EUR/USD Forecast: Next bounce may serve a sell opportunity on covid crisis, elections uncertainty

- EUR/USD has been under pressure amid the increase in European coronavirus cases.

- Sky-high tension toward the US elections is set to boost the US dollar.

- Monday's four-hour chart is showing oversold conditions, pointing to a bounce.

A new week, same dead-cat bounce? Fundamentals of EUR/USD continue pointing to the downside, and only oversold conditions seem to provide a temporary upside for EUR/USD.

COVID-19 cases, deaths, and hospitalizations continue rising in the old continent and dampen the economic forecasts. Germany's "lockdown light" is coming into force on Monday while France hopes to ease the strict limits – yet such optimism may be premature.

Mortalities continue rising rapidly in the EU:

Source: FT

Governments across Europe are struggling with fatigue from measures as the second round of restrictions weighs on consumer sentiment. The industrial sector is still holding up, and that will likely be confirmed by Markit's Manufacturing Purchasing Managers' Indexes for October.

Nevertheless, Christine Lagarde, President of the European Central Bank, signaled additional stimulus is coming in December in last week's rate decision. She also warned that Europe may suffer a "double-dip" recession – a return to contraction in the fourth quarter after enjoying a bounce in the three months ending in September. Investors seem to focus on the downbeat prospects for the present and future rather than the rapid recovery.

Covid statistics are also on the rise in the US and are the main topic on the agenda in the elections. President Donald Trump and rival Joe Biden have been crisscrossing the battleground states in the last effort before Election Day on Tuesday. There are fewer people left to convince, as 94 million Americans – around 68% of the total vote count in 2016 – have already cast their ballots.

Turnout is higher in southern swing states than in northern ones. Quick results are likely from Florida, the perennial swing state, while counting in Pennsylvania – seen by most analysts as the tipping point state – could last for longer. Markets fear that a protracted process could result in a contested election and a constitutional crisis.

See 2020 Elections: Three states traders should watch, plus places that could provide surprises

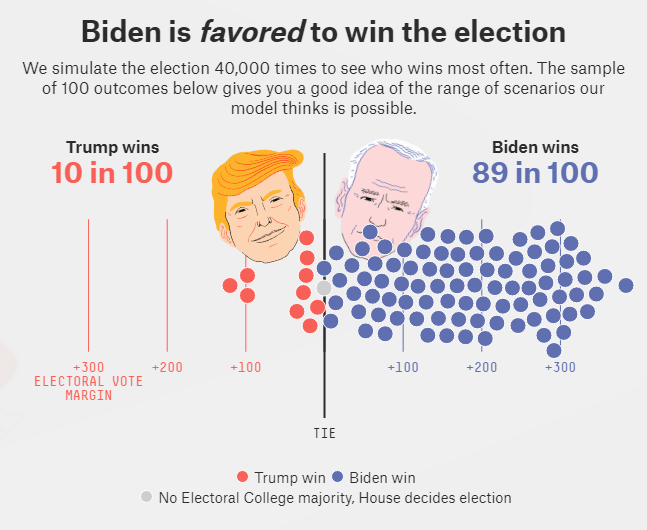

Biden has a commanding lead over Trump in national opinion polls, while races in those closely-fought states are closer. Nevertheless, Nate Silver's FiveThirtyEight gives the former Vice-President an 89% chance of winning.

Source: FiveThirtyEight

The safe-haven dollar is benefiting from uncertainty ahead of the first results, due late on Tuesday.

Later in the day, the ISM Manufacturing PMI is set to show ongoing growth in the sector, with over 55 points. This release is the first hint toward the Non-Farm Payrolls, in a busy week that also consists of a rate decision by the Federal Reserve.

See US October Manufacturing PMI Preview: Eyes on the New Orders Index

All in all, covid and the elections are closely watched.

EUR/USD Technical Analysis

The Relative Strength Index on the four-hour chart is below 30 – indicating oversold conditions and a potential for a bounce. The previous such dip triggered a temporary surge before euro/dollar resumed its falls. Will it happen again?

Support awaits at 1.1625, which was a low point in mid-September. It is followed by that month's trough of 1.1610, and then by 1.1550.

Resistance is at 1.1650, which served as support last week, followed by 1.1695, a temporary cap. The next level to watch 1.1720.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.