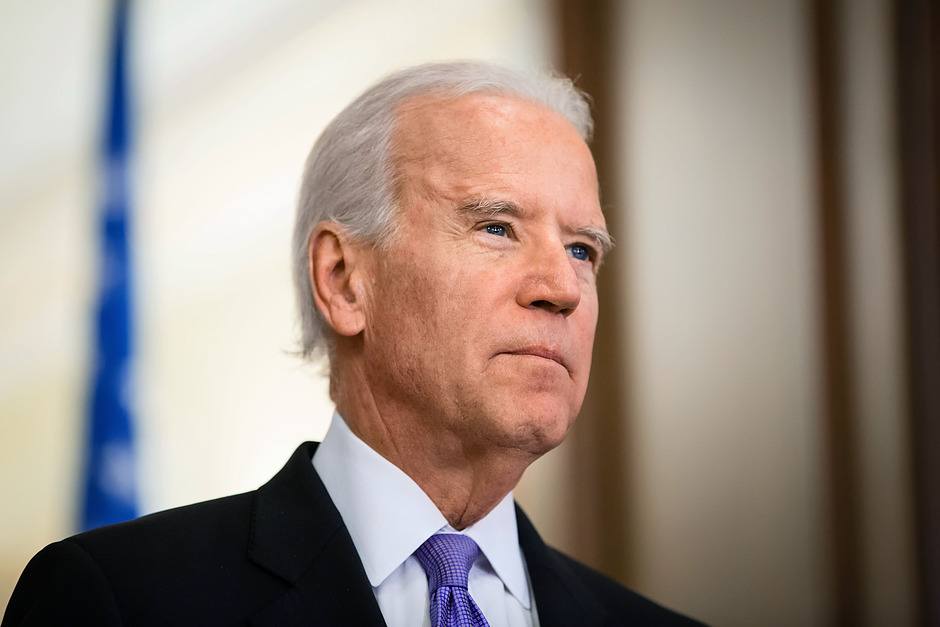

Biden says cause was Ukraine air defense missile system

EU Mid-Market Update: NATO holds emergency on Polish missile incidence; Biden says cause was Ukraine air defense missile system; UK inflation at fresh 41-year high.

Notes/Observations

- US Pres Biden confirms Poland missile strike was caused by Ukrainian air defense missile, according to a NATO source, alleviating fears of intentional escalation by Russia. Russia denies involvement in the strike.

- European Aerospace and Defense equity sector receives bid tailwind in light of recent Poland events.

- UK Oct CPI hits 41-year high of 11.1% YoY, in line with BOE 'peak' projections and ahead of Autumn Budget Statement tomorrow where major tax rises and spending cuts are expected. ONS analysis indicates majority of weighting came from household energy bills and projected that without the energy price cap, the reading would have been 13.8%. However, broadening of inflation seen as food and household furniture rises 10%. GBP/USD roughly 20% higher off Sept record lows following 'Mini Fiscal Budget' saga.

- Asia closed mixed with Shanghai Composite underperforming at -0.5%. EU indices are mostly lower with FTSE100 exception at +0.2%. US futures are +0.2%. Gold +0.6%, DXY -0.4%; Commodity: Brent +0.6%, WTI +0.3%, UK Nat Gas -5.7%; Crypto: BTC -0.2%, ETH -2.0%.

Asia

- China Oct New Home Prices fall for the 14th straight month with annual rate -1.6% was fastest pace of decline in the last 7 years (M/M: -0.4% v -0.3% prior; Y/Y: -1.6% v -1.5% prior.

- Reports circulated that PBOC said to potentially cut the Loan Prime Rate (LPR) to stabilize the economy.

Ukraine conflict

- Poland Foreign Min: Russia produced rocket has fallen on a Polish Village at 15:40 local time; Summoned Russian Ambassador.

- NATO ambassadors to hold emergency meeting regarding Russia and recent rocket hitting inside Poland.

- President Biden says the trajectory of the missile showed it is unlikely it was fired from Russia but they would investigate.

- G20 communique: We deplore in strongest terms Russian aggression against Ukraine; Most members strongly condemned the war but there were other views.

Americas

- Donald Trump officially announced he is running for President for the 2024 elections.

Energy

- Weekly API Crude Oil Inventories: -5.8M v +5.6M prior.

Speakers/fixed income/FX/commodities/erratum

Equities

Indices [Stoxx600 -0.61% at 431.80, FTSE +0.18% at 7,382.76, DAX -0.76% at 14,269.63, CAC-40 -0.23% at 6,626.52, IBEX-35 -0.91% at 8,113.57, FTSE MIB -0.40% at 24,600.00, SMI -0.62% at 10,957.70, S&P 500 Futures +0.19%].

Market Focal Points/Key Themes: European indices open generally mixed but drifted lower through the early part of the session; sectors trending higher include energy and financials; sectors trending lower include consumer discretionary and industrials; oil & gas subsector supported following a surge in crude prices; UK CMA accepts remedies in Carpinter/Recticel deal allowing it to move forward;focus on press conferences by leaders in sidelines of G20 meeting; earnings expected in the upcoming US session include Lowes, Target, and TJX.

Equities

- Consumer discretionary: Air France-KLM [AF.FR] -10% (convertibles offering).

- Energy: Siemens Energy [ENR.DE] +5.5% (earnings), Tullow Oil [TLW.UK] -0.5% (earnings).

- Healthcare: Biocartis [BCART.BE] -15% (rights offering).

- Industrials: Alstom [ALO.FR] +2.5% (earnings), Experian [EXPN.UK] +2.5% (earnings), Rheinmetall [RHE.DE] +1% (CMD; contract; Poland incident), Nel [NEL.NO] +1% (GM partnership).

- Utilities: SSE plc [SSE.UK] -1.5% (earnings).

Speakers

- ECB Bi-annual Financial Stability Review noted that risks were on the rise as the economy headed for a likely recession, banking sector might need to build up provisions.

- ECB’s De Guindos (Spain) stated that tended to always see collateral scarcity towards year-end. Difficult to have financial stability without price stability.

- ECB’s Centeno (Portugal): Inaction on inflation is not an option.

- Chancellor of the Exchequer (Fin Min) Hunt stressed that could not have long-term sustainable growth with high inflation. Govt duty to help BOE achieve its inflation target by acting responsibly with the country's finances (**Note: On Nov 17th, UK will deliver the Autumn Statement).

- UK PM Sunak stated that his number one priority was the economy and tackle inflation.

- Japan govt said to be considering increasing corporate and other taxes to fund additional defense spending.

Currencies/fixed income

- USD eased during the session and did not encounter much safe-haven flows despite some initial panic eases amid doubts about where rocket came from that hit inside Poland. NATO was meeting on the incident.

- UK inflation rose more than expected to a 41-year high of 11.1%, putting further strain on household budgets already at breaking point. Cable roughly steady at 1.1880 area with focus turning to Thursday’s budget speech by Fin Min Hunt.

Economic Data

- (UK) Oct CPI M/M: 2.0% v 1.8%e; Y/Y: %11.1 v 10.7%e (highest annual pace since Oct 1981); CPI Core Y/Y: 6.5% v 6.4%e; CPIH Y/Y: 9.6% v 93%e.

- (UK) Oct RPI M/M: 2.5% v 1.9%e; Y/Y: 14.2% v 13.6%e; RPI-X (ex-mortgage Interest Payments) Y/Y: 13.9% v 13.2%e; Retail Price Index: 356.2 v 354.1e.

- (UK) Oct PPI Input M/M: 0.6% v 0.3%e; Y/Y: 19.2% v 18.1%e.

- (UK) Oct PPI Output M/M: 0.3% v 0.5%e; Y/Y: 14.8% v 14.6%e.

- (CZ) Czech Oct PPI Industrial M/M: 0.6% v 0.5%e; Y/Y: 24.1% v 24.3%e.

- (IT) Italy Oct Final CPI M/M: 3.4% v 3.5% prelim; Y/Y: 11.8% v 11.9% prelim; CPI Index (ex-tobacco): 117.2 v 113.5 prior.

- (IT) Italy Oct Final CPI Harmonized M/M: 3.8% v 4.0% prelim; Y/Y: 12.6% v 12.8% prelim.

- (UK) Sept ONS House Price Index Y/Y: 9.5% v 9.8%e.

Fixed income issuance

- (IN) India sold total INR220B vs. INR220B indicated in 3-month, 6-month and 12-month bills.

- (DK) Denmark sold total DKK2.2B in 2024 and 2031 DGB Bonds.

- (SE) Sweden sold SEK2.0B vs. SEK2.0B indicated in 1.75% 2033 Bonds; Avg Yield: 2.0050% v 2.2300% prior, bid-to-cover: 4.33x v 3.80x prior.

Looking ahead

- 05:25 (EU) Daily ECB Liquidity Stats.

- 05:30 (DE) Germany to sell 1.0% May 2038 Bunds.

- 05:30 (PT) Portugal Debt Agency (IGCP) to sell 6-month and 12-month bills.

- 05:30 (ZA) South Africa announces details of next bond auction (held on Tuesdays).

- 06:00 (IE) Ireland Sept Property Prices M/M: No est v 1.3% prior; Y/Y: No est v 12.2% prior.

- 06:00 (ZA) South Africa Sept Retail Sales M/M: -0.6%e v -1.8% prior; Y/Y: 1.0%e v 2.0% prior.

- 06:00 (IL) Israel Q3 Advance GD) (1st reading) Y/Y: 1.6%e v 6.9% prior.

- 06:00 (RU) Russia OFZ Bond auction (if any).

- 06:45 (US) Daily Libor Fixing.

- 07:00 (US) MBA Mortgage Applications w/e Nov 11th: No est v -0.1% prior.

- 07:00 (UK) Weekly PM Question time in House.

- 07:45 (FR) ECB’s Villeroy (France).

- 08:00 (PL) Poland Oct CPI Core M/M: 1.0%e v 1.4% prior; Y/Y: 11.1%e v 10.7% prior.

- 08:00 (UK) Daily Baltic Dry Bulk Index.

- 08:15 (CA) Canada Oct Annualized Housing Starts: 275.0Ke v 299.6K prior.

- 08:30 (US) Oct Advance Retail Sales M/M: 1.0%e v 0.0% prior; Retail Sales (Ex-Auto) M/M: 0.5%e v 0.1% prior; Retail Sales (ex-auto/gas): 0.2%e v 0.3% prior; Retail Sales (control group): 0.3%e v 0.4% prior.

- 08:30 (US) Oct Import Price Index M/M: -0.4%e v -1.2% prior; Y/Y: 4.2%e v 6.0% prior; ; Import Price Index (ex- petroleum) M/M: -0.8%e v -0.5% prior.

- 08:30 (US) Oct Export Price Index M/M: -0.2%e v -0.8% prior; Y/Y: 7.1%e v 9.5% prior.

- 08:30 (CA) Canada Oct CPI M/M: 0.8%e v 0.1% prior; Y/Y: 6.9%e v 7.0% prior; CPI Core- Common Y/Y: 5.9%e v 6.0% prior; CPI Core- Median Y/Y: 4.8%e v 4.7% prior; CPI Core- Trim Y/Y: 5.3%e v 5.2% prior; Consumer Price Index: 153.6e v 152.7 prior.

- 09:15 (US) Oct Industrial Production M/M: 0.1%e v 0.4% prior; Capacity Utilization: 80.4%e v 80.4% prior; Manufacturing Production: 0.2%e v 0.4% prior.

- 09:15 (UK) BOE Gov Baily with members Mann, Dhingra testify at Treasury Select Committee.

- 09:50 (US) Fed’s Williams.

- 10:00 (US) Sept Business Inventories: 0.5%e v 0.8% prior.

- 10:00 (US) Nov NAHB Housing Market Index: 36e v 38 prior.

- 10:00 (US) Fed’s Barr.

- 10:00 (EU) ECB chief Lagarde.

- 10:00 (IT) ECB’s Panetti (Italy).

- 10:30 (US) Weekly DOE Oil Inventories.

- 11:00 (RU) Russia Q3 Advance GDP (1st of 3 readings) Y/Y: -4.7%e v -4.1% prior.

- 11:30 (US) Treasury to sell 17-Week Bills.

- 13:00 (US) Treasury to sell 20-Year bonds.

- 14:00 (AR) Argentina Sept Capacity Utilization: No est v 69.5% prior.

- 14:35 (US) Fed’s Walle.

- 16:00 (US) Sept Net Long-Term TIC Flows: No est v $197.9B prior; Total Net TIC Flows: No est v $275.6B prior.

- 16:45 (NZ) New Zealand Q3 PPI Input Q/Q: No est v 3.1% prior; PPI Output Q/Q: No est v 2.4% prior.

- 18:50 (JP) Japan Oct Trade Balance: -¥1.620Te v -¥2.094T prior; Adj Trade Balance: -¥1.951Te v -¥2.010T prior; Exports Y/Y: 29.3%e v 28.9% prior; Imports Y/Y: 50.0%e v 45.7% prior (revised from 45.7%).

- 19:30 (AU) Australia Oct Employment Change: +15.0Ke v 0.9K prior; Unemployment Rate: 3.5%e v 3.5% prior; Full Time Employment Change: No est v 13.3K prior; Part Time Employment Change: No est v -12.4K prior; Participation Rate: 66.6%e v 66.6% prior.

- 19:30 (SG) Singapore Oct Non-Oil Domestic Exports M/M: -2.5%e v -4.0% prior; Y/Y: -1.7%e v +3.1% prior; Electronic Exports Y/Y: No est v -10.6% prior.

- 20:00 (CN) China Oct Swift Global Payments (CNY): No est v 2.44% prior.

- 22:30 (JP) Japan to sell 12-Month Bills.

- 22:35 (JP) Japan to sell 20-Year Bonds.

- 23:00 (MY) Malaysia Sept Trade Balance (MYR): 29.9Best v 31.7B prior; Exports Y/Y: 24.7%e v 30.1% prior; Imports Y/Y: 30.8%e v 33.0% prior.

Author

TradeTheNews.com Staff

TradeTheNews.com

Trade The News is the active trader’s most trusted source for live, real-time breaking financial news and analysis.