Pound Sterling falls against USD with thin trading volume on Thanksgiving Day

- The Pound Sterling falls to near 1.2660 against the USD as the latter bounces after plunging on Wednesday.

- Market speculation for the Fed to cut interest rates in December has increased.

- BoE’s Lombardelli supports reducing interest rates gradually amid risks of inflation overshooting the bank’s target.

The Pound Sterling (GBP) dropsto near 1.2660 against the US Dollar (USD) in Thursday’s North American session after failing to visit the round-level resistance of 1.2700 the prior day. The GBP/USD pair is expected to trade sideways amid thin trading volume as United States (US) markets are closed on Thursday and will open for a short duration on Friday on account of Thanksgiving Day.

The US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, bounces back to near 106.40 after a sharp sell-off on Wednesday. The USD plunged as investors trimmed the so-called “Trump Trades” with the intention to go light in an extended weekend.

The Greenback was also pressured by weak Durable Goods Orders data for October. New orders for Durable Goods grew by 0.2% in the month, slower than the estimates of 0.5%. Meanwhile, the Personal Consumption Expenditures Price Index (PCE) report for October showed that price pressures rose in line with estimates. The core PCE inflation data – which excludes volatile food and energy prices – rose by 2.8%, as expected, faster than 2.7% in September.

An expected increase in the US PCE inflation data has boosted market expectations for the Fed to cut interest rates by 25 basis points (bps) again in the December meeting. At the time of writing, there is a 68% chance that the Fed will cut its key borrowing rate by 25 bps to the 4.25%-4.50% range next month, escalated from 56% a week ago, according to the CME FedWatch tool.

Going forward, investors will focus on the US ISM Manufacturing Purchasing Managers Index (PMI) data for November, which will be published on Monday. The economic data will show the current status of activities in the manufacturing sector.

Daily digest market movers: Pound Sterling edges higher as BoE seems to follow gradual policy-easing approach

- The Pound Sterling ticks up against its major peers on Thursday. The British currency edges higher but is expected to trade sideways as the United Kingdom (UK) economic calendar has nothing to offer in the later part of the week.

- The performance of the Pound Sterling has remained strong against its peers for a few weeks, except the US Dollar, on expectations that the Bank of England (BoE) will be one of those central banks that will follow a gradual policy-easing approach due to persistent upside risks to inflation.

- BoE Deputy Governor Clare Lombardelli warned about risks of inflation remaining higher than the bank’s forecast where wage growth normalizes at 3.5%-4% and the Consumer Price Index (CPI) around 3% rather than 2% in her speech at King's Business School on Monday. Lombardelli added, “I support a gradual removal of monetary policy restriction.”

- Going forward, the Pound Sterling will be guided by market speculation about whether the BoE will cut interest rates in the December meeting. Traders are highly confident that the central bank will leave its key borrowing rates unchanged at 4.75% next month.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.29% | 0.10% | 0.32% | -0.07% | 0.00% | 0.17% | 0.20% | |

| EUR | -0.29% | -0.21% | 0.02% | -0.36% | -0.30% | -0.12% | -0.10% | |

| GBP | -0.10% | 0.21% | 0.21% | -0.16% | -0.09% | 0.07% | 0.10% | |

| JPY | -0.32% | -0.02% | -0.21% | -0.38% | -0.30% | -0.19% | -0.12% | |

| CAD | 0.07% | 0.36% | 0.16% | 0.38% | 0.08% | 0.23% | 0.26% | |

| AUD | -0.01% | 0.30% | 0.09% | 0.30% | -0.08% | 0.16% | 0.21% | |

| NZD | -0.17% | 0.12% | -0.07% | 0.19% | -0.23% | -0.16% | 0.03% | |

| CHF | -0.20% | 0.10% | -0.10% | 0.12% | -0.26% | -0.21% | -0.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Technical Analysis: Pound Sterling faces resistance near 1.2700

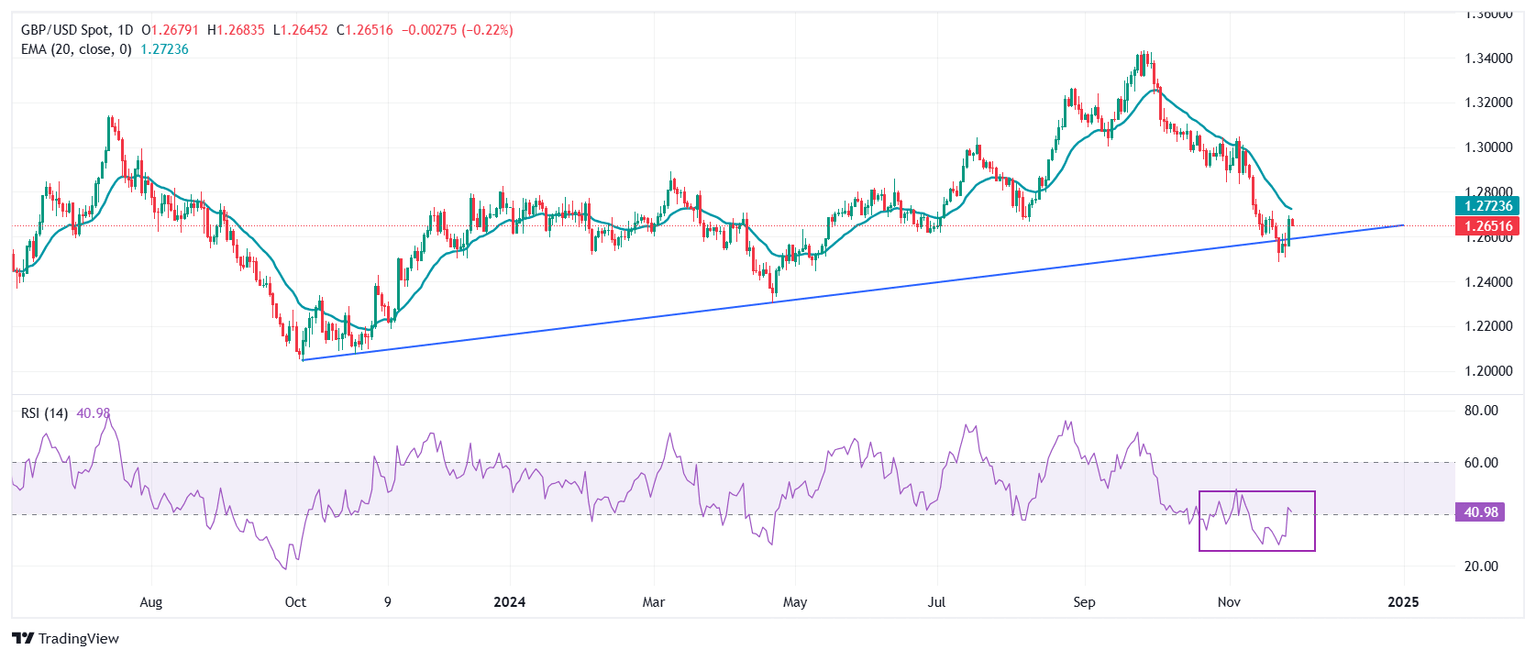

The Pound Sterling falls to near 1.2650 against the US Dollar in European trading hours on Thursday. The GBP/USD pair corrects after posting a fresh weekly high near 1.2700 the prior day. The recovery move in the Cable came after it found buying interest near the upward-sloping trendline around 1.2550, which is plotted from the October 2023 low around 1.2040.

The 14-day Relative Strength Index (RSI) rebounds after turning oversold. However, the downside bias remains afloat.

Looking down, the pair is expected to find a cushion near the psychological support of 1.2500. On the upside, the 20-day Exponential Moving Average (EMA) around 1.2725 will act as key resistance.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.