- China's manufacturing economy has started to emerge from a draconian COVID-19 lockdown

- Chinese Non-Manufacturing PMI will be closely observed by the markets, expecting a big recovery number.

Chinese Non-Manufacturing PMI and NBS Manufacturing PMI, both for March, are due today at 0100GMT. This data will be the first since China started to emerge from the peak of the COVID-19 epidemic and a draconian lockdown. Both PMIs are expected to rebound substantially, as Febusrays was not a high bar to cross and considering conditions are on the path to gradually revert to their normal trend.

Expectations

- Manufacturing expected 44.8% MoM, prior 35.7%

- Non-manufacturing expected 42.0% YoY, prior 29.6%

- Composite prior 28.9.

PMI figures, which are calculated with data from monthly surveys of private sector companies, are considered as a key indicator of a county's economic health. China makes up a third of world manufacturing and is the world's largest exporter and the restrictions in place in the so-called "factory of the world" harmed companies such as Apple, Diageo and major auto industry names which rely on China's production and consumer market. This data will paint an outlook for global trade and the health of the economy once the world emerges out from the COVI-19 crisis, hence, today's data could be a market mover.

The Chinese economy experienced a difficult 2019 due to the impact of the Sino-US trade war which equated to slowing consumption and no matter how soon China gets back to work, it is expected that economic growth will take a significant hit in the first half of this year. However, it should be recalled that although Hubei Province has been the epicentre that accounted for over 70% of the confirmed cases, the impact on the entire Chinese manufacturing industry will have been limited as its share in the country’s manufacturing industry is small.

Positively, however, we have started to see much better activity in March which will be reflected in today's data. Last month, factory activity in China fell at a record rate with manufacturers closed in order to contain the spread of coronavirus. The country's official measure of manufacturing activity - the Purchasing Manager's Index (PMI) - dropped to 35.7 from 50 in January.

How will the data affect the markets?

A focus will be with commodities, (metals and oil in the main) global equities, (cash and futures, (the ASX 200 rebounded very sharply yesterday, with its 7.0% gain the largest on record)), and the FX space. AUD is the proxy to this data.

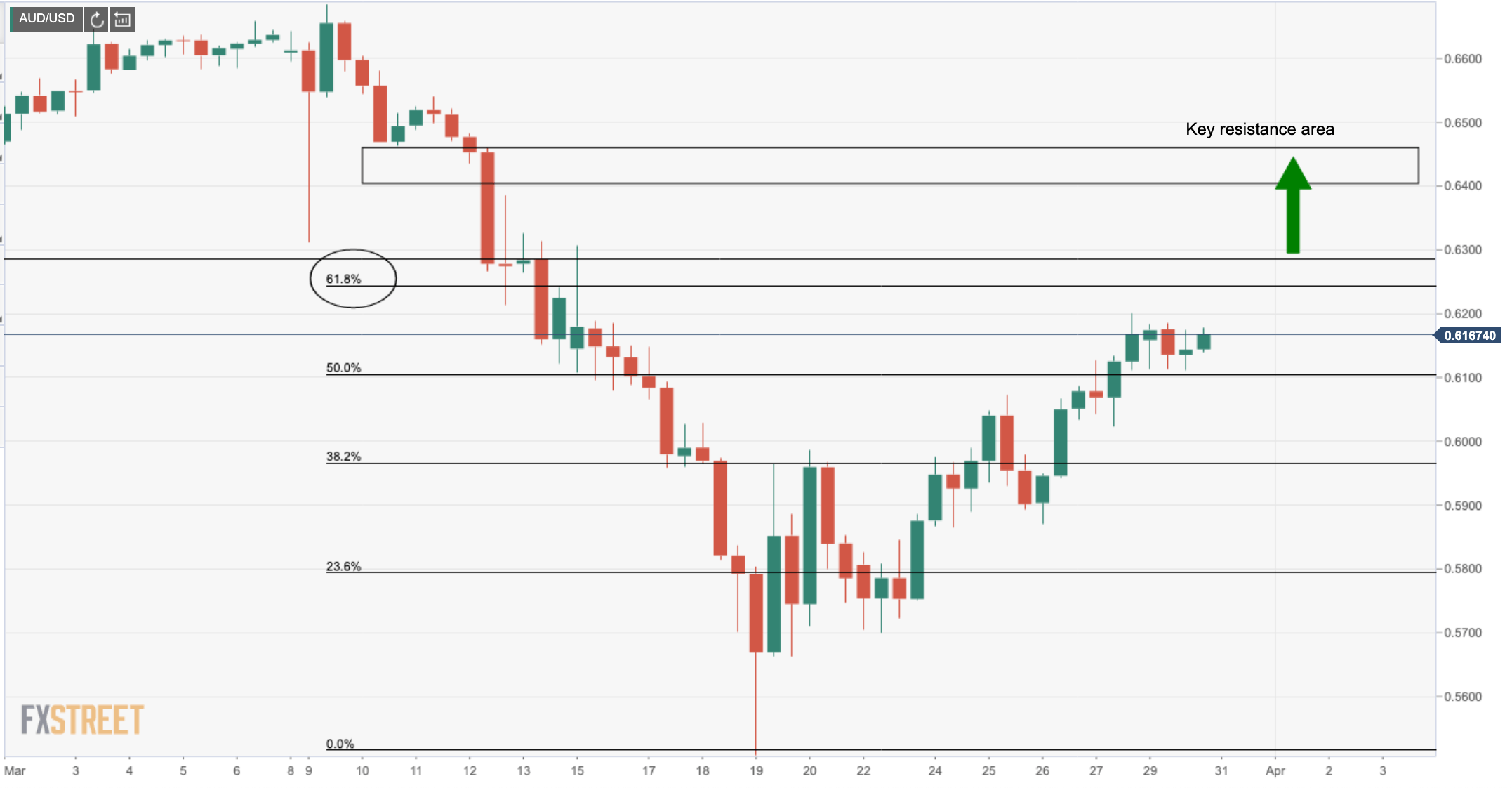

we are yet to see how tuned in FX is to economic data considering the array of stimulus measures implemented by governments and banks to battle against the invisible enemy. Investors will be twice shy about entering long of an instrument in the face of higher fluid COVID-19 risks. On the other hand, considering how AUD has begun to correct, a nudge from the data which could positively impact commodities, (CRB index needs a booster), bulls could find that they have a green light to chase down upside targets beyond 0.6230 (a 61.8% Fibonacci of the March drop) with sights on a 78.6% and a confluence of support at 0.6430:

Overall, the manufacturing industry is one of those with large numbers of workers and will face great challenges. After the wave of resumption of work, labour-intensive manufacturing will face a higher uncertainty because of the epidemic.

While we expect to see an improvement today, the big question now is how a large number of people returning to work from their hometowns all over China will play out considering the increased mobility of people and the increased density of people in public places. This experiment serves to risk the potential spread of the epidemic again, but for the sake of the global economy, the world has little choice. One thing we can count on is that pollution will be back, so enjoy those blue winter skies in China while you still can.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.