Next week we get personal income and consumption data, meaning the PCE deflator, too

Outlook

We get no US data of real weight today, but we do start getting Fed speeches and more of the endless talk about the 50 bp cut. A lot of analysts are saying a lot of seemingly smart things, but while perhaps true, not useful. We already know the Fed’s stance—it thinks the data justifies not only the 50 bp already under the belt, but also another series of cuts going into 2025.

Trump complains the big rate cut was politically motivated, but nearly all economists can make the case that 50 bp was justified on the data. The problem with the data is that like Mother Nature, it can turn around and bite. Most economists point that out, and Mr. Powell gave it a place, too.

Tidbit: Romanchuk in the BondEconomics newsletter delivers the skeptic’s point of view perfectly: “I am still somewhat skeptical that the rate cut campaign will be sustained in the absence of a recession. I am not in a position to opine on recession odds. It is clear that the Powell Fed has concerns with the utility of the Fed’s models, and so rate cuts would be based more on vibes than following some rigid Taylor Rule concept. I would expect moderate cuts to some round number, a declaration of victory over deceleration, and then a return to “wait and see” mode.”

Forecast

Today is square-up Friday and next week is month-end and quarter-end, implying even more squaring up, er, “consolidation.” This will likely favor the dollar but may be misleading. Next week we get personal income and consumption data, meaning the PCE deflator, too. It’s forecast down to 2.3% from 2.5%, vindicating the Fed, but with the core likely the same or up a hair from 2.6% to 2.7%, casting doubt.

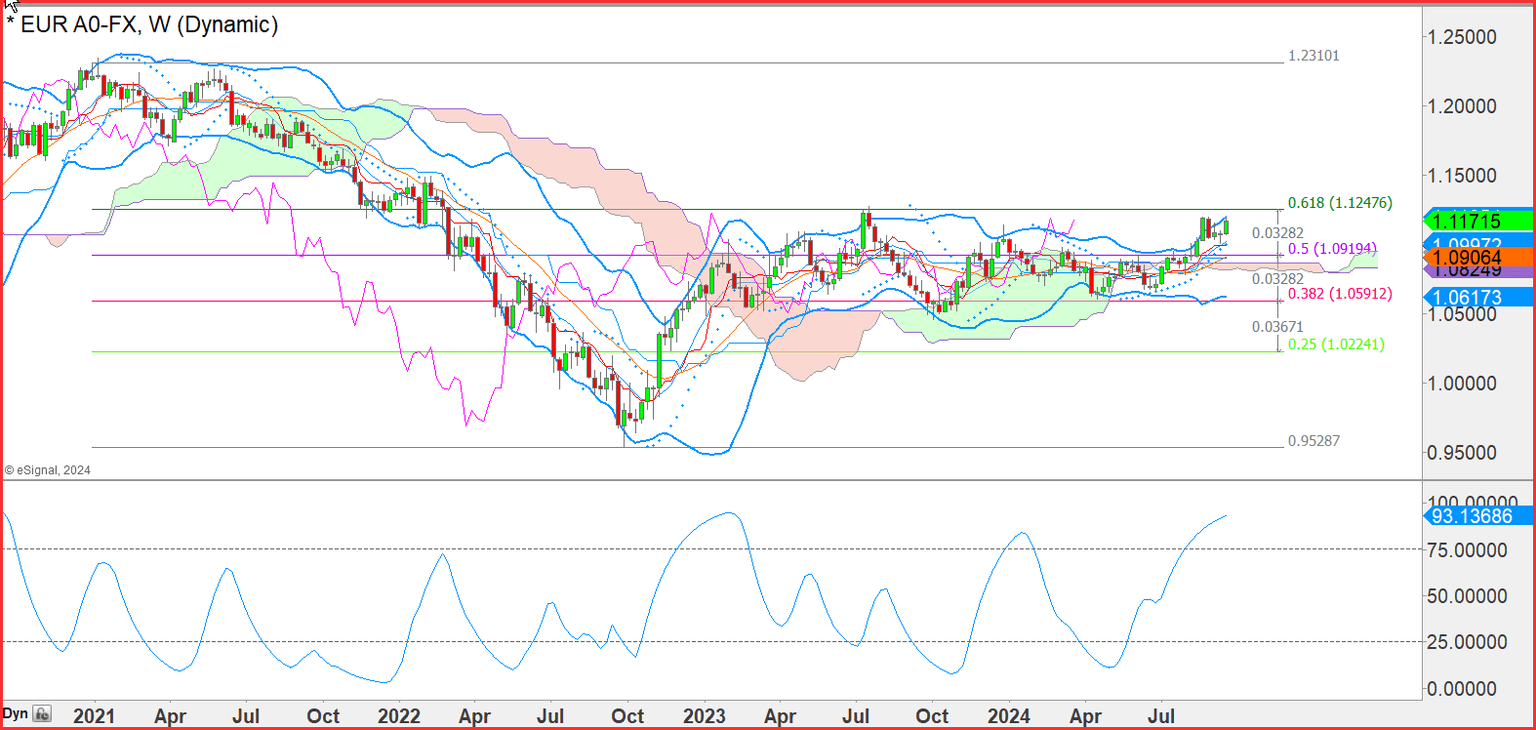

The standard viewpoint is being tested—that a giant rate cut automatically means a drop in the currency. It ain’t necessarily so. The BoE declined to cut but sterling rallied anyway on good data. We see serious doubt in the charts that the euro, for one, will surpass previous highs and make it over 1.1250.

Just for kicks, see the weekly euro chart. The previous high is 1.1276 from July 2023, close to the 62% retracement level. Will we see it again? Coin-toss.

Political Tidbit: Yesterday the Washington Post published its own poll of “likely and registered voters” showing Harris has 48% of the vote and Trump, 47%. :After excluding minor candidates, Harris and Trump are both at 48 percent among likely voters, with Harris at 48 percent and Trump at 47 percent among registered voters.” Even Fox “News” had a poll showing Harris ahead by 2 points. Reuters has 5 points--47% Harris vs. 42% Trump. Still, everyone notes polls are not elections especially with the dreadful electoral college that gives the power to seven states.

Trump is out charging cheating but doesn’t have a new attention-grabbing lie. Instead he is going to the Ohio town, whose mayor and state governor have loudly said please don’t come-the town already has daily bomb threats from Trumpies, where the Haitian immigrants are not illegal and not eating the cats.

As the preaching-to-the-choir commentators on CNN and MSNBC bring up quite often, the economy and the stock market do better under Dem presidencies than Republican ones. This ignores the lag factor, but never mind. As for the deficit, the only presidents to cut it since the war are all Dems, too (comment not fact-checked). Thanks to a clever Reader for this. We are tempted to show the one of the Trump voodoo dolls, but no, not dignified.

You’d think the Dem candidates might bring it up instead of promising child care. They should also make a Big Deal of tariffs NOT being paid by China and other exporters but rather by the consumer. Everyone is laughing at Trump promising a return of the deductibility of state taxes from federal tax returns—something he himself removed in 2017. Now if only the Republican voter would listen.

The vice presidential debate will be Oct 1, when the government may be shutting down because the Republicans couldn’t pass their own bill. Given our history with this shameful thing, nobody in finance is taking it seriously as a risk-maker.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat