EUR/USD Price Forecast: Corrective advance to soon be over

EUR/USD Current price: 1.0409

- United States annualized growth was upwardly revised in Q3 to 3.1%

- The Federal Reserve's hawkish cut maintains the US Dollar near fresh multi-week highs.

- EUR/USD recovery seems corrective, near-term picture supports another leg lower.

The EUR/USD pair trimmed part of the Fed-inspired losses and traded in the 1.0410 price zone ahead of the American opening on Thursday. The pair fell to 1.0343 following the United States (US) Federal Reserve (Fed) monetary policy announcement on Wednesday. The Fed decided to cut the benchmark interest rate by 25 basis points (bps) as expected, delivering alongside a quite hawkish message heading into the new year.

Additionally, the Summary of Economic Projections (SEP) showed policymakers decided to scale back the number of cuts they expect to make next year. Officials also project a strong economy but do not see inflation reaching their 2% goal until 2027. Ten out of the seventeen voting members foresee two rate cuts in 2025, while three members estimated just one trim. Even further, Chairman Jerome Powell said the decision was a “close call” as some voting members would prefer to leave rates unchanged.

Wall Street collapsed with the hawkish cut, leading to losses among its overseas counterparts on Thursday.

Data-wise, the EU published the October Current Account, which posted a seasonally adjusted surplus of €26 billion, missing the expected €33.5 billion. Across the pond, the United States released the final Q3 Gross Domestic Product (GDP) estimate, which suffered an upward revision. Annualized growth was confirmed at 3.1%, against the 2.8% previously estimated. Meanwhile, Initial Jobless Claims for the week ended December 13 declined to 220K from 242K in the previous week, also beating the expected 230K. The figures confirmed the Fed’s stance.

EUR/USD short-term technical outlook

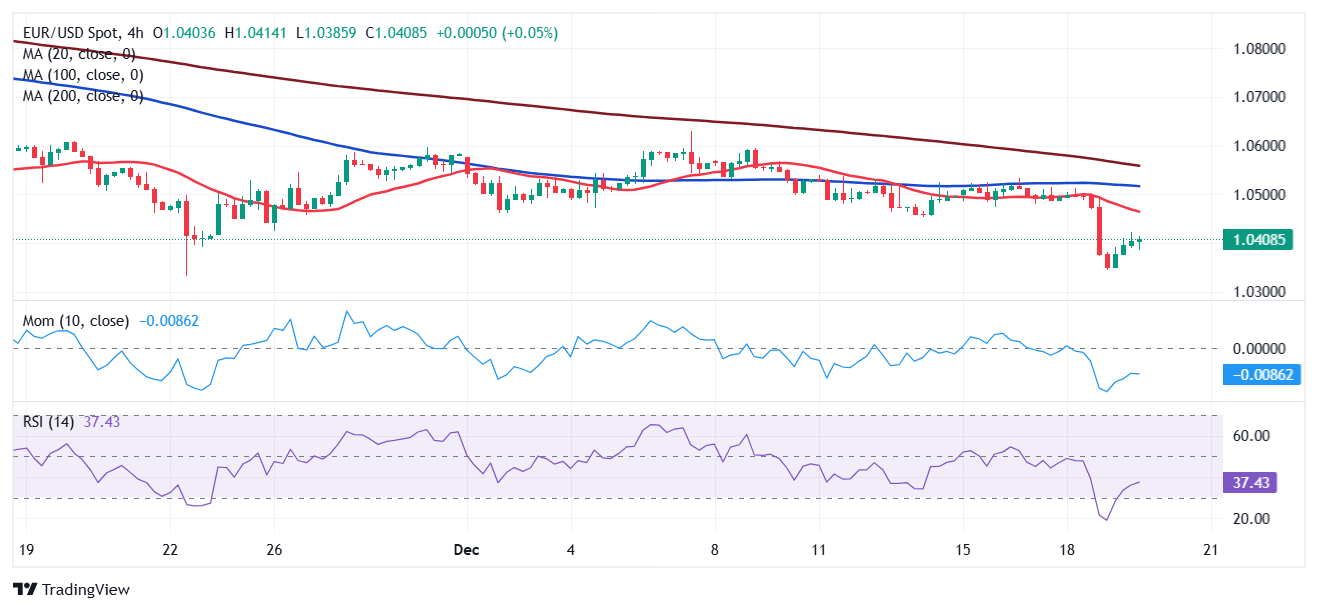

US data initially backed the Greenback, but an uptick in stocks helps EUR/USD to remain afloat. Technical readings in the daily chart, however, show the ongoing advance could be just corrective, given that the pair trades below all its moving averages. Even further, the 20 Simple Moving Average (SMA) heads south below also bearish 100 and 200 SMAs. Technical indicators, in the meantime, barely bounced from their recent lows, lacking enough upward strength to support another leg higher.

The near-term picture suggests that EUR/USD may soon resume its slide. Technical indicators in the 4-hour chart have corrected extreme oversold conditions before losing their upward strength well below their midlines. Finally, the 20 SMA accelerated lower below the longer ones while above the current level.

Support levels: 1.0375 1.0330 1.0290

Resistance levels: 1.0440 1.0485 1.0520

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.