The EUR/USD pair is trading higher this Thursday advancing for fourth consecutive day, but with a limited upward momentum, with the common currency underpinned by dollar's weakness rather than gaining on self strength.

View the Live chart of the EUR/USD

The US Federal Reserve decision has left rates unchanged, and despite reaffirming the economy is still growing and showing that concerns over global and financial developments are less worrisome, the market was unable to establish a clear directional trend, either favoring the greenback or against it. But for the most, the market believes that the FED will be able to provide only one rate hike this year, which ends up being generally negative for the USD.

The pair benefited from the BOJ's decision to leave its policy unchanged, which resulted in the USD/JPY plummeting over 200 pips and speculative interest selling the greenback. In the data front, Germany released its April employment figures, showing that unemployment declined more than expected, as the number of people out of work fell by a seasonally adjusted 16,000 to 2.706 million. The unemployment rate, however, remained unchanged at 6.2%.

Later on the day, the US will release its advanced GDP for the first quarter of the year, and the economy is expected to have grew 0.7% compared to an upwardly revised 1.4% in the last quarter of 2015.

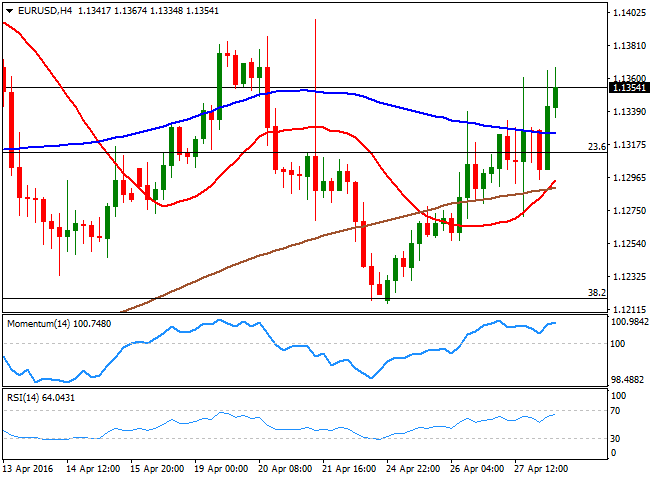

From a technical point of view, the pair presents a mild positive tone, as the price is near its weekly high of 1.1367 and above its moving averages, with the 20 SMA heading sharply higher well below the current level in the 4 hours chart. In the same time frame, the technical indicators hold in positive territory, but lacking directional strength. The pair needs to accelerate beyond the 1.1380 region to extend its gains today, with the next short term resistances at 1.1420 and 1.1460.

A strong support is now in the 1.1310/20 region, with a break below it indicating a continued decline down to the 1.1270 region.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.