Will Ethereum price take a break before $2,000?

- Ethereum price starts a new trading week at $1,571.

- RSI has hit levels last seen in August 2021, when ETH kick-started its rally to $4,900.

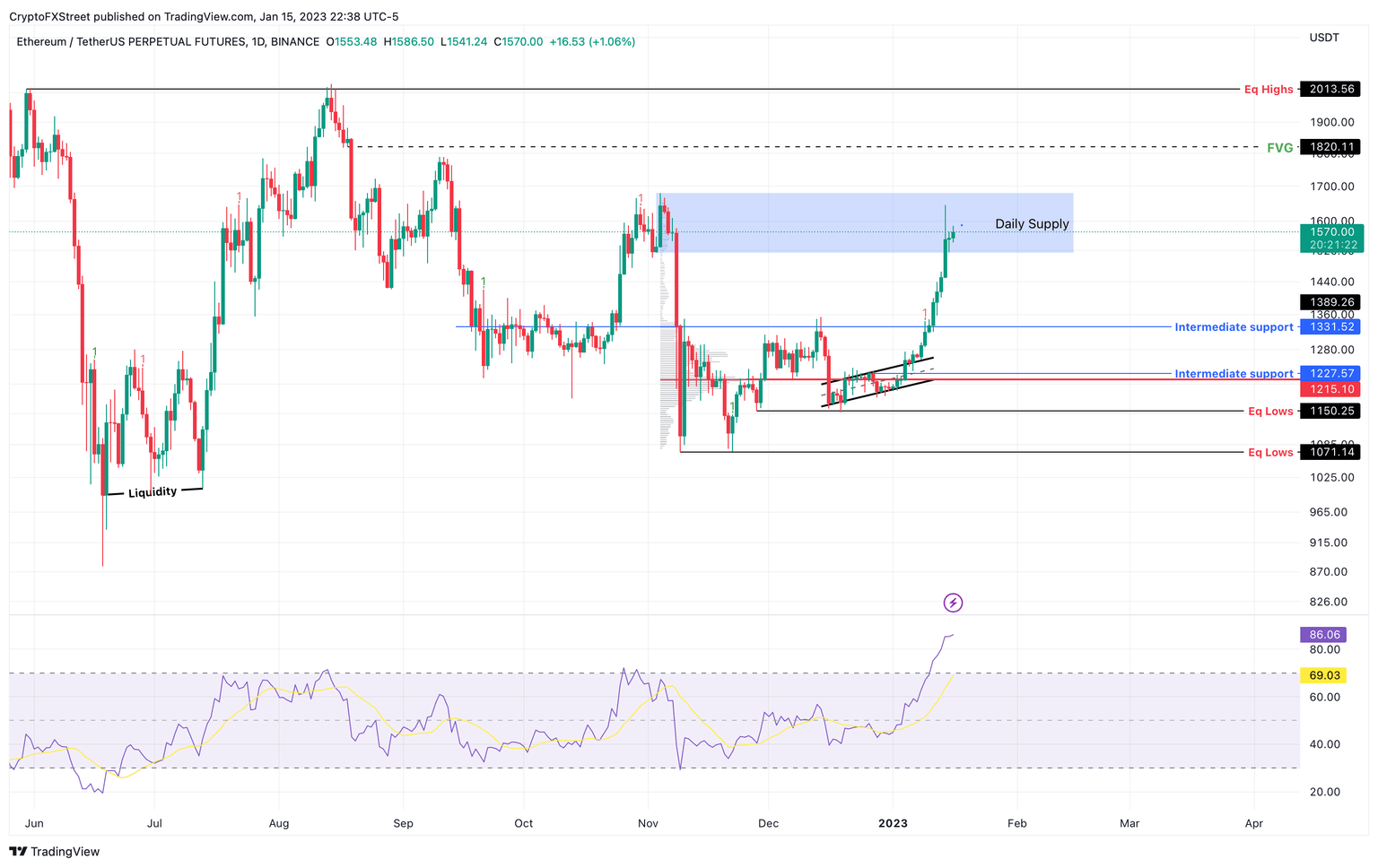

- Failure to overcome the $1,514 to $1,679 supply zone could result in a reversal.

Ethereum price stands tall after its two-week long rally without any signs of reversal. However, ETH is currently facing some significant hurdles that could trigger its reversal, so investors need to exercise caution.

Also Read: Ethereum Shanghai hard fork and token unlock: A complete guide to unstaking ETH

Ethereum price at inflection point

Ethereum price has rallied 37% since January 1 and shows no signs of slowing down even as it pierces through a daily supply zone that extends from $1,515 to $1,679. This exponential move has Bitcoin to thank for initiating this run-up.

Furthermore, the speculation on Ethereum price is relatively higher compared to other altcoins due to the upcoming Shanghai hard fork. All-in-all, this rally was impressive but ETH bulls face a tough decision - overcome $1,679 and continue its rally or retrace due to exhaustion.

The Relative Strength Index (RSI) has extended into the overbought zone. The last time Ethereum price has such a huge spike in momentum was in August 2021, when ETH kick-started its ascent to $4,900.

Ideally, a retracement to stable support levels should occur before a further run-up. A confirmation of a pullback will occur if Ethereum price starts to form a local top in the aforementioned supply zone. In such a case, ETH will eye a retest of $1,820 and $2,013 hurdles, respectively.

ETH/USDT 1-day chart

While the bullish outlook does look apparent, investors need to exercise caution, especially after such a massive bear market rally. If Ethereum price produces daily candlestick close below $1,514, it will be the first sign of a reversal.

In such a case, if Ethereum price sets up a lower low below the said supply zone, it will add confirmation to the bullish exhaustion. This development should see ETH target the $1,331 support level, allowing bulls to recuperate for the next Ethereum price rally.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.