Ripple price prediction: XRP traders not buying the message from the Fed with a 15% penalty

- Ripple price consolidates as price action goes nowhere.

- XRP flatlines as the most eventful week of 2022 cannot trigger a rally or a selloff.

- Expect pressure to build further with a possible leg lower as the underpinned area at $0.3616 gets crushed.

Ripple (XRP) price looks deaf and dumb for anything in the markets these days. With the biggest central bankers' week of the year, XRP did not move as traders were looking for any direction. The big risk is that traders could pull out their cash again as the Christmas rally is not happening this year, triggering another correction in the last two weeks of 2022, similar to its overall performance.

XRP to go through the last two weeks as the whole of 2022?

Ripple price had good hopes at the beginning of the week as it was piercing through the 200-day Simple Moving Average (SMA), which was quite important at the end of November. Unfortunately, cold water poured on the premature rally after the US CPI numbers triggered an upbeat market environment. That came from the US Federal Reserve, which warned that the market could get a downside surprise as US Federal Reserve Chairman Powell sees more hikes needed.

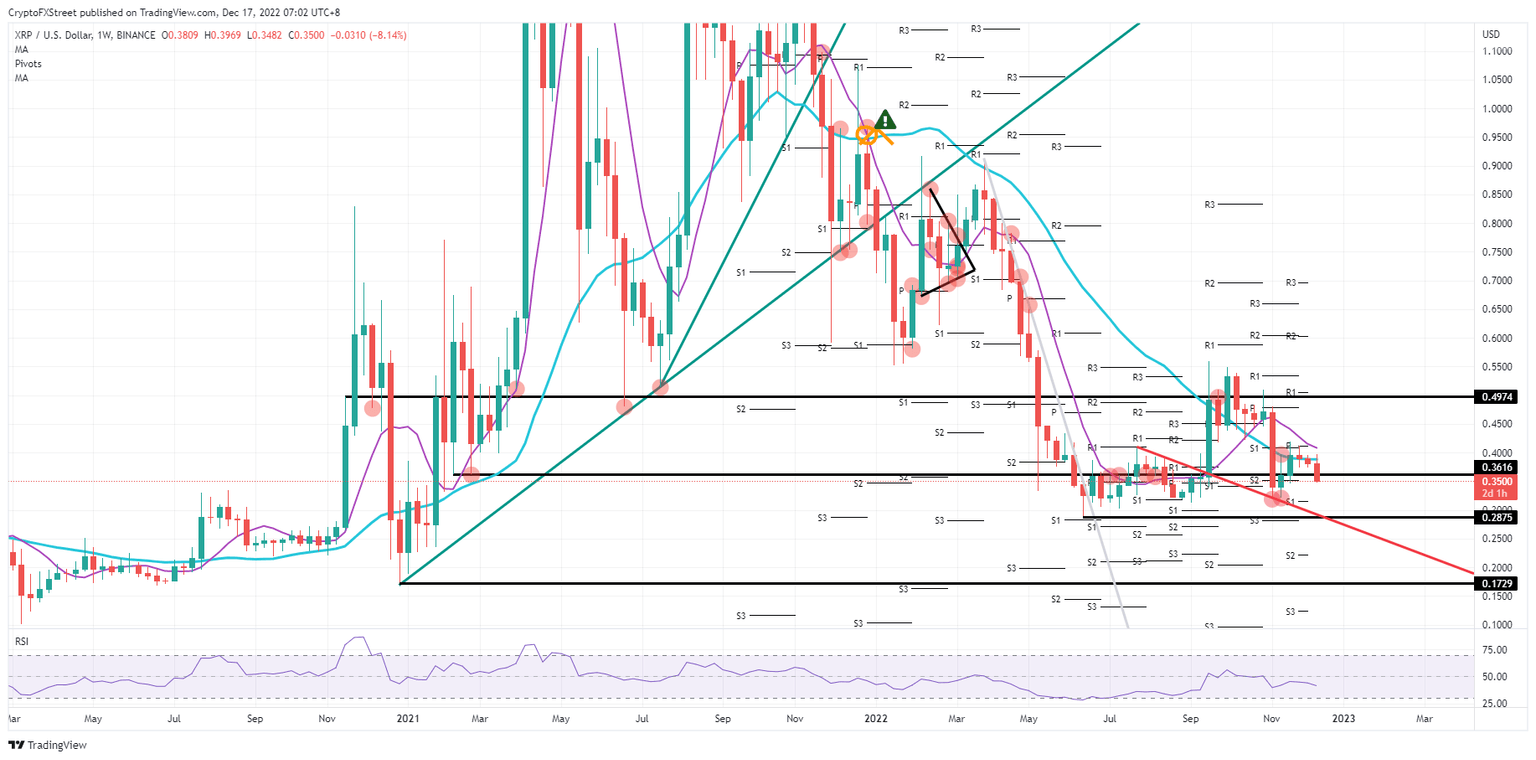

XRP price currently flirts with its underpinned level at $0.3616. Once that breaks and prints new lows for December, that would mean the risk that XRP enters back into the lower area from 2022. The monthly S1 level is a good reference at $0.3145 to find some support. A small excursion below $0.3000 is not unthinkable to get the red descending trend line as support for a bounce.

XRP/USD weekly chart

Should Ripple price be able to move back towards $0.4000, the 55-day SMA could form an issue for more upside potential. So should XRP be able to close before Sunday evening, that would be a much better position to rally further in the remaining days of 2022, where $0.4974 could be up for grabs by New Year. That would bear roughly 30% gains in just 14 days.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.