XRP Price Analysis: Ripple traders are nervous about that stubborn US Dollar strength

- Ripple price sees traders weary of the US Dollar strength that keeps popping up.

- XRP traders have learned the lesson in a harsh way to be careful in a stronger USD environment.

- Expect losses to remain limited as the Greenback is set to ease, seeing the end-of-the-year flow.

Ripple (XRP) price action is entering a calmer moment of the year as the Bank of Japan (BoJ) monetary policy decision event is the true and final point for this volatile 2022. Finally, some tail risks can start to ease and stay in the background as we break our heads on what to buy for Christmas and New Year at the last minute. Meanwhile, XRP price is trading on the waves of the market, with market players awaiting the year-end flow that normally should see a weaker US Dollar by the 31st of December.

XRP traders are betting on the seasonality inflows

Ripple price sees traders looking at each other to make that first move to trigger a bunch of buy-orders and run price action quite quickly upwards. Traders, however, are weary of the side effects of the US Dollar as currently, both EUR/USD and the US Dollar Index (DXY) are not going anywhere and could kick back into gear at any given moment. If there is one lesson that cryptocurrency traders have learned, then it is that they should not fight the US Dollar if it overpowers any cryptocurrency.

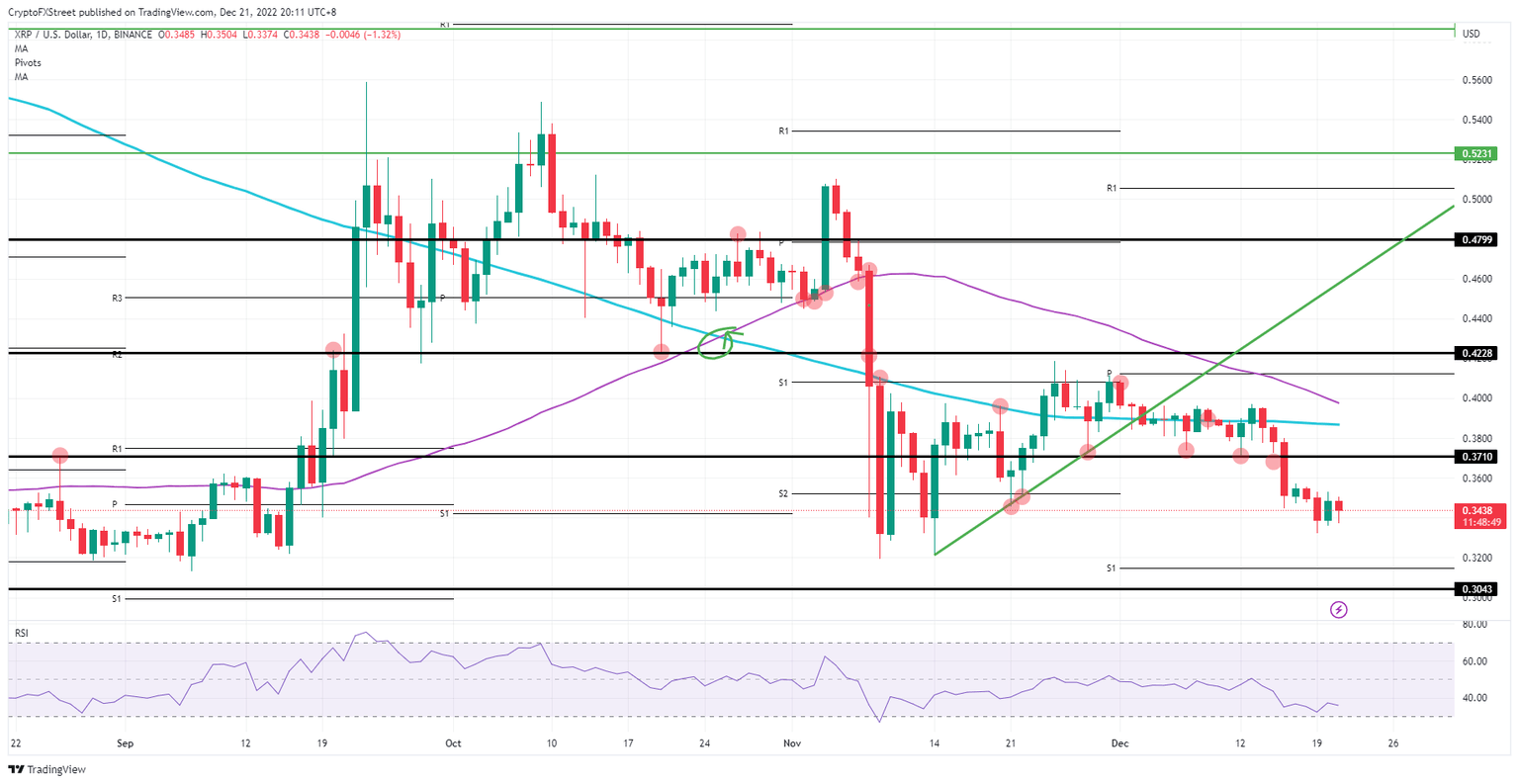

XRP could still be skyrocketing as a seasonal US Dollar chart shows that December is often when the Greenback is sold. This time of year would make even more sense as shorters from the beginning of the year will want to take profit and cash in, similar to hedge funds that start to pay out dividends to their investors. XRP price is thus on its way still to $0.3710 as the current faint is just a blip on the chart.

XRP/USD daily chart

Downside risk remains entangled with the tail risks on the geopolitical front. Central bankers might have closed up shop for this year, but Vladimir Putin and the situation in Ukraine, China and Taiwan are not keeping track of Christmas or New Year. Any escalation of war and nuclear threat will see US Dollar strength overpower again and quickly squash bulls with a nosedive move towards $0.3043.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.