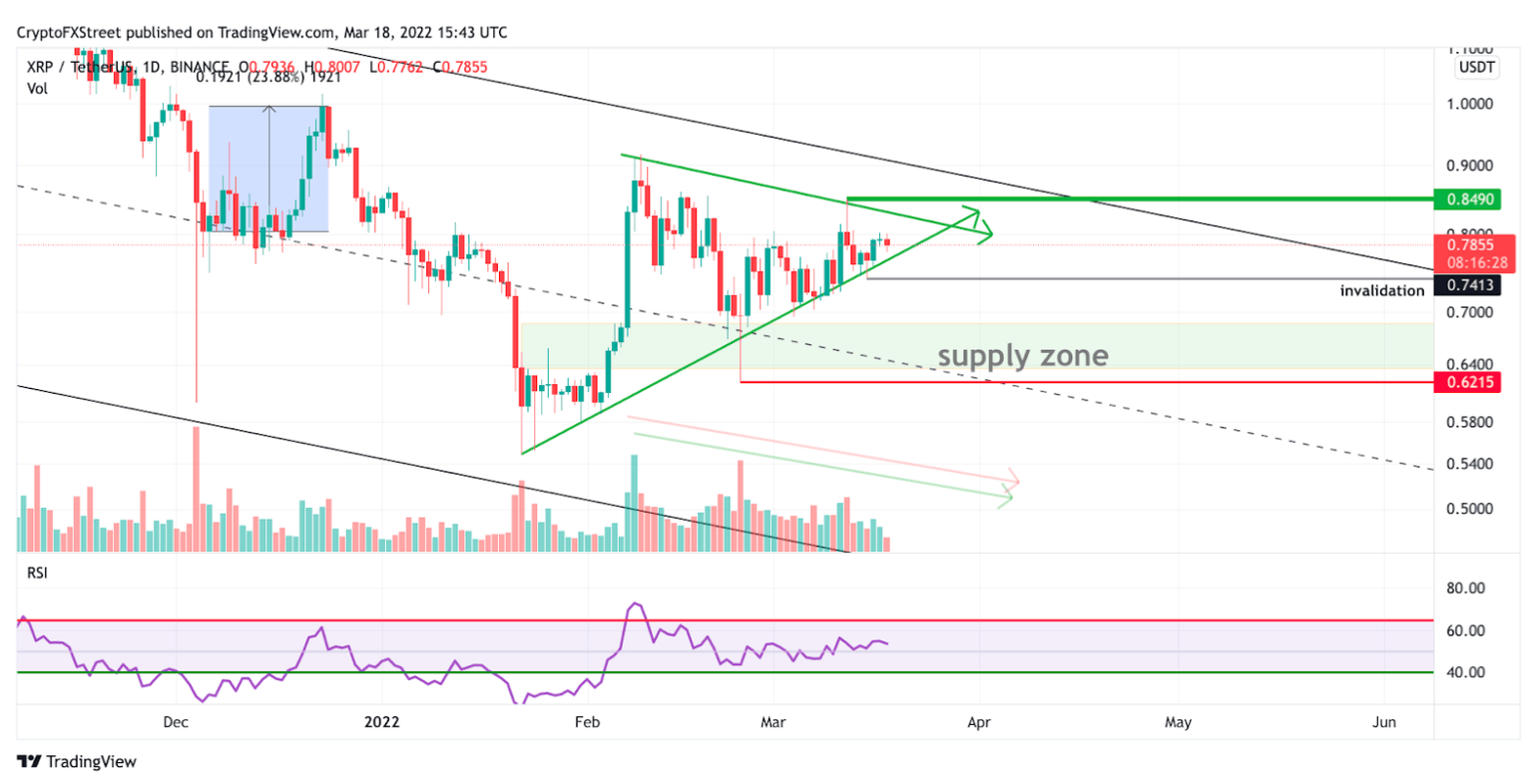

XRP Price Prediction: Ripple bound for a 34% breakout

- XRP price continues displaying low volatile behavior on the daily chart.

- There is no bearish indication at the moment.

- A daily close below $0.74 will invalidate the bullish thesis.

XRP price is still coiling within a pennant formation as it trades at around $0.79. The low volatile market condition is indicative that a breakout is coming, but evidence of the rally’s emergence has not yet arrived.

XRP price is back in snooze mode

XRP price went from the calm before the storm to hardly any drizzle as price action has been very mundane lately. Low volatile environments like these are usually halted with abrupt surges in price actions, so traders should not veer too far away from the remittance token. The green trend line should help XRP bulls sleep at night as the price is still being respected on the daily chart.

XRP price is ultimately in need of more consolidation time. All indicators are pointing up, so we will likely see price surges in the future as the coiling trend lines will eventually squeeze the current price action. It may be best for traders to consider not being early buyers and save their buying power for more promising markets.

XRP/USDT 1-Day Chart

Still, it's understandable for XRP enthusiasts to want to know every alternative scenario to invalidate the bullish sentiment. The easiest invalidation will be a close below the trend line on the daily chart. Secondly, if this happens price should impulsively head back to visit $0.72 and retest the supply zone at $0.67 up to 17% below current prices. Traders could then look for early buy signals as the long-term trend of XRP price still looks very bullish.

Author

FXStreet Team

FXStreet