An analysis of US potential economic growth – Part one

Summary

An economy's long-run sustainable rate of economic growth—the rate at which it can grow over a long period of time at a constant inflation rate—is determined by underlying supply factors, specifically by its labor force growth rate and its underlying rate of labor productivity growth.

The potential rate of economic growth in the United States has trended lower over the past few decades as labor force growth has slowed considerably. Productivity growth has waxed and waned over that period, but it is slower today than it was in the 1950s and 1960s. The Congressional Budget Office estimates that potential economic growth in the United States is only 2.2% per annum today.

Potential economic growth can have important real world consequences. An economy that grows in excess of its potential growth rate for a long enough period of time will likely experience rising inflation. Conversely, an economy that consistently falls short of potential economic growth could experience a downward spiral of falling prices and rising defaults among borrowers.

Furthermore, differences in potential GDP growth compound over time, affecting a country's ability to project economic and military power.

In a series of five reports, we will analyze the outlook for potential economic growth in the United States. We will address U.S. labor force growth in Part II before turning to the two factors that determine growth in labor productivity. Part III will focus on changes in the capital stock while we will discuss total factor productivity in Part IV. We will offer concluding thoughts in Part V.

Potential economic growth is an economy's sustainable rate of real GDP growth

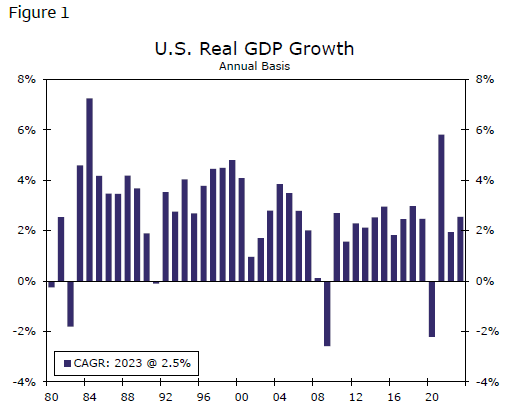

The U.S. economy has grown at a solid rate over the past few years (Figure 1). Real GDP in the United States shot up nearly 6% in 2021, its strongest annual average growth rate since 1984. Of course, this robust rate of real GDP growth in 2021 reflects, at least in part, a rebound from the pandemic-distorted year of 2020. That noted, the 2.5% growth rate that the economy notched in 2023, which was largely free of pandemic-related distortions, was in line with the average per annum growth rate of 2.4% that the U.S. economy registered during the long economic expansion of 2010-2019.

As Figure 1 makes clear, real GDP can grow at essentially any rate in any given year due to changes in economic policies and shocks (e.g., pandemics, natural disasters, wars, etc.). But an economy's long-run sustainable rate of economic growth—the rate at which it can grow over a long period of time at a constant inflation rate—is determined by underlying supply factors. Economic theory posits that this so-called “potential rate of economic growth” is determined by growth in an economy's labor force and its underlying (i.e., secular) rate of productivity growth.1 That is, an economy can potentially produce more goods and services if it has more workers to do so. Even if the labor force is not growing, an economy can potentially produce more goods and services if each worker can produce more. It is important to note than an economy's potential economic growth rate is not directly observable as its GDP growth rate is during any quarter. Although labor force growth is readily observable, productivity growth must be estimated as the difference between growth in output and growth in aggregate hours worked. The implied rate of productivity growth can be volatile on a quarter-by-quarter basis, and past estimates of productivity growth are often revised considerably. Therefore, an economy's underlying productivity growth rate must be estimated.

Author

Wells Fargo Research Team

Wells Fargo