XRP price has bullish undertones despite the market-wide crash

- XRP price is coming into the buyers' territory on the 2-day chart.

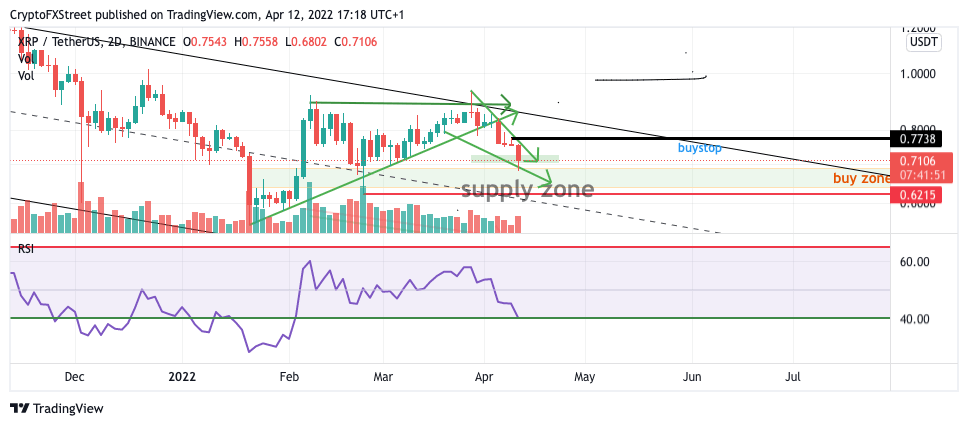

- XRP price looks like an ending diagonal.

- Invalidation of the bullish setup will be a close below $0.62.

XRP price is off with the rest of the crypto market. However, there are a few reasons to believe in a bounce at these levels.

XRP price will bottom eventually

XRP price is currently trading at $0.70, hovering exactly where analysts forecasted it to fall on April 4th. Now that the XRP price has validated the bearish thesis, traders should keep their eyes on the digital remittance token for early signs of a bottom.

Ripple price has added bullish confluence based on the Relative Strength Index, as it is currently falling into ideal buyers' territory. The safest bullish trade setup will be to place a buy stop at the previous consolidation level at $0.78 with a stop loss at the swing low, looking for a significant 30% reversal rally back to $0.93 to commence for XRP price in the coming weeks.

Riskier traders could look for buy signals at the current levels like hammers and bullish engulfing candles and, if they occur, place a stop loss under $0.62.

XRP/USDT 8-Hour Chart

Invalidation of the uptrend possibility is currently $0.62. If the bears can push through this level, the counter-trend rally will take much longer to commence. XRP price could fall to $0.60 and $0.56, resulting in a 20% dip from the current XRP price.

Author

FXStreet Team

FXStreet