US stocks slide after historic Wednesday rally, NASDAQ down 5.7% on Thursday

- NASDAQ Composite plunges as market grows more pessimistic on China tariffs.

- White House says that Trump's tariff on China is actually 145%.

- Trump hits Canada and Mexico with 10% tariffs that apply worldwide.

- Economists, analysts worry over continued trade war with China.

The US stock market is continuing its volatile trend, this time lurching lower on Thursday following Wednesday’s historic rally. The NASDAQ Composite (IXIC) has traded 5.7% lower at the time of writing on Thursday morning.

This comes after US President Donald Trump paused large tariffs on upwards of 70 trading partners for 90 days midway through Wednesday’s regular session, sending the NASDAQ Composite to its second-largest gain in history, closing up 12.16%.

While the market is quite excited about higher tariffs being paused on Japan, the European Union, India and Vietnam, on Thursday investors are grappling with Trump’s continuance of 10% worldwide base rate tariffs and extremely high tariffs on China.

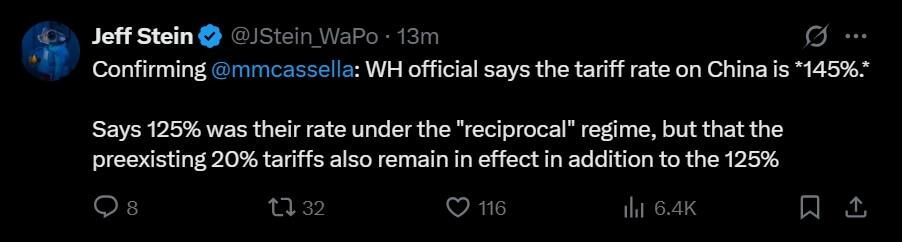

In a social media post on Wednesday, Trump appeared to be saying that tariffs on China would be increased to 125%, but on Thursday officials at the White House told The Washington Post that the figure comes in addition to the earlier 20% tariff rate and that the new rate for China is 145%.

Washington Post reporter Jeff Stein posts on X.com that White House confirms 145% tariff on China. April 10, 2025

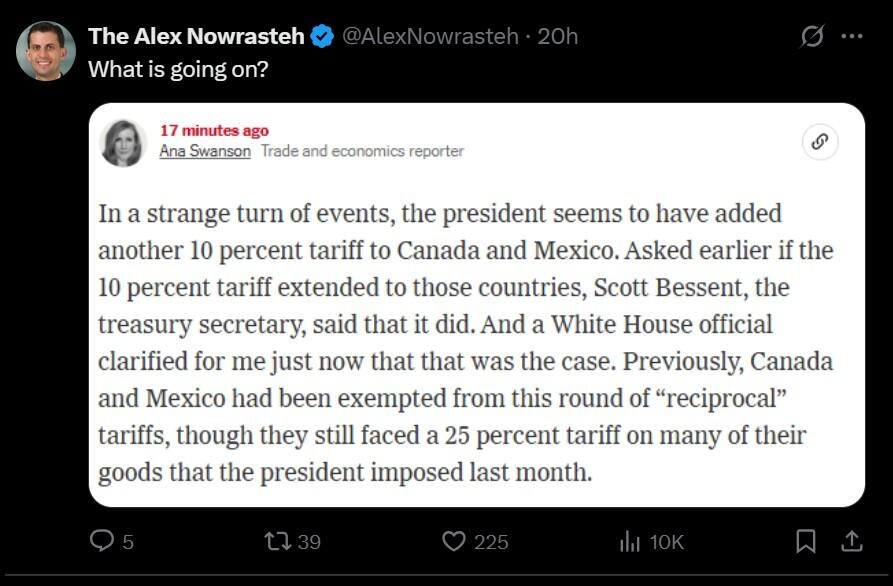

On top of that, Trump’s 10% general tariff also now applies to Mexico and Canada, something most investors did not realize on Wednesday. When Trump paused 25% tariffs on both of those countries last month, most products returned to their free trade status under the USMCA agreement that Trump signed during his first term.

The Cato Institute VP for Economic & Social Policy responds on X.com to New York Times reporter Ana Swanson reporting on Trump's additional 10% tariff on Canada and Mexico. April 9, 2025

Since Mexico, Canada and China are the US’s largest trading partners, US consumers should still feel the weight of higher prices. But at the moment, inflation looks to be on an even keel. Released on Thursday morning, the US Consumer Price Index (CPI) for March showed YoY core inflation falling to 2.8% from 3.1% in February.

Analysts see reason for concern despite tariff pause

Pantheon Macroeconomics released an outlook paper on Thursday that projects a 1% increase in US prices due to the current Trump tariff policy. By pushing tariffs on Chinese goods to 145%, the firm expects US-China trade to collapse by 90%. Instead, US consumers will substitute higher-priced products from other countries.

Since Chinese tariffs on US goods will likely halt most US exports to China, Pantheon expects that just one-third of those goods will find a market elsewhere. “That implies total goods exports falling by 5%, reducing GDP by 0.35%,” said Samuel Tombs, Pantheon’s US chief economist.

UBS’ chief economist Paul Donovan echoed some of Pantheon’s worries. Donovan said that the risk of recession in the US is lower on Thursday than it was the day before but still remains high.

Goldman Sachs gave a probability of 65% for a US recession on Wednesday but quickly retracted it once Trump paused the higher level of tariffs on about 75 countries.

“Together, these tariffs are likely to sum to something close to our previous expectation of a 15 percentage points increase in the effective tariff rate,” said Jan Hatzius, chief economist at Goldman. “As a result, we are reverting to our previous non-recession baseline forecast, with GDP growth of 0.5% and a 45% probability of recession.”

Deutsche Bank's Peter Sidorov, however, said the news is still negative overall since the tariffs on China signal a major decoupling of the globe’s two largest economies. Unlike other countries that tried to negotiate with Trump, China quickly responded with its own set of tariffs on US goods — something Trump had specifically warned against.

Amazon (AMZN) is said to be cancelling billions of dollars in orders from China in order to forgo the incredibly high tariffs. About 60% of the products sold on Amazon are managed by the company itself, while about 40% of products come from third-party sellers.

Hollywood will be another victim of the trade war. On Thursday, China’s government film office said that it would approve fewer US-produced films for import due to the ongoing trade war. This policy could hurt US companies like Warner Bros. Discovery (WBD), Paramount Global (PARA) and Disney (DIS).

NASDAQ Composite index forecast

The NASDAQ soared again on Thursday in a fashion that tells us the recent tariff-caused volatility remains high. Though it is off its lows, the NASDAQ broke through historical support at both 15,708 and 15,222. This makes the 14,500 level the new focus of support if Thursday's sell-off continues in subsequent weeks.

With the 50-day Simple Moving Average (SMA) sinking below its 200-day counterpart, it's clear that a period of weakness will be here for a while. IXIC needs to break back above the 17,500 support level to end this major bout of trader pessimism.

NASDAQ Composite daily index chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.