XLM price ponders 20% advance as cryptocurrency adoption continues to gain traction

- XLM price slowly ascends as it eyes a 20% climb to retest the $0.303 resistance level.

- Paraguay lawmaker to introduce regulation for Bitcoin after El Salvador’s historic decision.

- Stellar run-up could go awry if bears shatter the $0.218 support barrier.

XLM price is currently experiencing a slow but steady thrust that could propel it to crucial levels if the bullishness continues. Considering the adoption of cryptocurrencies being seen across the globe, it is likely that this activity will translate into meaningful price action soon.

Countries embrace cryptocurrencies

After El Salvador decided to make Bitcoin a legal tender on June 8, Carlitos Rejala, a Paraguayan lawmaker, has taken the next step in introducing a Bitcoin bill on July 14.

I am here to unite Paraguay , that is why we decided with Senator @FSilvaFacetti to present together the bill #bitcoin on Wednesday, July 14!

— Carlitos Rejala (@carlitosrejala) July 9, 2021

Stay tuned since there will be a mega surprise for Paraguay and the world. Something GIANT is coming #Bitcoin #btc

El Salvador’s adoption of BTC as legal tender is a milestone since it is one of a kind. Moreover, this decision received massive support from enthusiasts.

A similar development was seen in South Korea as Woori Financial Group, a large bank, decided to custody cryptocurrencies.

This decision involves CoinPlug, one of the earliest cryptocurrency exchanges in South Korea and Kakao, a blockchain payments company, in a joint venture with the bank.

With the massive cryptocurrency adoption wave sweeping over major banks and institutions, this downtrend could be a minor blip if the bull run restarts.

While this is bullish for Bitcoin price, JP Morgan suggested that El Salvador will face headwinds in using BTC as a medium of exchange.

XLM price sets up higher low

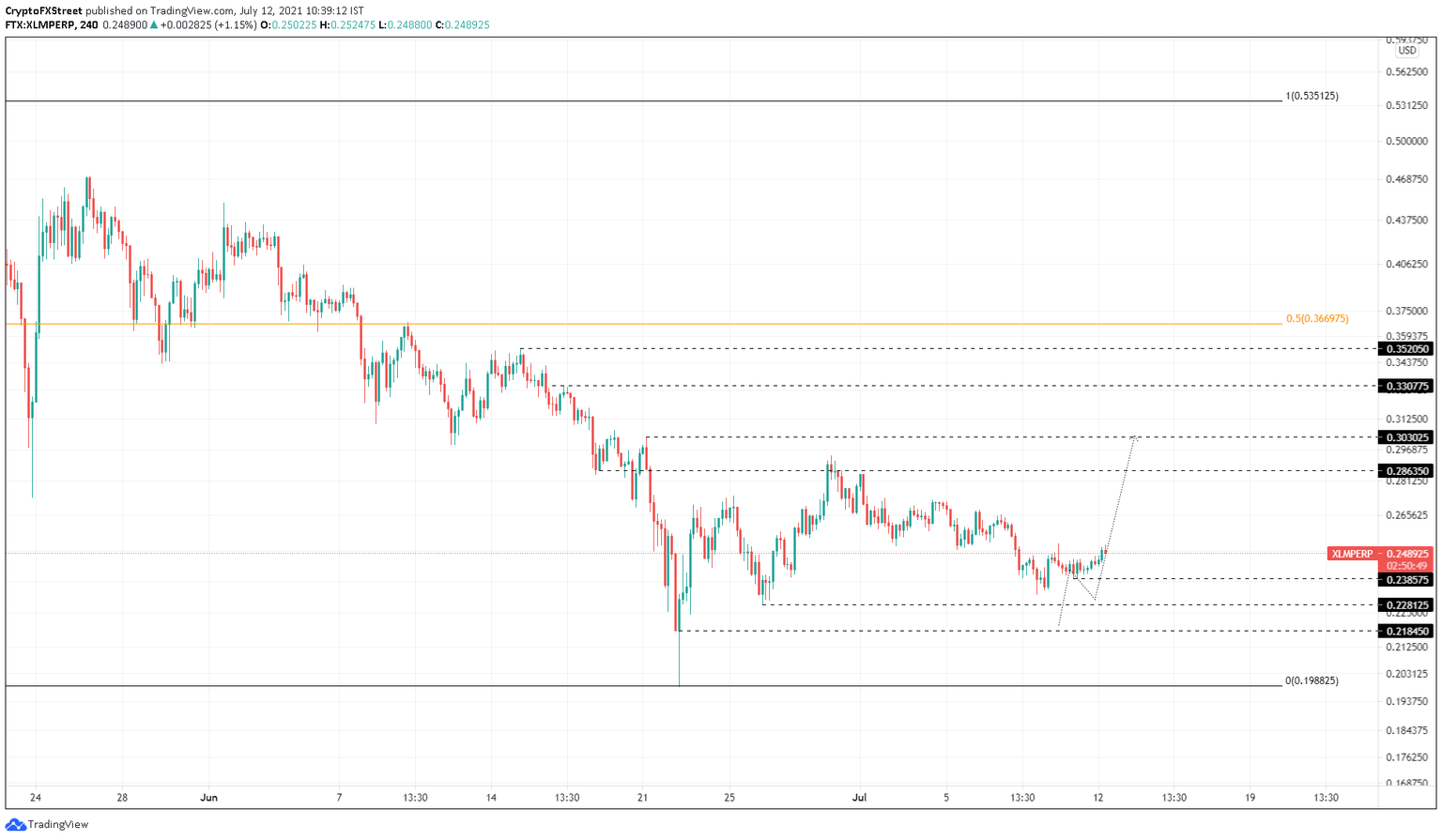

XLM price created a higher low on July 10 at $0.239, serving as a base for the upswing. If this run-up continues, Stellar will face $0.286, a critical resistance level that rejected the rally on June 29, leading to a 21% sell-off.

Therefore, XLM price needs to slice through this barrier to have any chances of tagging the June 21 swing high at $0.303.

If the remittance token produces a decisive 4-hour candlestick close above this level, it suggests a resurgence of buyers and an intention to scale higher. The supply ceiling at $0.331 is the next likely candidate toward which the bulls might push Stellar.

XLM//USDT 4-hour chart

On the flip side, if the uptrend fails to hold, XLM price will likely retrace. If this pullback produces a swing low below $0.239, it will signify weak buying pressure. In this case, Stellar will visit the $0.228 support barrier.

While this move does not invalidate the bullish outlook, it will delay it. However, a breakdown of the foothold at $0.218 will end the optimistic narrative and, in some cases, trigger a 9% downswing to the range low at $0.199.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.