After ignoring oil's price behavior, currencies finally resumed trading alongside with the commodity on Tuesday, as a drop below $30.00 a barrel spurred concerns over slowing global demand. Stocks ended sharply lower worldwide and the EUR/USD pair advanced up to the 1.0930 region, with the common currency on demand amid its condition of funding currency.

Asian shares plummeted, but European ones are struggling to turn positive, as the commodity is holding above 30.00, while US futures are in the green at this time of the day. In the data front, the main event is still US Nonfarm Payrolls on Friday, and the pair is expected to be for the most choppy ahead of it.

Today, the services sector PMIs across Europe resulted generally disappointing, missing expectations and coming below December readings. The one for the EU however, remained unchanged at 53.6. The region will release its Retail Sales readings later today, while in the US, the ADP survey and services sector data will be the one more capable to affect the market.

View the Live chart of the EUR/USD

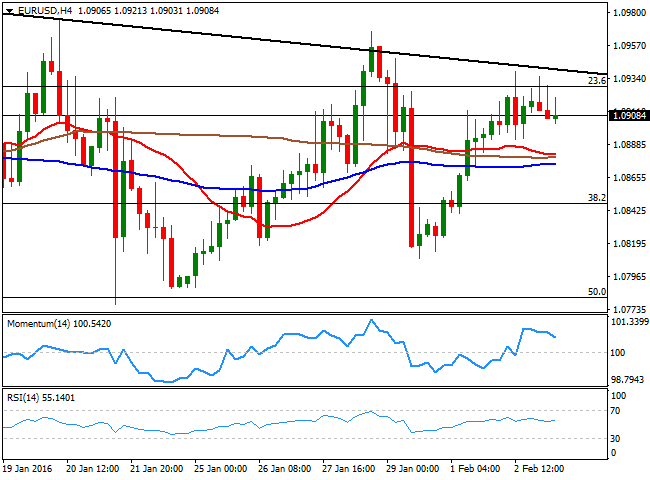

The EUR/USD pair trades a few pips above 1.0900, and the 4 hours chart shows that the price was unable to advance beyond the daily descendant trend line coming from December high of 1.1059, while the moving averages continue lacking directional strength, confined to a tight 20 pips range below the current level, and with the technical indicators turning south within positive territory.

The usual resistances are still in play, with 1.0930 and 1.0960, and only a clear acceleration beyond this last favoring a rally towards 1.1000. Below 1.0880 on the other hand 1.0845 and 1.0800 are the levels to watch today.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.