The EUR/USD pair remained within its latest range for one more week, rallying up to 1.0967, where the weekly descendant trend line capped once again the upside. Also, the pair erased most of its weekly gains on Friday, in spite of weaker-than-expected US Advanced Q4 GDP figures. Consensus was of a 0.8% growth against the finally informed 0.7%, but given the comments on weaker growth made within the FOMC latest statement, seems the market was pricing in an even weaker number.

Anyway, the dollar also got a nice boost from the BOJ, as the Japanese Central Bank decided to cut rates into negative territory during its Friday's meeting, leaving the main benchmark at -0.1%. This week we also knew that inflation ticked slightly higher in the EU and Germany, but still remains subdue. At least, things are starting to look better in that front. Also, the FED had its meeting last Wednesday, and decided to leave rates unchanged, as largely expected. The statement was dovish, but not that dovish, offering a mixed outcome that left investors clueless on what's next. Still, four rate hikes this year remain on the table.

As January comes to an end, the EUR/USD has had little to offer, and will likely remain that way. There are little chances that the US Payroll next Friday can break the range, as employment has been not a major concern lately, and therefore market is paying less attention. Still, strong divergences from expectations in the job's data, can set the tone for the dollar for the rest of the week.

Oil has had a major role this month, and will likely continue to be among the market leaders during the upcoming days, which means deciding trades in the EUR/USD pair can't be done without taking a look on what the commodity is doing.

View the Live chart of the EUR/USD

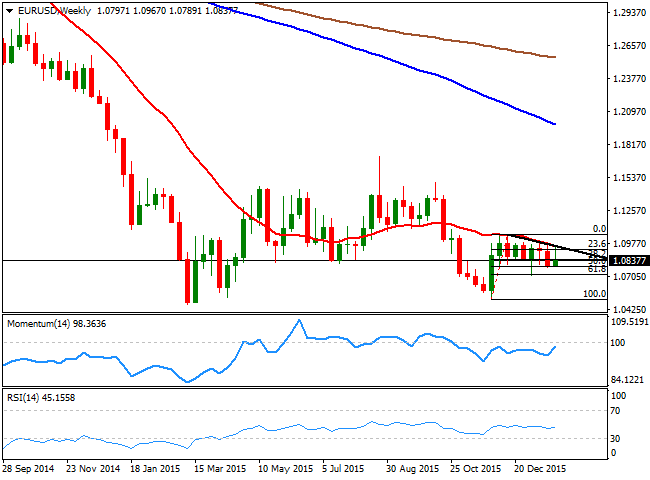

Technically, the weekly chart shows that the pair is ending the week around the 38.2% retracement of its December rally, while the 20 SMA converges with the mentioned trend line, reinforcing the strength of the static resistance. In the same chart, the technical indicators remain within bearish territory, all of which should continue to keep the upside limited. In the daily chart, the bearish tone prevails as the price is now heading lower below a horizontal 20 SMA while the technical indicators turned south around their mid-lines.

With no clear directional momentum, the base of the range stands at 1.0780/1.0800 and it will take a break below 1.0770, post ECB low, to confirm a downward continuation towards 1.0710, the 61.8% retracement of the afore mentioned rally, followed later by the 1.0620 region. The top of the range comes at 1.0930/60, and more selling interest is expected around 1.0000, which means only a clear break of December high of 1.1059 can lead to a more bullish outlook, and an upward continuation towards 1.1120.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.