Ethereum Price Prediction: Three warning signs for ETH bulls

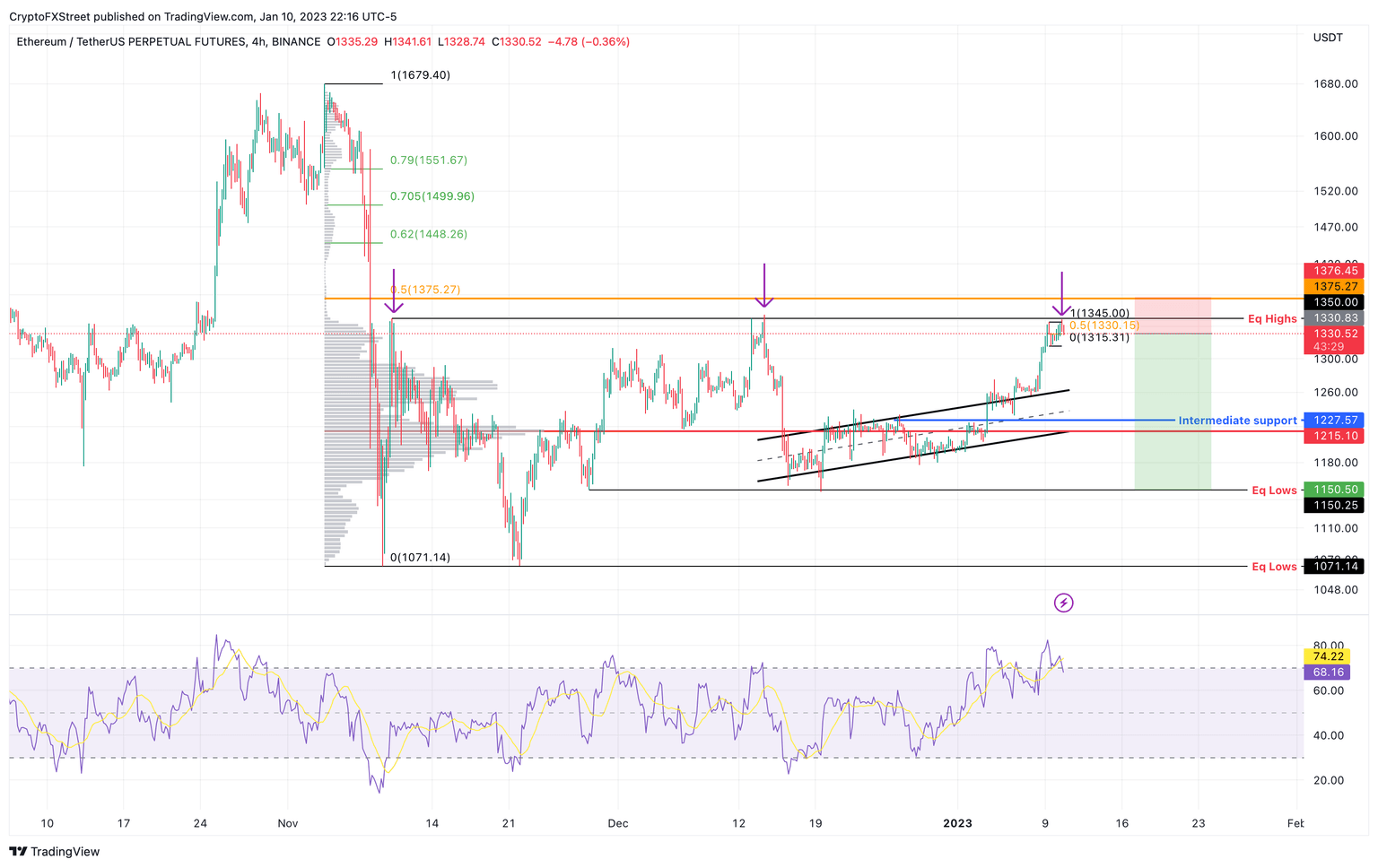

- Ethereum price shows a top formation around $1,350 hurdle and could trigger a market reversal.

- If sellers band together, ETH could slide 13% to retest the first target at $1,150 and nearly 20% to tag the second target at $1,071.

- A four-hour candlestick close that flips the $1,375 resistance barrier into a support level will invalidate the bearish thesis.

Ethereum price action over the last few hours has produced two local tops, which could catalyze a shift in trend, favoring bears. Interestingly, this move resembled a similar local top formed in mid-December that led to a steep correction.

Also Read: Bitcoin price might crash violently ahead of US CPI release, dragging altcoins with it

Ethereum price at make-or-break point

Ethereum price has rallied 16% in the last three weeks with no signs of stopping. As the smart contract token approaches the $1,375 hurdle, investors need to rethink their outlook on ETH due to three reasons.

- Ethereum price has formed two local tops at $1,375, making it a resistance level that needs to be watched carefully as it could result in another sell-off.

- The Relative Strength Index (RSI) is in the overbought reason, indicating that a trend reversal is likely.

- Lastly, Bitcoin price has clearly suggested a local top formation, which will lead to a quick correction that could extend as low as $15,443.

Let’s discuss the first two points.

Ethereum price is currently hovering inside the range, extending from $1,679 to $1,071, which was formed after a 36% crash in early November 2022. In addition to $1,375 being a formidable resistance level, the midpoint of the aforementioned range coincides here, making it a tough level to overcome.

Furthermore, the RSI has produced a bearish divergence, indicating that the sellers are likely to takeover. A bearish divergence occurs when the price of an asset is trending upwards but an indicator such as the RSI is trending downwards, suggesting a potential reversal of the current uptrend.Therefore, investors need to exercise caution when trading ETH.

ETH/USDT 4-hour chart

On the other hand, the $1,375 hurdle is a key level for Ethereum price. The volume profile indicator shows that hardly any volume was traded between $1,375 and $1,499. Therefore, a successful flip of the $1,375 barrier into a support floor, will be a significant development for ETH bulls.

Such a move will invalidate the bearish thesis and further propel Ethereum price to revisit the $1,500 psychological level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.