US Dollar flat in very calm trading Thursday with Thanksgiving holiday keeping US markets closed

- The US session sees several assets remain closed for trading this Thursday.

- France's budget talks are risk of concern for investors, triggering some safe haven flow from Euro into US Dollar.

- The US Dollar Index trades back above 106.00, bouncing off Wednesday's support.

The US Dollar (USD) trades in a tight range with most US participants at home enjoying the US bank holiday, with the US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, bouncing back above 106.00 after a sharp sell-off the prior day. The US trading time zone will be even more calm for the rest of the week with Thanksgiving and Black Friday taking place. Thin liquidity and most major trading floors will be closed across the United States.

Meanwhile, the focus shifts to Europe, where France is struggling to convince markets it can pass its much-needed budget after France’s Prime Minister, Michel Barnier, warned that mayhem could take place in financial markets if the French parliament does not support the budget bill with the possibility that the French government could fall, Bloomberg reports.

Daily digest market movers: Only headline risk ahead

- Recent European inflation figures out of Germany are confirming the possibility of a 25 basis points (bps) rate cut from the European Central Bank in its December meeting. Odds for a 50 bps rate cut have diminished to a near nil possibilty.

- The US economic calendar will be empty on Thursday and Friday due to the Thanksgiving holidays.

- Equities are trading in the green overall this Thursday. European indices are up nearly 1%, while US futures are flat to marginally higher on the day.

- The CME FedWatch Tool is pricing in another 25 basis points (bps) rate cut by the Fed at the December 18 meeting by 68.2%. A 31.8% chance is for rates to remain unchanged. The Fed Minutes have helped the rate cut odds for December to move higher.

- The US 10-year benchmark rate trades at 4.26%, and will not move this Thursday with the US bond market being closed.

US Dollar Index Technical Analysis: Europe concerns drive markets

The US Dollar Index (DXY) might be moving in the coming two days due to some outside forces. One driver could come from the Eurozone, where France’s budget hangs in the balance. Should the balance not pass Parliament, France’s yields and spreads with other European countries could get out of control and trigger uncertainty for the Eurozone and the Euro (EUR), thus making the US Dollar (USD) outperform the shared currency.

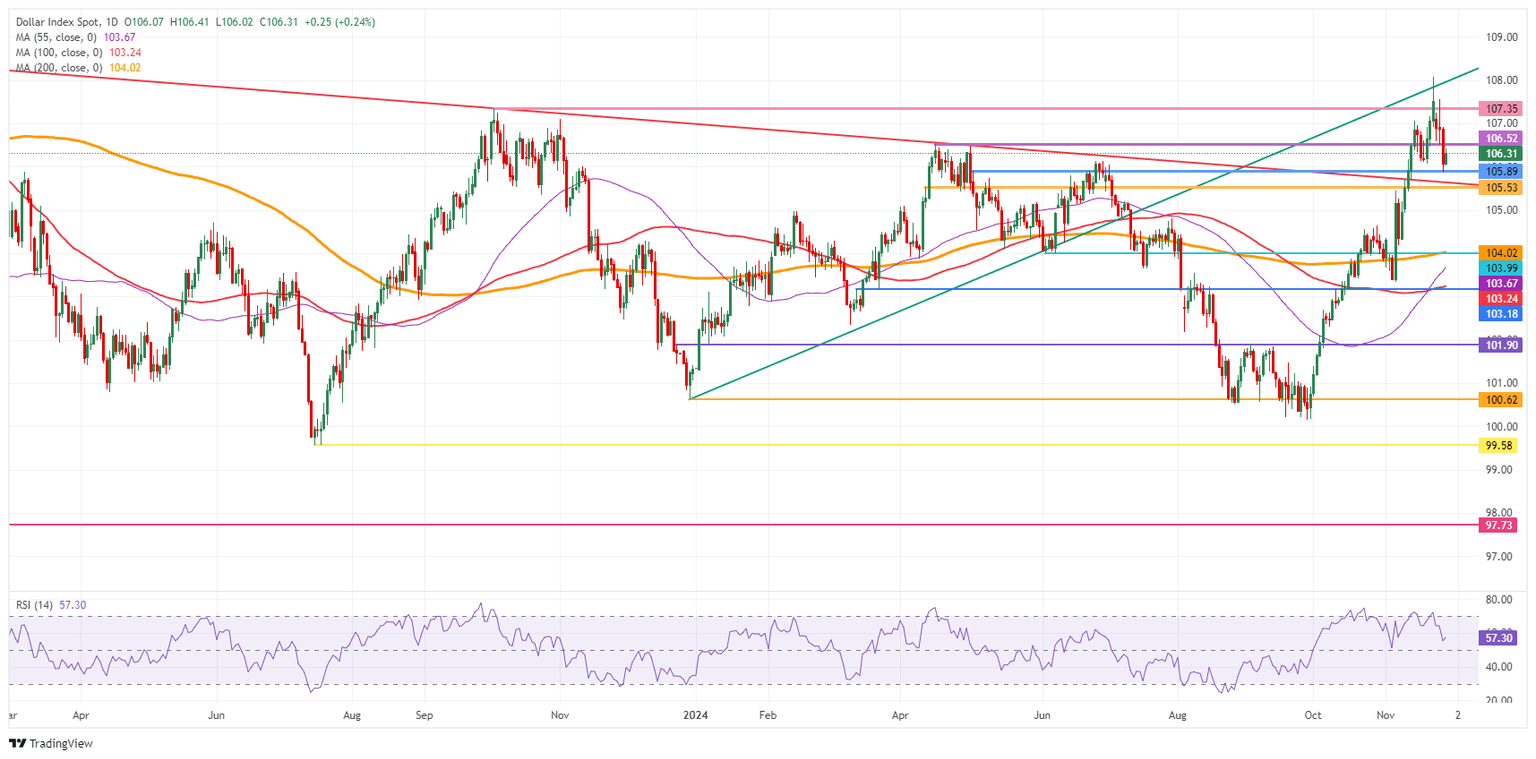

With the profit taking this week, the pivotal resistance of 107.35 (October 3, 2023, high) became active again. The fresh two-year high at 108.07 reached last Friday is the level to beat further up. A brief spike to the 109.00 big figure level could play out in a volatile moment.

The DXY is bouncing off from 105.89, a pivotal level since May 2, which was held under profit-taking pressure on Wednesday. A touch lower, the pivotal 105.53 (April 11 high) should avoid any downturns towards 104.00. Should the DXY fall all the way towards 104.00, the big figure and the 200-day Simple Moving Average at 104.02 should catch any falling knife formation.

US Dollar Index: Daily Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.