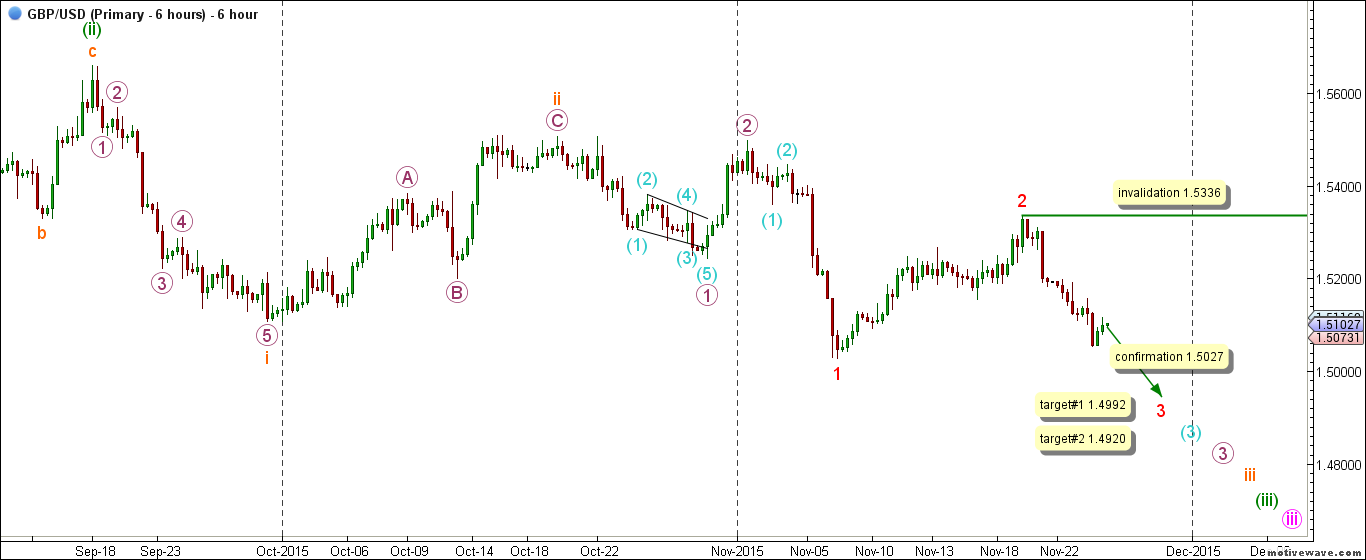

In our previous analysis GBPUSD: Getting Ready For Action! the alternate count expected Cable to unfold towards the upside to complete a second wave correction and Cable unfolded as expected and target was reached and exceeded.

This week`s count expects Cable to resume its downtrend within a third wave impulse.

As always we will wait for confirmation point to be reached to establish confidence in the main count`s view.

Main Count

- Invalidation Point: 1.5336

- Confirmation Point: 1.5027

- Upwards Target: 1.4992 -- 1.4920

- Wave number: 3 red

- Wave structure: Motive

- Wave pattern: Impulse

Elliott Wave chart analysis for the GBPUSD for 24th November, 2015. Please click on the charts below to enlarge.

Main Wave Count

This count expects that primary wave C maroon is unfolding downwards and within it intermediate waves (1) and (2) black might be complete and that intermediate wave (3) black has started unfolding towards the downside.

Within intermediate wave (3) black, it is expected that waves i and ii pink are complete and wave iii pink is underway.

Within wave iii pink is underway with waves (i) and (ii) green complete and wave (iii) green is underway.

Within wave (iii) green it is likely that waves i and ii orange are complete and wave iii orange is at its early stages.

Wave i orange unfolded as an impulse labeled waves 1 through 5 purple.

Wave ii orange unfolded as a zigzag labeled waves A, B and C purple.

Within wave iii orange it is likely that waves 1 and 2 purple are complete and that wave 3 purple is underway.

Wave 1 purple unfolded as a leading diagonal labeled waves (1) through (5) aqua.

Within wave 3 purple it is expected that waves (1) and (2) aqua are complete and wave (3) aqua is subdividing downwards.

Within wave (3) aqua waves 1 and 2 red are complete and wave 3 red is underway.

This count would be confirmed by movement below 1.5027.

At 1.4992 wave iii pink would reach 1.382 of wave i pink which is the next logical target and at 1.4920 wave 3 red would reach equality with wave 1 red.

This count would be invalidated by movement above 1.5336 as within wave 3 red no second wave may retrace more than 100 % of its first wave.

Food For Thought: A deeper look on the hourly chart suggests that a second upwards correction within wave 3 red might be underway before Cable resumes its downtrend. We examined that possibility in detail in today`s daily analysis.

We may also wish to keep an eye on the daily update GBP USD Forecast.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.