Fed has been preparing the markets for the end of the bond program since first mentioning it in the minutes of the April FOMC meeting released in mid-May.

Institutionally, the Fed knows that ultra low interest rates are not a feature of a well-functioning economy. Under Janet Yellen, the Fed fought a long campaign to bring interest rates higher, despite none of the traditional signals for tighter monetary policy from the economy.

Fed funds

The Fed governors are in a similar position now.

The economy is improving but the potential pitfalls from the unresolved labor and material shortages, inflation and the pandemic make any economic predictions fraught with uncertainty.

The US recovery can probably withstand higher interest rates but the risks are considerable.

As soon as the bank indicates that the taper will commence, the Treasury market will take interest rates higher and the dollar will follow. No matter how much the Fed insists that ending the bond program does not mean a rate hike is coming, that is a semantic game that fools no one. The credit markets do not depend on the fed funds rate for guidance.

As Napoleon observed, the logical outcome of a retreat is surrender, so higher interest rates are the logical outcome of the end of the Fed’s bond purchase program.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.