Crude oil price forms ascending triangle after Suez success

The Japanese yen weakened against the US dollar after the mixed economic data from the country. According to the statistics bureau, the country's retail sales dropped by 1.5% in February after falling by 2.4% in the previous month. This decline was better than the median estimate of 2.8%. The country's unemployment rate remained steady at 2.9% while the jobs to applications ratio declined from 1.10 to 1.09. These numbers are better than those in other countries. For example, the US unemployment rate is above 6%.

The price of crude oil was little changed after salvage operators managed to free The Ever Given, the stuck ship at the Suez Canal. The milestone will open the busy canal to more than 300 ships that were blocked last week. It will also return oil transport to normal. Later today, the American Petroleum Institute (API) will release the latest inventories numbers from the US. Last week, the data showed that the number of inventories rose by more than 2.92 million barrels.

The economic calendar will have some important events today. In Europe, the European Commission will publish the latest consumer and business confidence numbers. Analysts expect these numbers to show improved confidence because of the ongoing vaccination drive. In Spain, the statistics office will publish the preliminary consumer inflation number for March. In the United States, the Conference Board will publish the latest consumer confidence data.

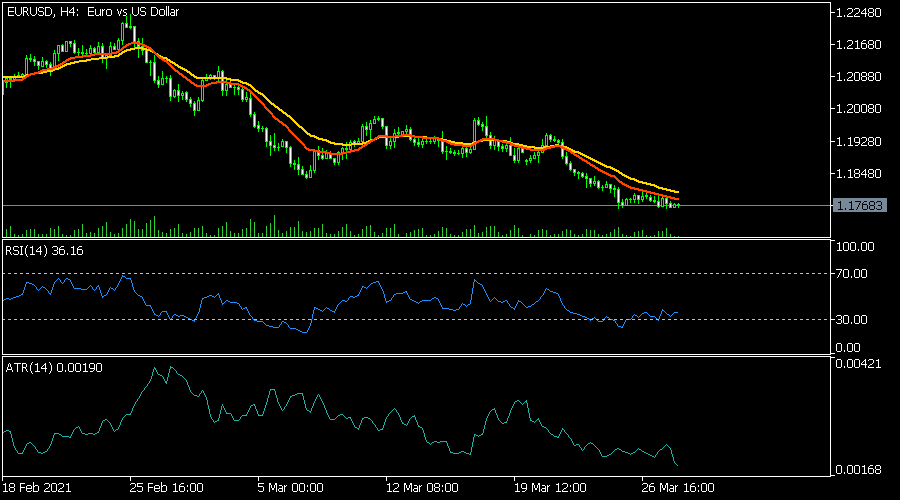

EUR/USD

The EUR/USD pair declined to an intraday low of 1.1765 in the overnight session. On the four-hour chart, this price is below the 25-day and 15-day exponential moving averages (EMA) while the Relative Strength Index (RSI) has moved slightly above the oversold level of 30. The Average True Range (ATR) has also continued to drop. Therefore, the pair may keep falling as bulls target the next key support level at 1.1700.

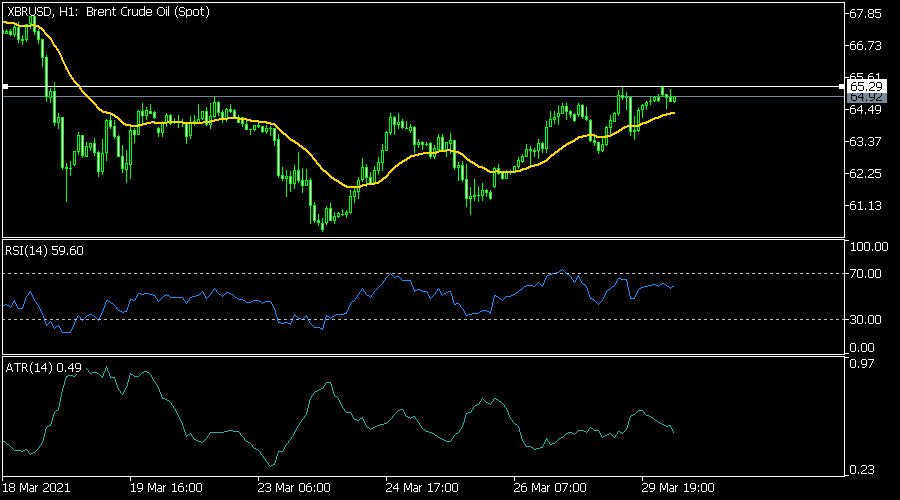

XBR/USD

The XBR/USD pair declined slightly in the Asian and American sessions. It is trading at 64.80, which is slightly below last week's high of 65.30. On the hourly chart, it seems to have formed an ascending triangle pattern. It is also being supported by the short and longer moving averages. Therefore, the pair will likely break out higher and possibly hit the resistance at 66.

USD/JPY

The USD/JPY rose to a multi-month high of 109.97 after the latest data from Japan. The price is slightly above the important resistance level at 109.31 and is slightly above the short and medium-term moving averages. The pair has also moved above the previous bullish flag pattern while the signal and main lines of the Stochastic have continued to rise. Therefore, the pair may keep rising as bulls attempt to move above 110.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.