US October Manufacturing PMI Preview: Eyes on the New Orders Index

- Manufacturing Index to rise to 55.6 from 55.4.

- Employment Index to fall sharply to 40.9 from 49.6.

- New Orders Index projected to plunge to 45.9 from 60.2

- Currency markets have returned to the US dollar safety-trade.

The manufacturing revival is expected to remain in gear but a dip in new business may herald a slower expansion in in the months ahead.

Business sentiment from Institute for Supply management (ISM) in its Purchasing Managers' Index (PMI) is forecast to edge to 55.6 in October from 55.4 in September.

The August score of 56 was the highest since November 2018 as the US trade dispute with China had ended the expansion long before the pandemic struck in March. The June through September average of 54.6 is the best run for the outlook in manufacturing since the second half of 2018.

New Orders and Employment

Despite the positive attitudes in the overall index the two most important secondary indexes, New Order and Employment show a quickly ebbing expansion. Reading above 50 in the PMI surveys indicate the sector is expanding and below 50 contraction.

The New Orders Index, the gauge of incoming business which had reached a record 67.6 just two month ago in August and then registered a strong 60.2 in September, forecast to drop back into contraction at 45.9 in October.

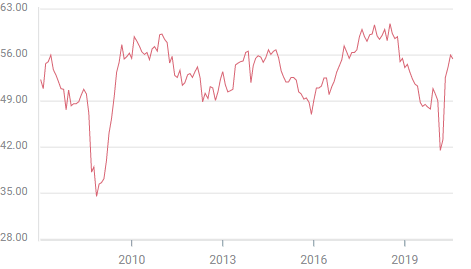

Manufacturing New Orders PMI

Sentiment toward hiring as given in the Employment Index is predicted to retreat to 40.9 in October from 49.6. The shutdown low as 27.5 in April. This index has not been above 50 since July 2019.

Manufacturing leads the economy

Though the manufacturing sector is only about 15% of US GDP it is considered a leading indicator for the overall economy. The longer lead ties for most manufacturing processes and the higher skill level of its workers makes its normal planning horizon year or more in the future. Building a new factory is a half-decade or more project.

The expected declines in New Orders and Employment are a warning that the burst of activity in the third quarter that produced a record 33.1% expansion (annualized rate) may be heading for serious problems in the final three months of the year. The magnitude of the drop in business far greater than the normal cycle during an expansion.

Employment is also set to reverse its gains of the third quarter and with 12 million of the 22 million people laid off in March and April still out of work, any hesitation to hire by factory managers is a serious setback.

Conclusion and markets

Markets have reverted to their early pandemic phase of watching viral case loads in Europe and the United States. While the recent gains in the US dollar have not been as violent or as far-reaching as those in March, they have become the dominant trading motif.

The record amount of new business in August had been a hopefull sign for a powerful recovery.

Between the pandemic focus and the US Presidential Election on Tuesday the potentially distressing data from the Institute will get lost in the news flow and should not elicit a currency market reaction.

It will not, however, be forgotten as the forth quarter unrolls.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.