Cardano stabilizes near $0.62 after Trump’s 90-day tariff pause-led surge

- Cardano gains traction in tandem with other cryptocurrencies as traders react positively to US President Donald Trump’s tariff pause.

- Cardano founder Charles Hoskinson predicts Bitcoin could hit $250,000 in 2025 as markets stabilize from the tariff turmoil.

- Cardano bulls defend $0.50 support ahead of a potential MACD buy signal.

Cardano (ADA) stabilizes around $0.62 on Thursday after a sharp recovery the previous day, triggered by United States (US) Donald Trump’s decision to pause tariffs for 90 days except for China and other countries that had retaliated against the reciprocal tariffs announced on April 2. China faces a 125% tariff to be levied on all exports to the US after the Asian country retaliated with 84% duties.

Cardano founder Charles Hoskinson predicts Bitcoin’s rise to $250,000 in 2025

Cardano blockchain founder Charles Hoskinson, speaking to CNBC, said that Bitcoin (BTC) has the potential to rally, reaching $250,000 “by the end of this year or next year.” His prediction anchors on the sentiment that the ongoing tariff war will cool down as countries negotiate with the US, leading to stability in markets.

“The markets will stabilize a little bit, and they’ll get used to the new normal, and then the Fed[eral Reserve] will lower interest rates, and then you’ll have a lot of fast, cheap money, and then it’ll pour into crypto,” Hoskinson told CNBC.

Bitcoin price holds at $81,600 at the time of writing on Thursday. BTC has corrected from Wednesday’s sharp rise to $83,588, suggesting profit-taking and pressure from overhanging macroeconomic factors.

According to Hoskinson, Bitcoin is supported by strong fundamentals, including an increase in the number of people who own digital assets. He argues that crypto is the best option for globalization, citing challenges in global business and territorial treaties.

Hoskinson clarifies that the crypto market may stall “for probably the next three to five months,” but there could be a massive wave of speculative interest in August or September.

Can Cardano price extend breakout to $1?

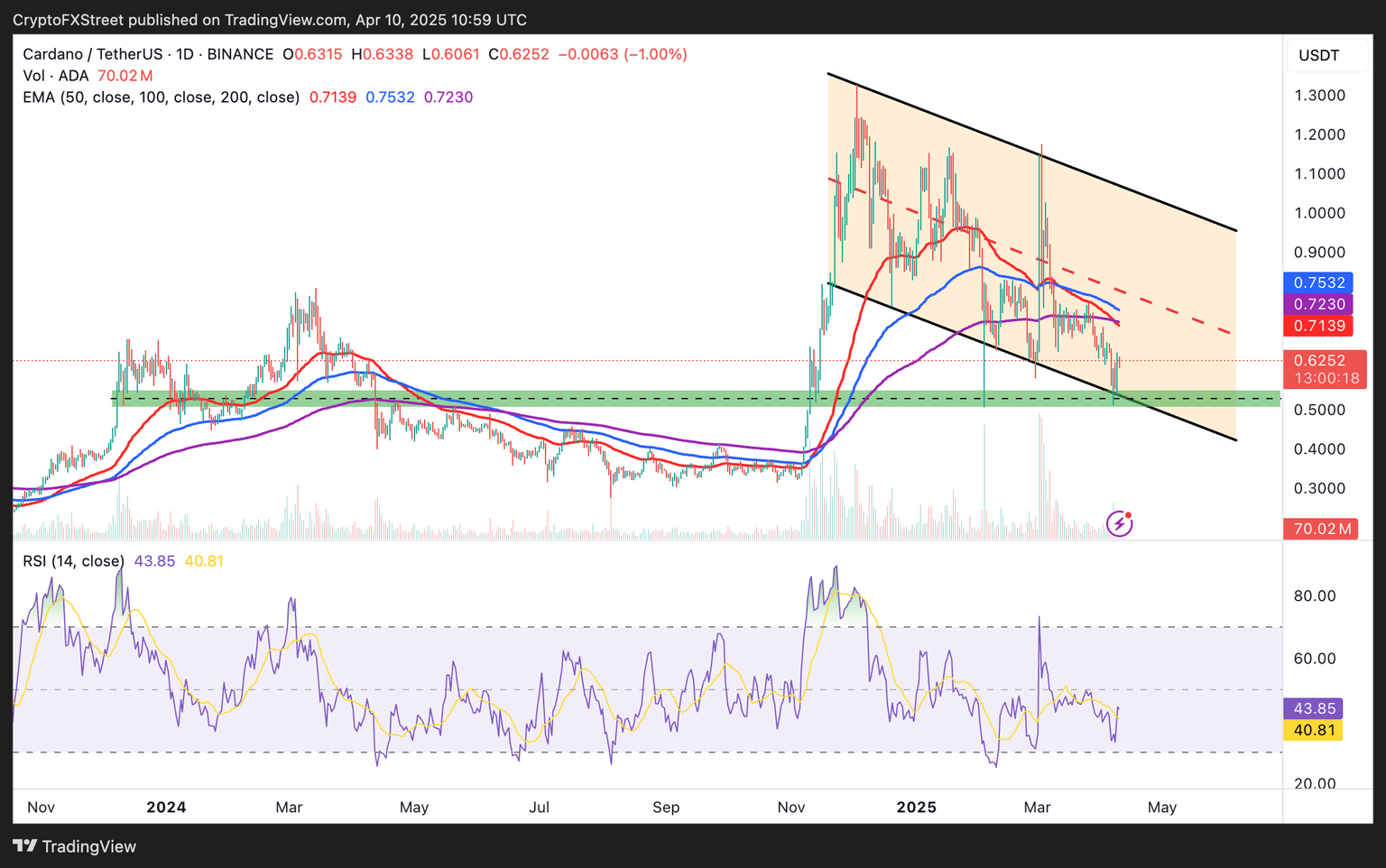

Cardano price defended support at $0.50, coinciding with the descending channel’s lower line on Monday, as the crypto market tumbled in anticipation of President Trump’s reciprocal tariffs. This formed the foundation of a sharp recovery that followed the announcement of a 90-day tariff pause on Wednesday, halting tariffs that had come into effect earlier that day.

Traders responded positively, scooping ADA tokens and providing bullish momentum to the world’s tenth-largest cryptocurrency, with a market capitalization of $22.53 billion.

Cardano hit a daily high of $0.6464 during the late American session on Wednesday. Bulls tried to uphold the gains in the Asian session on Thursday but lacked the conviction to push ADA higher.

The Relative Strength Index (RSI) indicator recovered to 43.65 in the daily chart, showing a decrease in bearish momentum. A break above the midline at 50 could bolster Cardano’s uptrend, calling traders to take up more long positions to tackle the channel’s middle line, which is forming resistance around $0.75. Trading volume must surge with the price to increase the probability of ADA tagging $1.00, a psychological level coinciding with the channel’s upper line.

ADA/USD daily chart

Despite the upswing in the last 24 hours, Cardano holds below the 50-day Exponential Moving Average (EMA) at $0.7139, the 100-day EMA at $0.7532 and the 200-day EMA at $0.7230.

If ADA fails to flip these EMAs into support, bullish momentum may be limited, encouraging bears to increase sell-side pressure. Support at $0.50 remains crucial in ADA’s quest to achieve higher highs in the short term, bringing into sight the previous resistance-turned-support at $0.40.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren