EUR/USD Current price: 1.0883

View Live Chart for the EUR/USD

The EUR/USD pair has recovered from a fresh multi-month low set at 1.0833 during the Asian session, initially falling on a strong advance in local share markets. The EU released its September Retail Sales figures earlier today, which fell by 0.1% against the expected rise of 0.2%, maintaining the upside limited in the pair. Nevertheless, the pair trades around its daily high as Pound weakness triggered some EUR demand through the EUR/GBP, but meeting some selling interest around 1.0900. The 1 hour chart shows that the price has advanced above its 20 SMA, whilst the technical indicators head slightly higher above their mid-lines, in line with a continued upward correction, should the pair extend beyond 1.0900. In the 4 hours chart, however, the bearish potential prevails, as the price stands well below a bearish 20 SMA, whilst the technical indicators have turned flat well below their mid-lines after correcting the oversold readings reached earlier in the day.Support levels: 1.0845 1.0815 1.0770

Resistance levels: 1.0920 1.0960 1.1010

GBP/USD Current price: 1.5270

View Live Chart for the GPB/USD

The British Pound plunged after the BOE's monthly economic meeting, against the greenback, as the Central Bank offered a doom inflation outlook. Having left rates and the APP unchanged, the BOE downgraded its inflation and growth forecast, anticipating inflation may get closer to the 2.0% target by 2017. The GBP/USD pair trades near its daily low of 1.5258, and with the 1 hour chart showing that the price is well below a bearish 20 SMA, whilst the technical indicators continue heading south, despite being in oversold levels. In the 4 hours chart, the technical indicators head sharply lower in oversold territory, whilst the price develops below a bearish 20 SMA. Additionally, the price is breaking below a daily ascendant trend line coming from October 1t low at 1.5156, all of which supports a bearish continuation.

Support levels: 1.5250 1.5220 1.5180

Resistance levels: 1.5300 1.5345 1.5390

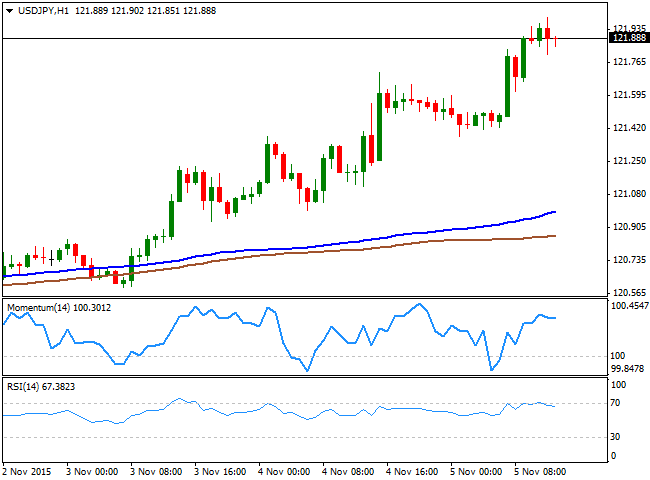

USD/JPY Current price: 121.88

View Live Chart for the USD/JPY

Breaking higher, 122.00 key. The USD/JPY pair surged up to 121.99 early Europe, extending its rally after breaking above its 200 DMA late Wednesday. Currently retreating from the high, the 1 hour chart shows that the price remains well above its 100 and 200 SMAs that slowly aim higher far below the current level, whilst the technical indicators have turned south from near overbought levels, rather reflecting the ongoing bearish correction than supporting further declines. In the 4 hours chart, the technical indicators are also retreating partially from overbought readings, with no actual bearish momentum at the time being. The pair can enter wait-and-see mode for the rest of the day and ahead of the US Nonfarm Payroll report, albeit some follow through beyond the 122.00 figure should see it advancing steadily during the American session, towards the 122.50 region.

Support levels: 121.45 121.15 120.90

Resistance levels: 122.05 122.50 122.90

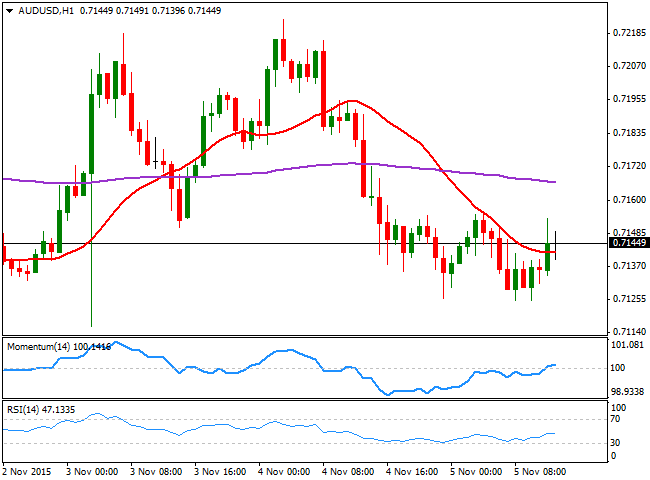

AUD/USD Current price: 0.7148

View Live Chart for the AUD/USD

The AUD/USD pair trades slightly higher daily basis, but confined to an uneventful range below 0.7150. The technical picture is mild positive in the short term, as the 1 hour chart shows that the price holds a few pips above its 20 SMA, whilst the technical indicators aim higher above their mid-lines, but lacking upward potential. In the 4 hours chart, however, the technical indicators are barely correcting higher, but remain well below their mid-lines, whist the 20 SMA stands flat above the current level, limiting changes of further gains.

Support levels: 0.7110 0.7075 0.7030

Resistance levels: 0.7160 0.7195 0.7240

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold price pullback on Fed hawkish tilt amidst lower US yields, weaker US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.